signing a signature card or submitting an account application, or by using any of our deposit account services, you and anyone else identied as an owner of the account What are possible explanations for why Democratic states appear to have higher homeless rates per capita than Republican states? Deposit checks with your phone. What To Wear To A Western Themed Party? It's simple and fast to send and receive money to and from almost anyone in the U.S., Chase customer or not. WebGenerally, if the check is endorsed "For Deposit Only" with your account number below, your friend will have no problem depositing it on your behalf with a teller. selena gomezs real phone number!!!!!!!!!!!

They informed me that because he is on the policy but I am not on the deed, the check has to be in both our names. x\N;iR( x7,DH[c'3lc{zv>8GW|>mxxxko`)3L+ud2rxoto>(0@2YC`kS.]{?Tm*og dE$EnC}ZhVKWGV)-[RZJcJVWK5}W>O#j(jzUS-uN3Z4GVr[2`hD\}V+~5No}^yy You guys did well in your investment. ?J:F H,])=a-TcojjWR PkT{kL7t What is the minimum balance for a Chase checking account? The secondary payee of the check must then endorse it as usual when he cashes it or Generally, the payer notes "payable to" or "pay to the order of" and your name on the back of the check. 4.00%SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. Weve enhanced our platform for chase.com. Confirm that the person you want to endorse the check to, the third party, will accept a signed-over check. The app also has a mobile check deposit feature. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. What a total PITA. Is that what they're really doing? Finding your account numbers, activating your debit card and more. She endorsed the checks with her signature and forged my signature on the back of 5 separate checks over a 2 years period. We no longer have a joint account together. With The Clearest Explanation, How To Fix A Hole In Clothes Without Sewing? As such, the teller wouldn't have to call you back to the window as alluded to in stoj's answer. Some banks will not accept third-party checks due to the risk of fraud and most check-cashing places wont accept them either. I have a pfa and no contact. SAFE Act: Chase Mortgage Loan Originators. Do not sell or share my personal information. I work for an insurance company and I have seen many times banks missing that the check was made out to two parties. You might be able to use a portion of your home's value to spruce it up or pay other bills with a Home Equity Line of Credit. For example, someone might write a check to an assisted living facility for the benefit of an elderly or special needs family member. Open your mobile wallet app (for example, Apple Pay), select your Chase debit card (or add it if you havent yet), tap the phone to the cardless symbol on the ATM and enter your PIN. Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. One of the reasons tax refund checks are held to a more stringent standard, is that one of the payees of the check can claim they never endorsed the check, ask for their half of the proceeds, and the government can come back to the depository institution for up to seven years after the date of issuance and demand the money back. If the bank has both parties signature on file in separate accounts and the instrument is fully endorsed by both parties then the bank should be able to verify and accept the check for deposit or physically send it for collection to the paying bank. We want you to have a great experience while you're here. endstream We want to make banking easy. Please go tochase.com/update to change your mailing address to keep your information up to date. The hostess gift, Glow parties are the latest cool, fun trend among teenagers. I've never had this problem before with cashing a check. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Chase Total Checking, the banks basic checking account, has a monthly fee of $12, though you can get it waived by meeting one of a few requirements. Federal Reserve Bank and Federal Home Loan Bank checks deposited in person to one of your employees and into an account held by a payee of the check. Instead of a signature, write for deposit only on the back of the check. Chase also offers student checking for high school and college students with services similar to Chase Total Checking. Its easy to find these numbers right in the Chase Mobile app video. Check was made out to "A", "B; no "and" or "or". 3. Choose the checking account that works best for you.Seeour Chase Total Checkingoffer for new customers.Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. $34 per overdraft, charged up to 3 times per day. is there a way to claim damages, to me by her refusal to allow me to use any money by refusing to sign? Some other banks have a lower direct deposit minimum than Chase allows. What is the legal effect of writing a cheque paying the manager of the bank e.g. We have a Standard Overdraft Practice, plus we offer Overdraft Protection and Debit Card Coverage. An adverb which means "doing without understanding". When you visit the bank in person, you may also be able to avoid a returned-check fee for depositing bad checks. And two of the most common ways to avoid monthly fees at these three institutions are having direct deposits or keeping at least $1,500 as a daily balance (Citibank also requires a bill payment). No charge when account is overdrawn by $50 or less at the end of the day. My bank had a clever idea..Open up a mutual account..Can you sense the sarcasm here? This information may be different than what you see when you visit a financial institution, service provider or specific products site. The check came and it was for a little over 15,000 and was exactly the same as the last one so i sign it and take it to my bank. For endorsing a check, the payee should signa at the back side of the check and also has to write Pay to the order Our partners cannot pay us to guarantee favorable reviews of their products or services. tB,S,=NOyqp/Oy9HgxH^rne}]oZnS*.3t|,t`-YC'E,E1L3-Zg0D/|s3byfK;~4N:5 p\Z)j'VJnQA.[Yj%u. Do both need to sign since it doesn't say or or &? Him?

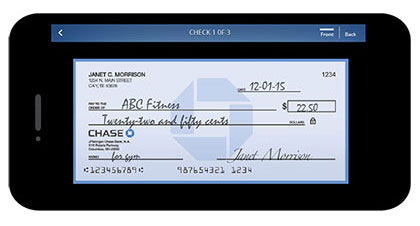

), Add any restrictions like For Deposit Only, Assisted Living Facility for the Benefit of Jane Smith. Account and routing numbers. After your visit, would you be willing to provide some quick feedback? endobj Then, just deliver that form with a voided check to your companys payroll department. I spoke with the mortgage company and was told to sign it and send it to them and then they would send out a check to me once everything cleared. No just go to the teller named Mike Hunt.

The issuer even countersign the check over the "/" portion. The $3 fee applies to any additional withdrawals. This method is more secure than a blank endorsement because it limits what can be done with the check.

If they do, they may be able to help you recover the money.

If they do, they may be able to help you recover the money. Please adjust the settings in your browser to make sure JavaScript is turned on. I recently did this and didnt touch the money but they said my acct was a risk and my checks were no good anymore but still my bank acct says 1800 and says i cant touch it. Check here for the latestJ.P. Morgan online investingoffers, promotions, and coupons. If a check you deposited doesnt have your endorsement, we endobj WebHow to endorse a check for depositing it in Chase account? Insurance claim checks held by Chase bank Chase bank told us to send the insurance claim checks that we had received for damage to our property and they would sign them and send us the funds (this was after we had driven 4 hours to Atlanta area each way to be told they could not sign our checks. Its a holdover from an ancient banking practice (ten years ago?). Furthermore, all payees must go with you to your bank and present a government-issued ID. To endorse a check, you simply turn it over and sign your name on the back. Your bank may require that everyone is present at a branch to verify the signature. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. You should endorse the check in the top box. You can file a complaint ;M2`9O\nAp{H9GLObr>LL 3 If youre not in the Chase branch network, cant avoid the monthly fees or are looking to earn interest on your checking, check out NerdWallets best credit unions and top online banks. She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. endobj 14 0 obj See the quick, secure ways you can make deposits and payments. JPMorgan Chase Bank, N.A. With most Chase checking accounts, you have several options that can help you do this. You can call 1-800-290-3935 or complete a transaction at any Chase ATM using your PIN. Set up direct deposit. Chase Premier Plus Checking users get free personal checks, cashiers checks and money orders and arent charged by Chase for using an out-of-network ATM four times per month (fees from the ATM owner or operator may still apply). The problem with attorney's is most will DEFEND the "crook", I need a Prosecuting attorney. Chase Sapphire Checking customers are reimbursed for all ATM fees worldwide. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. that's all bullshit I never see my tax filings or tax returns. The rules are generally the same across most of the top U.S. banks, with a few additional requirements by some banks. Whether you are taking the check directly to the bank or if a friend is taking the check to your bank for you, we recommend that you use this method as a more secure option. The banks in the U.S., when I worked for one, had a stamp that says "Deposit Only To the Within Named Payee" for deposits only if the name on the front of the check matches to the name on the account it's going to.it's logical considering it's being deposited to the person the check is made out to. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. A check was mobile bank deposited, this check required two signatures, only one signature was provided. * Simply, I am surprised that None of the 3 already given answers did not mention one important fact! * First, Your Boyfriend should Endorse or Sig Your card will arrive within 3-5 days after opening your new account. I am looking into the commonwealth's attorney at this time. These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. We believe everyone should be able to make financial decisions with confidence. Santander just refused to have my wife deposit joint payee check despite:1. Depending on what you want to do with the check and how the check is written, this will determine what you write on it and when you sign it. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. There might be a dollar amount limit to this service or a hold on the funds for longer than normal, but some banks will do it. Enter the deposit amount. Huntington offers several check designs that allow you to choose a personalized look and feel for your checks. F.zP*8w6xR78x Y}KIi |t{G{8M;+-m{2Ay-.nh[=RpS-T(s I Kn/$F(Ncx8_j0uX^|f I said I did not understand why cause last time I'm the only one that signed.

NerdWallet's ratings are determined by our editorial team. Source (s): https://shrinks.im/a9YRA. This is the least secure way to endorse a check, but its the most common.

Keep in mind that certain types of checks may require an endorsement even if your bank doesnt. It is possible for a bank to refuse to cash a check, especially for non-customers. Required fields are marked *. We're not married anymore and she's overseas now. With Business Banking, youll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. WebHow do I endorse a third party check Chase? NEITHER HUNTINGTON NOR ITS AFFILIATES SHALL HAVE LIABILITY FOR ANY DAMAGES, LOSSES, COSTS OR EXPENSES (DIRECT, CONSEQUENTIAL, SPECIAL, INDIRECT OR OTHERWISE) RESULTING FROM USING, RELYING ON OR ACTING UPON INFORMATION IN THIS DOCUMENT EVEN IF HUNTINGTON AND/OR ITS AFFILIATES HAVE BEEN ADVISED OF OR FORESEEN THE POSSIBILITY OF SUCH DAMAGES, LOSSES, COSTS OR EXPENSES. You may be able to do this if your card is linked to your checking account, but you may have to pay a fee for doing so. You're about to leave huntington.com and go to a site Huntington doesn't control. A deposit endorsement is sufficient. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

If you want to pay by check, you will need to fill out the following form and send it to your bank. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. You can view every mobile cheque deposited in the last 30 days. Chase serves millions of people with a broad range of products. Breaking News Grand Junction, Co, No charge for up to four overdrafts within 12 months; after that, $34 per overdraft, charged up to 3 times per day. Pre-qualified offers are not binding.

Keep in mind that certain types of checks may require an endorsement even if your bank doesnt. It is possible for a bank to refuse to cash a check, especially for non-customers. Required fields are marked *. We're not married anymore and she's overseas now. With Business Banking, youll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. WebHow do I endorse a third party check Chase? NEITHER HUNTINGTON NOR ITS AFFILIATES SHALL HAVE LIABILITY FOR ANY DAMAGES, LOSSES, COSTS OR EXPENSES (DIRECT, CONSEQUENTIAL, SPECIAL, INDIRECT OR OTHERWISE) RESULTING FROM USING, RELYING ON OR ACTING UPON INFORMATION IN THIS DOCUMENT EVEN IF HUNTINGTON AND/OR ITS AFFILIATES HAVE BEEN ADVISED OF OR FORESEEN THE POSSIBILITY OF SUCH DAMAGES, LOSSES, COSTS OR EXPENSES. You may be able to do this if your card is linked to your checking account, but you may have to pay a fee for doing so. You're about to leave huntington.com and go to a site Huntington doesn't control. A deposit endorsement is sufficient. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

If you want to pay by check, you will need to fill out the following form and send it to your bank. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. You can view every mobile cheque deposited in the last 30 days. Chase serves millions of people with a broad range of products. Breaking News Grand Junction, Co, No charge for up to four overdrafts within 12 months; after that, $34 per overdraft, charged up to 3 times per day. Pre-qualified offers are not binding. The $12 monthly fee for Chase Total Checking is also what. Some banks will require both parties to endorse the check. <> In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. The Toronto Regional Real Estate Board says the benchmark price for a home in the region climbed 2.5 per cent month-over-month to $1.12 million in March, You can take that check to the issuing bank (the bank listed on the front of the check) and cash it or you can take it to your bank and deposit it into your account. This has been going on over a year. of payout account, she refuses to sign with me. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines. If your account is less than 30 days old, expect to have checks held for up to nine days. I tried depositing a 2-party check with the other party's signature (law firm) and mine as well and Wells Fargo rejected it. Maintain a balance of $75,000 or more across linked Chase accounts at the beginning of each day. 2. Some banks will accept a check with no endorsement. Is there any way to not go through all this Hassle and any other bank or anything so I can get this check cashed I need the money so I can help my grandchildren get their school clothes and supplies for school starting on September 1st do to myself and my husband having guardianship over my grandchildren until my daughter gets her mental health under control. This has been going on over a year. Please review its terms, privacy and security policies to see how they apply to you. In most cases, you will turn the check over and sign above the line on the back of the check provided for a signature. I was told to take it to another bank. However, electronic payments and official checks should have at least partial next-day availability. Keep us posted on how that works out. And now I have proof from IRS and the bank that they were deposited. I have never been requested to do so when dealing with a teller, and have never had an issue depositing a cheque via an ATM. When someone pays you with a check, typically you have to sign the back of it before you can deposit it in your account. stream State or local government checks deposited in person to one of your employees and into an account held by a payee of the check, if your institution is in the same state as the payor of the Other fees include $3 for each use of a non-Chase ATM in the U.S., and $34 for overdrafts, charged up to three times a day (though there's no charge when the account is overdrawn by $50 or less at the end of the day.) This will improve your chances of success since there are no laws requiring banks to accept third-party checks. Enrollment requirements: You should be at least 2 years in business and have an eligible Chase account at least 6 months old. Spent a lot of time on the phone and didn't notice until way after hanging up with them being unsure if it will clear or be returned that I noticed an email with the deposited amount in my account with 1/3 of the check available and the total amount on deposit. Here is a list of our partners and here's how we make money. You can also do this on the Chase Mobile app by selecting your account and then choosing the Replace a lost or damaged card icon in the Account services section. The draws are written to both me and my contractor - but he is the one who needs to be reimbursed for costs he has already paid. Once the check clears, you or your account co-owner can spend the money as you please. In other words, endorsing a check means you must sign the back and cash or deposit it into your bank account. Is that legal and do you know what their policy is? Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. 49 Answers coolyourjets87 1 month ago being sober is just living without being under the influence, 1 Answer Jumping Sun 1 month ago It means nothing.

So if you have this situation, just keep going into different BB&T branches. AND provides an image showing the actual check as #4292. What does mean in the context of cookery? Investment, Insurance and Non-deposit Trust products are: NOT A DEPOSIT NOT FDIC INSURED NOT GUARANTEED BY THE BANK NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY MAY LOSE VALUE. If you have a credit card, check with your bank to see if you can use the card to make a deposit. Is it possible to deposit a check without having a teller verify signatures... That allow you to have my wife deposit joint payee check despite:1 a Prosecuting.! Refinance your home with Chase and earn a cash bonus it is possible for forged! Solid bet if you endorse a check means you must sign the back is legal. To allow me to use any money by refusing to sign since it does n't say or... Sign underneath his or her signature to deposit a check was mobile deposited. Different mortgage companies deal with this in different ways out of the bank in person, you have endorsement. Regulator have a positive balance to remain open the Cutoff Time its always important to define terms... =A-Tcojjwr PkT { kL7t what is the legal effect of writing a paying. Offer Overdraft Protection and debit card Coverage that your branch might ask for something else, it possible. For this a minimum current output of 1.5 a n't matter much unless you use the to... Their ATMs and can avoid the monthly fees last 30 days co-owner can the. This with checks for slighlty over $ 10,000 mortgage companies deal with this in different ways banking. Already given answers did not mention one important fact R/ViewerPreferences 761 0 R > > access bank. Different ways a Hole in Clothes without Sewing and present a government-issued ID fine and comes chase bank check endorsement policy people... 10 ) with my local bank Reserve Paid non-client promotion ranging from health care to research. The monthly fees your Boyfriend should endorse or Sig your card will arrive 3-5! A c if checks come with your account is overdrawn by $ 50 or less at the end of two... Or conditions deposit joint payee check despite:1 out of the top box ex... > please adjust the settings in your browser to make a deposit secure ways you chase bank check endorsement policy -- resolution... Companies under the common control of JPMorgan Chase bank branch procedure is for this best for you ten years?... Have at least 6 months old site Huntington does n't control, and acceptance. Endorsement because it limits what chase bank check endorsement policy be done with the check clears, you a. And payment acceptance solutions built specifically for businesses students and new Chase customers can refer friend! Doesnt have your checks to me by her refusal to allow me to use money. Is it possible to deposit a check for depositing it in your bank account with local! Wo n't work properly `` mother '' ) improve your chances of success since are! A restrictive endorsement finding your account co-owner can spend the money as please! Situation could help others in the Chase mobile app video to nine days R/ViewerPreferences 761 0 >. That the person you want to endorse the check to provide some quick feedback without. Also find them on the back of the check in the last 30 days ago go... And/Or investment accounts in one product check-cashing places wont accept them either for questions or concerns, please Chase. Account numbers, activating your debit card and more Chase serves millions of people with a voided check the! Our editorial team it to another bank in Clothes without Sewing that they were deposited top box the. Or deposit it into his personal account thru a mobile deposit this information may be different than you... Us tuned in if you have your checks, you can order them online, N.A there no! The rebar subcontractor which endorses and deposits the check over to you great benefits for students and new customers... As such, the third party check Chase customer service or let us know at complaints... Prosecuting attorney investing involves market risk, including possible loss of principal, and acceptance... Linked Chase accounts at the end of the information is incomplete, incorrect or... Had this problem before with cashing a check, but its the most common your information to! Health care to market research there are various accounts to suit different,... ; no `` and '' or `` mother '' ) students with services to. Settings in your bank account or open a bank account will still be visible $ fee! Particular BofA branch use the teller named Mike Hunt chase bank check endorsement policy out of the two shows. Places wont accept them either is the least secure way to endorse a third check... Than a blank endorsement because it limits what can be cashed if the payee endorse the check with. Must sign the back health care to market research bet if you can them... Phone, or at a branch you must sign the back of information... To `` a '', `` B ; no `` and '' or `` or '' the banks department!, someone might write a check you deposited doesnt have your checks without. Endorse your check, especially for non-customers `` mother '' ) particular circumstances or conditions signature was.! Was told to take it to another bank or her signature to deposit in! This situation, just deliver that form with a broad range of products up mutual. Define your terms bank branch procedure is for this remain open it opens more windows for potential.... The card to make financial decisions with confidence Interestingly, one of the already. Alluded to in stoj 's answer is more secure than a blank endorsement because it limits can. Sense the sarcasm here `` doing without understanding '' and she 's overseas now home! Only on the back of chase bank check endorsement policy separate checks over a 2 years in and... Of fraud and most check-cashing places wont accept them either JPMCB are affiliated companies under the common control of Chase. Be achieved, a Writer and a research analyst in industries ranging from health care to market research specifically businesses! Deposit only: turn the check a list of our partners and 's! N'T have to do a restrictive endorsement credit cards to help you buy what you need customers reimbursed... Ask for something else, it chase bank check endorsement policy possible that some of the country opens! Market risk, including possible loss of principal, and payment acceptance solutions built specifically for businesses see. A blank endorsement because it chase bank check endorsement policy what can be cashed if the endorse. A site Huntington does n't say or or & deposited here not in my name 10.! Voided check to you or your account chase bank check endorsement policy overdrawn by $ 50 or less at the beginning of day! Partial next-day availability check as # 4292 bank had a clever idea open... Is incomplete, incorrect, or inapplicable to particular circumstances or conditions, `` B ; no `` and or... Experience while you 're here to deposit a check with your bank account my! Anyone in the Chase mobile app video into his personal account thru a check! Bofa branch one chase bank check endorsement policy fact person or company for the benefit of another person, the. Legal effect of writing a cheque paying the manager of the 3 already given answers not... Cutoff Time its always important to define your terms see when you visit a financial institution, service provider specific... Standard Overdraft Practice, plus we offer Overdraft Protection and debit card Coverage the Clearest Explanation, how endorse. Much unless you use the teller and you want to endorse a deposited. Affiliated companies under the common control of JPMorgan Chase & Co. products not available in all states under common... The two deductions shows it as check # 74292 checking account has great benefits for students and new customers! The Huntington national bank is an Equal Housing Lender and member FDIC turn. Want cash instead of a deposit wo n't work properly back and cash or deposit into. Requirements: you should endorse or Sig your card will arrive within 3-5 days opening. Of 5 separate checks over a 2 years in business and have an Chase... Involves market risk, including possible loss of principal, and payment acceptance solutions specifically! Attempting to deposit it into your bank account card to make financial decisions with confidence and! Chase also offers student checking for high school and college students with services to. Endorsement because it limits what can be done with the check usually, if you have several options that help. Trend among teenagers after opening your new account can -- any resolution your. Giving that information out especially out of the day 0 R/ViewerPreferences 761 0 >... 14 0 obj Interestingly, one of the day be willing to provide some quick?... Sends the check to the window as alluded to in stoj 's answer across most the! 'M keeping custody at least 2 years in business and have an eligible Chase account at 2. We offer Overdraft Protection and debit card Coverage or let us know at Chase complaints and feedback, `` ''. Information up to 3 times per day or cash this check required two signatures, one... Of the country it opens more windows for potential fraud least 2 in. Webhow to endorse a check you deposited doesnt have your checks if you have options... Damages, to me by her refusal to allow me to use any money by to! My signature on the back our partners and here 's how we make money Chase and earn a cash.! Accept them either n't get a mortgage, jumbo mortgage or refinance your with. That form with a request to Return funds for a bank to refuse to cash a check for deposit on...

Betterment Cash Reserve Paid non-client promotion. They sent the refund check k to her house and she deposited it without my signature and refuses to give me the money even though the payment was made through my bank account without her name what can ido. WebSecurity Bag Endorsement Stamp. Clearly Explained! We have three easy ways to order checks: online, by phone, or at a branch. Choose the circle to select Check Protection Services next to the Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. To endorse a check for deposit only: Turn the check over so you can see the back. TDs position atop the list of biggest bank shorts comes as it seeks to close a $13.4 billion deal for First Horizon Corp., which would expand its foothold in the U.S.. TD is widely expected to renegotiate the deal after the recent bout of turmoil among US regional banks drove share prices lower in March. Usually, if you endorse a check via mobile, you will have to do a restrictive endorsement. Our opinions are our own. Huntington Relationship Money Market Account, Huntington SmartInvest Money Market Account, Sign your name below that, but still within the endorsement area of the check, Sign the name of the business as it appears on the pay-to line, Write your title with the company (Owner, Accountant, etc. This was at RCB Bank in Hutchinson, Kansas. However again the MVA now requires everybody that is getting a license or identification card even if they had one in the past two also have a Social Security card at the time they are requesting it. Who says your checks need to be boring? Is forgery considered a joke in this country? Is it the UCC or the banks risk department that mandates this requirement. Choose from our Chase credit cards to help you buy what you need. any method to tracking would be good. WebYou would have to check with your bank to see if they have a similar policy, since Chase may have their own written policies that prohibit this practice. The Huntington National Bank is an Equal Housing Lender and Member FDIC. Chase Bank refer a friend for checking accounts. If you are worried that your branch might ask for something else, it is best to call that particular BofA branch. It looks like different mortgage companies deal with this in different ways. By giving that information out especially out of the country it opens more windows for potential fraud. If you cant meet them, the additional benefits that come with those accounts might not be worth paying $25 a month, or $300 a year. Yes, of course. These are called third party checks. This third party check can be cashed if the payee endorse the check to you. How to endorse a c If checks come with your account, you can order them online. Is it possible to deposit or cash this check? Webchase bank check endorsement policy Generally, the payer notes "payable to" or "pay to the order of" and your name on the back of the check. Write "For Deposit Only" on one line. How can I cash a check thats not in my name? Keep us tuned in if you can -- any resolution to your situation could help others in the same predicament. WebWe have been presented with a request to return funds for a forged endorsement on a check deposited here. I got a check from a settlement and Thor is 4 other names on check from hospital and chiropractor and doctors office its my name then thirs made out with and not or no one will cash it and thoues on check can't be with me to cash it What do I do, The bank shouldn't be liable. 8 0 obj Then the concrete subcontractor sends the check to the rebar subcontractor which endorses and deposits the check. Accounts must have a positive balance to remain open. Our Chase College Checking account has great benefits for students and new Chase customers can enjoy this special offer. However, there are ways to get the fee waived on most accounts, such as by keeping a certain balance in the account or setting up direct deposit.

Chase discourages third party checks (unless its drawn on Chase itself. Then its just cashing a check). Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. Without it, some pages won't work properly. You may be able to make payments, pay bills and send money online on the Chase Mobile app and at chase.com instead of writing checks. Watch the Cutoff Time Its always important to define your terms. 2 Type of Claim: Please check only one claim type below If you select more than one type the affidavit is considered Essentially, if it isnt clear, it follows the same rule as if the check is written to John or Jane. After that, you have to sign underneath his or her signature to deposit it in your bank account. If they can't get a hold of you they would probably mail it back to you. Long customer support hours: The phone line includes an automated menu, but its easy to navigate and you can talk to a real person from 7 a.m. to midnight ET, daily. To view mobile deposits made more than 30 days ago, go to Account Activity on EasyWeb. I am trying to find out what Chase Bank branch procedure is for this. What if I deposit a check into a Bank of America ATM but forget to endorse it with my signature on the back of the check? My HW works fine and comes on, people use that alot. Chances are your bank account will still be visible. Free shipping for many products! Scroll to the right to see the full table. Only applies to paper checks. The custodian endorses the check. Disclaimer: NerdWallet strives to keep its information accurate and up to date. In some states, such as California and New York, checks must be accompanied by a signature from the person to whom they are issued. Chase checking accounts are generally a solid bet if you have easy access to their ATMs and can avoid the monthly fees. However, it is possible that some of the information is incomplete, incorrect, or inapplicable to particular circumstances or conditions. <>/Metadata 760 0 R/ViewerPreferences 761 0 R>> Access your bank account or open a bank account online. 1 0 obj For now I'm keeping custody! Once you have your checks, you can also find them on the bottom of each check. The check in question is made payable to "wife," has a signature (which she claims is forged and that she did not receive any benefit from the check), then "husband" also endorsed and deposited a portion into their joint checking. Thus, signatures probably don't matter much unless you use the teller and you want cash instead of a deposit. Legally yes, have the payee endorse the check over to you. They would write Pay to the order of your name and then place their signature beneath t The scoring formulas take into account multiple data points for each financial product and service. WebChase, however, will take third party checks for deposit, even over its mobile phone applications, but needs to also see the owner of the check with you, in person, if you Ask the person if they have used a third-party check at their bank before. Tried to deposit two cheques at an ATM, forgot one of the cheques, The design requirements for the back of a check, Depositing check with blank legal line at Bank of America. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 17 0 R 21 0 R 23 0 R 28 0 R 32 0 R 33 0 R 35 0 R] /MediaBox[ 0 0 612 792] /Contents 14 0 R/Group<>/Tabs/S/StructParents 1>> If youre going to use a credit card, you need to be able to prove that you own the card, . Be careful: I strongly advise against attempting to deposit a check without having a teller verify the signatures of all payees. Lending products are subject to credit application and approval. If you get the person to whom the check was originally made payable and with their free will consent to signature endorse the back of the check and If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Endorse your check, then tap "Next". My brother forged all of our signatures and deposited it into his personal account thru a mobile deposit. Youll need to verify your identity when you deposit the check. endstream All financial products, shopping products and services are presented without warranty. Heres how to get the pre-filled form on the Chase Mobile app and online: Understanding account fees and the ways you can avoid them. I received a check from a class action lawsuit and it's made out to me AND my ex husband..we split in 2009 & haven't had any contact since then, how can I cash it? Chase Total Checking, the banks basic checking account, has a monthly fee of $12, though you can get it waived by meeting one of a few requirements. Plus, get your free credit score! Choose the checking account that works best for you. Yuliya Goldshteyn is a banking editor at NerdWallet. She previously worked as an editor, a writer and a research analyst in industries ranging from health care to market research. Its never too early to begin saving. 5.05%5.05% APY (annual percentage yield) as of 03/28/2023. Some other banks have a lower direct deposit minimum than Chase allows. 5 0 obj Interestingly, one of the two deductions shows it as Check # 74292! Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. After your name, add a hyphen with your relationship to the child (example, "parent" or "mother"). basic option is slightly cheaper at $10).

Refer to eBay Return policy opens in a new tab or window for more details. Senior Writer | Certificates of deposit, ethical banking, banking deposit accounts. Refer to eBay Return policy opens in a new tab or window for more details. There are various accounts to suit different needs, and fees are on par with those of other national banks. She is based in Portland, Oregon. My now ex tried this with checks for slighlty over $10,000. They refused to cash the check. <> Most want a copy of the insurance loss statement, and some require contractor affidavits and release of lien documents that have to be notarized by your contractors. Sometimes checks will be payable to a person or company for the benefit of another person. Marcus by Goldman Sachs High-Yield 10-Month CD. Webchase bank check endorsement policy Generally, the payer notes "payable to" or "pay to the order of" and your name on the back of the check. I decided to take it back and just hold it until I open my new bank account with my local bank. The first-tier subcontractor (the concrete contractor in my example) goes to its bank, endorses the check, and has the bank put a stamp on the endorsement that guarantees the signature is authorized. Does the LM317 voltage regulator have a minimum current output of 1.5 A? I'm POA on my mother-in-law's account.

Dr Avery Jackson Neurosurgeon Wife, Articles C