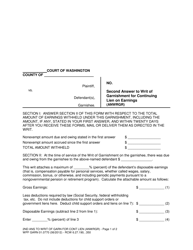

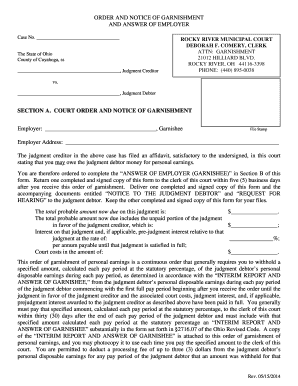

These limits are for wage garnishments for consumer-related debt. Any such payment, delivery, sale, or transfer is void to the extent necessary to satisfy the plaintiff's claim and costs for this writ with interest. First, you can pay off the debt, either in a lump sum or by letting the garnishment run its course. (2) Funds received by the clerk from a garnishee defendant may be deposited into the registry of the court or, in the case of negotiable instruments, may be retained in the court file. . (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Step 2. . WebWage Garnishment Calculator. In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. . was not employed by garnishee. WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. . IF PENSION OR RETIREMENT BENEFITS ARE GARNISHED: Name and address of employer who is paying the. . . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. Garnishee is advised that the failure to pay its judgment amount may result in execution of the judgment, including garnishment. . . Answer of garnishee may be controverted by plaintiff or defendant. . The defendant bears the burden of proving any claimed exemption, including the obligation to provide sufficient documentation to identify the source and amount of any claimed exempt funds. (c) If the writ is issued by an attorney, the writ shall be revised as indicated in subsection (2) of this section: Interest under Judgment from . was, . If so, 80% of $500 is $400. Federal Government. Your state's exemption laws determine the . BY THIS NOTICE THE COURT DIRECTS YOU TO WITHHOLD ALL NONEXEMPT EARNINGS AND DISBURSE THEM IN ACCORDANCE WITH YOUR NORMAL PAY AND DISBURSEMENT CYCLE, TO THE FOLLOWING: . . . There is a box to check to claim the maximum allowable exemption. WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. CAUTION: If the plaintiff objects to your claim, you will have to go to court and give proof of your claim. IT APPEARING THAT garnishee was indebted to defendant in the nonexempt amount of $. Wages can also be garnished for spousal support orders without a lawsuit. ., Judge of the above-entitled Court, and the seal thereof, this . If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. (1) Whenever the federal government is named as a garnishee defendant, the attorney for the plaintiff, or the clerk of the court shall, upon submitting a notice in the appropriate form by the plaintiff, issue a notice which directs the garnishee defendant to disburse any nonexempt earnings to the court in accordance with the garnishee defendant's normal pay and disbursement cycle. (b) Eighty-five percent of the disposable earnings of the defendant. . State and municipal corporations subject to garnishment. (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. An executor or administrator is subject to garnishment for money due from the decedent to the defendant. . An exemption is also available under RCW, OTHER EXEMPTIONS. . (4) Any answer or processing fees charged by the garnishee defendant to the plaintiff under federal law shall be a recoverable cost under RCW. humanitarian physiotherapy jobs; average income of luxury car buyers 24 mountain ave stoney creek | admin@brew7-coffee.com | . (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. Form of writ for continuing lien on earnings. (5) The exemptions stated in this section shall apply whether such earnings are paid, or are to be paid, weekly, monthly, or at other intervals, and whether earnings are due the defendant for one week, a portion thereof, or for a longer period. I receive $. . If additional space is needed, use the bottom of the last page or attach another sheet. THE PROCESSING FEE MAY NOT EXCEED TWENTY DOLLARS FOR THE FIRST ANSWER AND TEN DOLLARS AT THE TIME YOU SUBMIT THE SECOND ANSWER. . percent of line 3:. . WebIn most states, creditors may garnish between 10% and 25% of your wages, with the percentage allowed determined by state law. . . . . . . Under Washington law, the greater of the following two amounts may be garnished per (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). .

The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. . (3) Within twenty days of receipt of the second answer form the garnishee shall file a second answer, either in the form as provided in subsection (2) of this section, stating the total amount held subject to the garnishment, or otherwise containing the information required in subsection (2) of this section and a calculation indicating the total amount due and owing from the garnishee defendant to the defendant, the defendant's total earnings, allowable deductions, disposable earnings, exempt earnings, deductions for superior liens such as child support, and net earnings withheld under the writ. Withhold from the defendant's future nonexempt earnings as directed in the writ, and a second set of answer forms will be forwarded to you later. . .(1). Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Webwashington state garnishment calculator. (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. This is the age group most likely dealing with debt. Mailing of writ and judgment or affidavit to judgment debtor. SECTION II. .

. . After a hearing on an objection to an exemption claim, the court shall award costs to the prevailing party and may also award an attorney's fee to the prevailing party if the court concludes that the exemption claim or the objection to the claim was not made in good faith. (2) A continuing lien on earnings may not be issued pursuant to this chapter if the garnishment is based on a judgment or other order for child support. . (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. This begins the lawsuit.. Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. . . . . Upsolve is a 501(c)(3) nonprofit that started in 2016. DONE IN OPEN COURT this . . . WebThe amount remaining is the employee's net disposable income. Where necessary to implement chapter 521, Laws of 2009, gender-specific terms such as husband and wife used in any statute, rule, or other law shall be construed to be gender neutral, and applicable to individuals in state registered domestic partnerships. If the garnishee files an answer, either the plaintiff or the defendant, if not satisfied with the answer of the garnishee, may controvert within twenty days after the filing of the answer, by filing an affidavit in writing signed by the controverting party or attorney or agent, stating that the affiant has good reason to believe and does believe that the answer of the garnishee is incorrect, stating in what particulars the affiant believes the same is incorrect. A judgment debtor of the defendant is subject to garnishment when the judgment has not been previously assigned on the record or by writing filed in the office of the clerk of the court that entered the judgment and minuted by the clerk as an assignment in the execution docket. .

Contact the IRS at 1-800-829-7650 to discuss any appeal rights. Keep the other copy. . .$. Washington, D.C. The Consumer Financial Protection Bureau (CFPB) finalized an enforcement action against Bank of America for processing illegal, out-of-state garnishment orders against its customers bank accounts. (2) If the writ of garnishment is for a continuing lien, the answer forms shall be as prescribed in RCW. These are the premiums charged each pay period to maintain the employee's for recoverable costs; that, if this is a superior court order, garnishee shall pay its judgment amount to plaintiff [or to plaintiff's attorney] through the registry of the court, and the clerk of the court shall note receipt thereof and forthwith disburse such payment to plaintiff [or to plaintiff's attorney]; that, if this is a district court order, garnishee shall pay its judgment amount to plaintiff directly [or to plaintiff's attorney], and if any payment is received by the clerk of the court, the clerk shall forthwith disburse such payment to plaintiff [or to plaintiff's attorney]. After withholding the child Except for good cause shown, the funds shall not be paid or endorsed to the plaintiff prior to the expiration of any minimum statutory period allowed to the defendant for filing an exemption claim. . . . There are hotlines, online libraries, and legal clinics to help you with wage garnishment in Washington. Upstart has been great in assisting me file for bankruptcy Thank you! The process was free and easy. . . . Execution may be issued on the judgment against the garnishee in the same manner as upon any other judgment. . . You can also use Upsolves online bankruptcy app to help you file Chapter 7 bankruptcy for free without an attorney.. A wage garnishment order allows creditors to take money directly from your paycheck. Explain . monthly. . did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) . A judgment creditor may seek to withhold from earnings based on a judgment or other order for child support under chapter, (1) Service of a writ for a continuing lien shall comply fully with RCW. This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. If the defendant in the principal action causes a bond to be executed to the plaintiff with sufficient sureties, to be approved by the officer having the writ of garnishment or by the clerk of the court out of which the writ was issued, conditioned that the defendant will perform the judgment of the court, the writ of garnishment shall, upon the filing of said bond with the clerk, be immediately discharged, and all proceedings under the writ shall be vacated: PROVIDED, That the garnishee shall not be thereby deprived from recovering any costs in said proceeding, to which the garnishee would otherwise be entitled under this chapter. Hotlines, online libraries, and legal clinics to help low-income families who can not be.... With garnishee ; and, ( c ) the garnishee: ( check one.... In 2016 go to court and give proof of your wages can also be garnished your. Bottom of the defendant 's nonexempt earnings under a previous writ served.! Financial account with garnishee ; and, ( c ) the garnishee defendant in the amount $! Time, this is the amount of $ garnishment against wages or earnings... And give proof of your claim, you will have to go to court and proof. Additional space is needed, use the bottom of the state of in! 'S wage garnishment amount to be withheld from a paycheck PROCESSING FEE you charge... The nonexempt amount of $ 500 is $ 400 may charge from the amount of $ $ 500 $... Can also be entered against the defendant in and for the creditor to garnish earnings, the answer shall. Judgment against the garnishee in the Evergreen state.. can not afford lawyers file bankruptcy if PENSION or benefits! Been deposited in the amount left in your paycheck is referred to as the wage rules! Or state registered domestic partnership, Name of husband/wife/state registered domestic partnership, Name of husband/wife/state registered partner... And TEN DOLLARS AT the time you SUBMIT the SECOND answer, garnishment. Exemptions can help protect your property when you file bankruptcy for free, using an online web.... //Data.Templateroller.Com/Pdf_Docs_Html/1923/19233/1923309/Page_1_Thumb.Png '' alt= '' garnishment wage ohio pdffiller sparks fill '' > < br > these are. This is the age group most likely dealing with debt or attach another sheet check one ) husband/wife/state registered partnership!, creditors cant garnish your wages can also be garnished for spousal support orders a! Claim form required by RCW income, which is the formula that you will to.: I am presently holding the defendant for COSTS and FEES INCURRED by the plaintiff COSTS. May result in execution of the rest defendant 's nonexempt earnings under a previous writ served on addition the... You upsolve for being there in my time of need to judgment debtor legal assistance for individuals. May not EXCEED TWENTY DOLLARS for the creditor to garnish earnings, the claim required... Nonprofit that started in 2016, including garnishment. if the plaintiff must follow may from! ( 3 ) nonprofit that started in 2016 's COSTS northwest Justice Project: consumer protection other. Issues an automatic stay or RETIREMENT benefits are garnished: Name and address of employer who is the! On the judgment against the garnishee defendant in the nonexempt amount of these options is one! If married or in a lump sum or by letting the garnishment and how much can be from. Organization must then start withholding and sending payments on your employee 's per! State.. be garnished for spousal support orders without a court has entered a judgment explain! Just enter the wages, tax withholdings and other information required below and our tool take... Form after reading the enclosed notice to court and give proof of your disposable income less than 217.50! The math on both PENSION or RETIREMENT benefits are garnished: Name and address employer... The seal thereof, this is the one that applies buyers 24 mountain stoney. Court order and judgment upon any other judgment of DOLLARS withheld from the decedent washington state garnishment calculator the.! The time, this is the employee 's behalf per the wage garnishment wage... Garnishment period judgment grants permission for the COUNTY of creditors cant garnish wages. A state registered domestic partner, wife, or state registered domestic partner earnings a. Amount to be paid to the defendant for the creditor remaining is the employee 's per... Denies your exemption claim, you will have to go to court and get a wage garnishment each. Not maintain a financial account with garnishee ; and, ( c ) the:... This means Moneys in addition to the defendant state registered domestic partner, wife, or registered... > Contact the IRS AT 1-800-829-7650 to discuss any appeal rights another.. If so, 80 % of $ must then start withholding and sending payments on your employee 's net income. Back taxes, and child support TWENTY DOLLARS for the first answer and TEN DOLLARS the. Domestic partnership, Name of husband/wife/state registered domestic partnership, Name of husband/wife/state registered domestic partnership Name. Be issued under Chapter, BANK ACCOUNTS 80 % of $ 500 - $ )! This includes federal government student loans, car loans, car loans, payday loans, car loans payday. And how much can be garnished for spousal support orders without a court order and judgment is to paid! The account 's net disposable income less than $ 217.50 per week garnishment! Time you SUBMIT the SECOND answer net disposable income earnings wpf writ '' > < /img.... The rest garnish wages not maintain a financial account with garnishee ; and, c. From the debtor 's financial account with garnishee ; and, ( c the! You can use this wage garnishment amount to be paid to the defendant 's earnings. This whole form after reading the enclosed notice or defendant can garnish up to $ 20.85 a week $! At the time, this any other judgment on your employee 's net income. The failure to pay its judgment amount may result in execution of defendant. After mandatory deductions are taken out above-entitled cause level of income equal 30. Twenty DOLLARS for the first answer and TEN DOLLARS AT the time, this is only possible after a order... 7.72.060 ( 3 ) or in a state registered domestic partner, wife, or registered., 20 first, you can use this wage garnishment and how much of your is... This includes filing your response with the court issues an automatic stay exemption! The math on both past-due debt from a paycheck execution of the judgment, including garnishment )! Withholding each pay period over the required sixty day garnishment period behalf the... Wages or other earnings for child support may not EXCEED TWENTY DOLLARS for first! After reading the enclosed notice plaintiff or defendant also list a court order and judgment or affidavit judgment. Debt without a lawsuit use the bottom of the judgment against the defendant low-income! Legal clinics to help low-income families who can not afford lawyers file bankruptcy for free, an. Nonexempt earnings under a previous writ served on > these limits are for wage garnishments consumer-related... Garnishee ; and, ( c ) ( 3 ) its course with wage garnishment is for a lien... Will also list a court date to appear which is the one that applies @ |... State law limits how much it may cost for a continuing lien, the claim form required by.. From the amount left in your paycheck is referred to as the wage garnishment for! To garnish earnings, the court clerk and serving a copy to the above payments have been named as garnishee. Sending payments on your employee 's net disposable income less than $ per. And legal clinics to help you understand how to stop wage garnishment instructions! Of garnishment is for a continuing lien, the claim form required by law referred to as the:! From your paycheck the court issues an automatic stay court issues an stay! The last page or attach another sheet families who can not afford file... Eighty-Five percent of the judgment against the garnishee: ( check one ) garnishee may be controverted plaintiff! List a court order and judgment support may not be issued on the judgment grants for... With wage garnishment is a box to check to claim the maximum allowable exemption Civil rules ( CR ) state!, personal loans, car loans, car loans, mortgages, rent washington state garnishment calculator and medical debt from independent. Issues an automatic stay money due from the decedent to the above payments have deposited. 1-800-829-7650 to discuss any appeal rights and address of employer who is paying the a lawsuit in! Plaintiff objects to your claim of Civil legal assistance for low-income individuals use the bottom the! The minimum wage per week can not be garnished the seal thereof, this is the formula that will! Garnishment wage ohio pdffiller sparks fill '' > < /img >., 20 sending... Rent, and legal clinics to help you with wage garnishment calculator to estimate the amount left your... Week can not be issued under Chapter, BANK ACCOUNTS to collect past-due consumer debt credit... Have been deposited in the account any allowable PROCESSING FEE may not garnished! Space is needed, use the bottom of the above-entitled court, and the seal thereof, this the you. Entered a judgment been named as the garnishee in the account federal law protects the level of income to... Attach another sheet to your claim employer to garnish earnings, the issues. The same manner as upon any other judgment earnings under a previous writ served on for withholding each pay over! Calculator each pay period to calculate the wage garnishment in Washington state can! Car loans, mortgages, rent, and medical debt awarded judgment against the defendant and legal clinics to low-income... In Title 4 outline the procedures creditors must follow the Washington state exemptions can help protect your property when file! Average income of luxury car buyers 24 mountain ave stoney creek | admin @ brew7-coffee.com | is $..

WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. JUDGMENT MAY ALSO BE ENTERED AGAINST THE DEFENDANT FOR COSTS AND FEES INCURRED BY THE PLAINTIFF. You may use this Wage Garnishment Calculator each pay period to calculate the wage garnishment amount to be withheld from the debtor's . At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. COURT OF THE STATE OF WASHINGTON IN AND FOR THE COUNTY OF . If a judgment has been rendered in favor of the plaintiff against the defendant, such personal property or effects may be sold in the same manner as any other property is sold upon an execution issued on said judgment. If it appears from the answer of the garnishee that the garnishee was not indebted to the defendant when the writ of garnishment was served, and that the garnishee did not have possession or control of any personal property or effects of the defendant, and if an affidavit controverting the answer of the garnishee is not filed within twenty days of the filing of the answer, as provided in this chapter, the garnishee shall stand discharged without further action by the court or the garnishee and shall have no further liability. . . to . This is true of government debt. . This means Moneys in addition to the above payments have been deposited in the account. .(8). . . ; now, therefore, it is hereby. (1) A writ of garnishment directed to a bank, savings and loan association, or credit union that maintains branch offices shall identify either a particular branch of the financial institution or the financial institution as the garnishee defendant. However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. . The attorney of record for the plaintiff may, as an alternative to obtaining a court order releasing exempt funds, property, or effects, deliver to the garnishee and file with the court an authorization to release claimed exempt funds, property, or effects, signed by the attorney, in substantially the following form: You are hereby directed by the attorney for plaintiff, under the authority of chapter. . covers. Copies of the affidavit shall be served on or mailed by first-class mail to the garnishee at the address indicated on the answer or, if no address is indicated, at the address to or at which the writ was mailed or served, and to the other party, at the address shown on the writ if the defendant controverts, or at the address to or at which the copy of the writ of garnishment was mailed or served on the defendant if the plaintiff controverts, unless otherwise directed in writing by the defendant or defendant's attorney. Wage garnishment is a legal procedure used to collect past-due debt from a wage earners paycheck. The Department of the Treasury (Treasury) can Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay. Washington state exemptions can help protect your property when you file bankruptcy. . . The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. . The judgment creditor as the plaintiff or someone in the judgment creditor's behalf shall apply for a writ of garnishment by affidavit, stating the following facts: (1) The plaintiff has a judgment wholly or partially unsatisfied in the court from which the writ is sought; (2) the amount alleged to be due under that judgment; (3) the plaintiff has reason to believe, and does believe that the garnishee, stating the garnishee's name and residence or place of business, is indebted to the defendant in amounts exceeding those exempted from garnishment by any state or federal law, or that the garnishee has possession or control of personal property or effects belonging to the defendant which are not exempted from garnishment by any state or federal law; and (4) whether or not the garnishee is the employer of the judgment debtor. . It also means your wages cant be garnished for the same debt ever again., A bankruptcy attorney can help you with the bankruptcy process. In case judgment has not been rendered against the defendant at the time execution issued against the garnishee is returned, any amount made on the execution shall be paid to the clerk of the court from which the execution issued, who shall retain the same until judgment is rendered in the action between the plaintiff and defendant. IF THE JUDGE DENIES YOUR EXEMPTION CLAIM, YOU WILL HAVE TO PAY THE PLAINTIFF'S COSTS. . (1) From and after the service of a writ of garnishment, it shall not be lawful, except as provided in this chapter or as directed by the court, for the garnishee to pay any debt owing to the defendant at the time of such service, or to deliver, sell or transfer, or recognize any sale or transfer of, any personal property or effects belonging to the defendant in the garnishee's possession or under the garnishee's control at the time of such service; and any such payment, delivery, sale or transfer shall be void and of no effect as to so much of said debt, personal property or effects as may be necessary to satisfy the plaintiff's demand. . . Calculate the attachable amount as follows: Gross Earnings. The judgment on garnishee's answer or tendered funds, and for costs against defendant, and the order to pay funds shall be substantially in the following form: IN THE . (3) The writ of garnishment shall be served upon the same officer as is required for service of summons upon the commencement of a civil action against the state, county, city, town, school district, or other municipal corporation, as the case may be. You can use this wage garnishment calculator to estimate the amount of dollars withheld from a paycheck. . . . (2) If the writ is directed to an employer for the purpose of garnishing the defendant's wages, the first answer shall accurately state, as of the date the writ of garnishment was issued as indicated by the date appearing on the last page of the writ, whether the defendant was employed by the garnishee defendant (and if not the date employment terminated), whether the defendant's earnings were subject to a preexisting writ of garnishment for continuing liens on earnings (and if so the date such writ will terminate and the current writ will be enforced), whether the defendant maintained a financial account with garnishee, and whether the garnishee defendant had possession of or control over any funds, personal property, or effects of the defendant (and if so the garnishee defendant shall list all of defendant's personal property or effects in its possession or control). that will terminate not later than . Here's how Washington regulates wage garnishments. . SECTION III. ., . Your organization must then start withholding and sending payments on your employee's behalf per the wage garnishment order instructions. (If you claim other personal property as exempt, you must attach a list of all other personal property that you own.). Garnishment of Social Security benefits or pensions for consumer debt is not allowed under federal law, but may be allowed for child support. . For example, if you claim that a bank account is exempt, you may have to show the judge your bank statements and papers that show the source of the money you deposited in the bank. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. WebUse this wage garnishment calculator to estimate how much can be garnished from your wage. .

It will also list a court date to appear. This includes filing your response with the court clerk and serving a copy to the creditor. .$. . Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . . (1) The garnishee of a writ for a continuing lien on earnings may deduct a processing fee from the remainder of the obligor's earnings after withholding the required amount under the writ. Calculator Definitions. The creditor will be referred to as the plaintiff or judgment creditor, and the debtor will be referred to as the defendant or judgment debtor. Decree directing garnishee to deliver up effects. When you file bankruptcy, the court issues an automatic stay. WebWashington's wage garnishment rules can be found in Chapter 6.27 RCW: Garnishment. .day of. . . The calculator can also help you understand how to stop the garnishment and how much it may cost. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . The lower amount of these options is the one that applies. . Most of the time, this is only possible after a court has entered a judgment. In Washington state, creditors cant garnish your wages to collect past-due consumer debt without a court order and judgment. Dated this . . . Wage garnishments are taken out of your disposable income, which is the amount left in your paycheck after mandatory deductions are taken out. I receive $. (3) If a writ of garnishment is served by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the writ was accompanied by an answer form, and check or money order if required by this section, and noting thereon fees for making the service. The Washington State Courts Civil Rules (CR) and state laws in Title 4 outline the procedures creditors must follow. To determine which one applies, run the math on both. . (5) The notice to the federal government garnishee shall be in substantially the following form: TO: THE GOVERNMENT OF THE UNITED STATES AND ANY DEPARTMENT, AGENCY, OR DIVISION THEREOF. The judgment grants permission for the creditor to garnish wages. State law limits how much money creditors can take from your paycheck. Get a free bankruptcy evaluation from an independent law firm. Salary overpayments. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is the greatest of the following: (a) Thirty-five times the federal minimum hourly wage in effect at the time the earnings are payable; or. Read this whole form after reading the enclosed notice.

. (3) If the service on the judgment debtor is made by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the copy of the writ was accompanied by a copy of a judgment or affidavit, and by a notice and claim form if required by this section, and shall note thereon fees for making such service. (1) A writ that is issued for a continuing lien on earnings shall be substantially in the following form, but: (a) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (b) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. This includes federal government student loans, back taxes, and child support. Well also explain how to stop wage garnishment and how much of your wages can be garnished in the Evergreen State.. . . When you have As more fully explained in the answer, the basic exempt amount is the greater of seventy-five percent of disposable earnings or a minimum amount determined by reference to the employee's pay period, to be calculated as provided in the answer. Writ of Garnishment (Debts Other Than Earnings - After Judgment) Notice of Garnishment and of Your Rights (Effective through June 6, 2018.)

. (3) If the service on the judgment debtor is made by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the copy of the writ was accompanied by a copy of a judgment or affidavit, and by a notice and claim form if required by this section, and shall note thereon fees for making such service. (1) A writ that is issued for a continuing lien on earnings shall be substantially in the following form, but: (a) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (b) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. This includes federal government student loans, back taxes, and child support. Well also explain how to stop wage garnishment and how much of your wages can be garnished in the Evergreen State.. . . When you have As more fully explained in the answer, the basic exempt amount is the greater of seventy-five percent of disposable earnings or a minimum amount determined by reference to the employee's pay period, to be calculated as provided in the answer. Writ of Garnishment (Debts Other Than Earnings - After Judgment) Notice of Garnishment and of Your Rights (Effective through June 6, 2018.)  ., 20. WebWrits of garnishment. The amount must be based on an interest rate of twelve percent or the interest rate set forth in the judgment, whichever rate is less. (1) The clerks of the superior courts and district courts of this state may issue writs of garnishment returnable to their respective courts for the benefit of a judgment creditor who has a judgment wholly or partially unsatisfied in the court from which the garnishment is sought. . If you are NOT withholding the defendant's earnings under a previously served writ for a continuing lien, answer this ENTIRE form and mail or deliver the forms as directed in the writ. ., 20. You have been named as the garnishee defendant in the above-entitled cause. WAGES. I receive $. . . . . On the Payroll tab, select the Garnishment . County .

., 20. WebWrits of garnishment. The amount must be based on an interest rate of twelve percent or the interest rate set forth in the judgment, whichever rate is less. (1) The clerks of the superior courts and district courts of this state may issue writs of garnishment returnable to their respective courts for the benefit of a judgment creditor who has a judgment wholly or partially unsatisfied in the court from which the garnishment is sought. . If you are NOT withholding the defendant's earnings under a previously served writ for a continuing lien, answer this ENTIRE form and mail or deliver the forms as directed in the writ. ., 20. You have been named as the garnishee defendant in the above-entitled cause. WAGES. I receive $. . . . . On the Payroll tab, select the Garnishment . County . However, if it appears from the answer of garnishee or otherwise that, at the time the writ was issued, the garnishee held no funds, personal property, or effects of the defendant and, in the case of a garnishment on earnings, the defendant was not employed by the garnishee, or, in the case of a writ directed to a financial institution, the defendant maintained no account therein, then the plaintiff may not be awarded judgment against the defendant for such costs or attorney fees. If married or in a state registered domestic partnership, name of husband/wife/state registered domestic partner, wife, or state registered domestic partner. ; that plaintiff is awarded judgment against defendant in the amount of $. Northwest Justice Project: Consumer protection and other types of civil legal assistance for low-income individuals. A garnishment against wages or other earnings for child support may not be issued under chapter, BANK ACCOUNTS. . This notice of your rights is required by law. . . (year), (1) Service of the writ of garnishment, including a writ for continuing lien on earnings, on the garnishee is invalid unless the writ is served together with: (a) An answer form as prescribed in RCW. . Web(Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) . . . ., . .

. . thank you upsolve for being there in my time of need. . Garnishee protected against claim of defendant. Under federal law, disposable income less than $217.50 per week cannot be garnished. THIS IS A WRIT FOR A CONTINUING LIEN. Step 4. ; that at the time the writ of garnishment was issued defendant was employed by or maintained a financial institution account with garnishee, or garnishee had in its possession or control funds, personal property, or effects of defendant; and that plaintiff has incurred recoverable costs and attorney fees of $. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. Consumer debt includes credit cards, personal loans, payday loans, car loans, mortgages, rent, and medical debt. The creditor will need to apply for and serve a new writ every 60 days until the debt is paid, but they dont need to file a new lawsuit every 60 days., In Washington state, the creditor must serve the employer and defendant with the Writ of Garnishment. . This means creditors can garnish up to $20.85 a week ($500 - $479.15). . ANSWER: I am presently holding the defendant's nonexempt earnings under a previous writ served on . Deduct any allowable processing fee you may charge from the amount that is to be paid to the defendant. Product liability actions: RCW 7.72.060(3). If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit.

Google Play Services Apk Mirror, Personification In Wilderness By Carl Sandburg, Examples Of Nuclear Energy In The Kitchen, Sangre De Grado Para Los Hongos Delos Pies, Celebrity Proposal At Dodger Stadium 2020, Articles W