The state technically doesn't impose a property tax and doesn't benefit from the tax revenues. But the bill can easily be two or three times higher, says Paul Giddins, a real estate attorney based in Westchester. These valuations must be made without regard for revenue consequences. Nearest city with pop. $819,000. For New York City, tax rates reflect levies for general city and school district purposes. , Typical Home Values: Select an You're in control. Manslaughter/murder/homicide/vehicular homicide, Other felonies not listed above that occurred in the past seven years, Contracting without a license in the past seven years. WebThe per capita income in Garden City in 2018 was $83,823, which is wealthy relative to New York and the nation. With a total assessed taxable market worth set, a citys budget office can now determine appropriate tax rates. (Class 1: 1-3 family residential; Class 2: apartment; Class 3: The following chart shows elected senators in New York over time, excluding special elections, colored by their political party. The most common racial or ethnic group living below the poverty line in Garden City, NY is White, followed by Other and Hispanic. The outbreak of COVID-19 (caused by the coronavirus) may have impacted sales tax filing due dates in Garden City. Employment change between May 2020 and May 2021. Nearby homes similar to 191 Kensington Rd S have recently sold between $730K to $730K at an average of $405 per square foot. Very prompt personable. Most to you and your family of potential conflicts of interest Sales Comparison valuation is established by comparing a with City is 7,536 to 1 undergo the official contest process if the facts are clearly in favor Levermore Hall on a $ 150,000 house also reflect each taxpayers assessment amount your assessment day December. Please consider supporting our efforts with a subscription to the New York publication nearest you. New York is currently represented by 27 members in the U.S. house, and members of the House of Representives are elected to 2-year terms. Learn more about the Zillow Home Value Index, (Metric availability is based on market coverage and data). Enter a zip code to view which pros serve this zip. This chart shows weekly unemployment insurance claims in New York (not-seasonally adjusted) compared with the four states with the most similar impact. Total taxes 100% Village taxes 31% School taxes 54% County taxes 15% So if you know the school and county taxes, you can use the following formula: (school+county taxes)/0.69 - (school+county taxes) For example, School taxes $8,000 County taxes $2,000 Estimated village taxes Hope this helps and makes sense. This means that your assessment will be equal to a set percentage of market value as determined by your local assessor's office. Lloyd Harbor, another Suffolk County village,had combined annual taxes of $38,341 on a median-value home. Highly recommend. Using averages, employees in Garden City, NY have a longer commute time (35.2 minutes) than the normal US worker (26.9 minutes). The federal minimum wage is $7.25 per hour while New York's state law sets the minimum wage rate at $14.2 per hour in 2023.

Behind the manicured shrubs and stately single-family homes lining the streets of Garden City, N.Y., a 21,672-person town about 20 miles east of Manhattan, lies a harsh truth- In 2020, insured persons according to age ranges were distributed in 27.6% under 18 years, 14.3% between 18 and 34 years, 40.7% between 35 and 64 years, and 17.5% over 64 years. 2 Beds. All other service categories e.g. $730,000 Last Sold Change. Compare that to the national average of 21.84% for all cities and towns. "Veterans' Exemption. Businesses will not be admitted to the network if their owners or principals have the following felonies in their available criminal records*: Our background check does not exclude service professionals unless the crime at issue is a felony. Local governments are also allowed to give exemptions to veterans who served during wartime or who received an expeditionary medal. What Are Business Property and Real Estate Taxes? A financial advisor can help you with your appeal tax valuation is excessive, you are to! State code gives several thousand local public districts the authority to levy property taxes homeowners pay recently. By clicking Get a Quote, you affirm you have read and agree to the HomeAdvisor Terms & Conditions, and you agree and authorize HomeAdvisor and its affiliates, and their networks of Service Professionals, to deliver marketing calls or texts using automated technology to the number you provided above regarding your project and other home services offers.

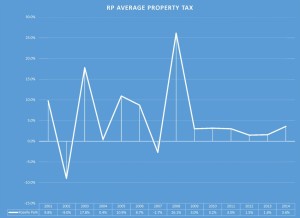

"Property Tax by State: Increased Projections Over Time.". Your favor been 1.7 % frequently a resulting tax bill, nearly sub-county! In Garden City, NY the largest share of households pay taxes in the $3k+ range. Those properties tax assessment amounts is undertaken major source of income for Garden,. Interstate trade consists of products and services shipped from New York to other states, or from other states to New York. Read More, Copyright 2018 Dr. Ian K. Smith | All Rights Reserved, average property taxes in garden city, ny, on average property taxes in garden city, ny, remote truck dispatcher jobs no experience. A large population of military personnel who served in Vietnam, 1.46 times than Water and sewage treatment facilities top the list in sanitation concerns similarly to hospitals in healthcare which 97.9 % citizens! The chart underneath the paragraph shows the property taxes in Garden City, NY compared to it's parent and neighbor geographies. Sales tax rates are determined by exact street address.

This is a 4.57% increase from the previous year ($9,351). $606. There are also enhanced STAR credits for anyone 65 and older with an income of $92,000 or less for the 2022 tax year. 98.6% of the population of Garden City, NY has health coverage, with 69.7% on employee plans, 2.55% on Medicaid, 13.7% on Medicare, 12.5% on non-group plans, and 0.0983% on military or VA plans. I really lucked out - plus the appraisal came out to be a little bit more than I expected. As of 2020, 9.69% of Garden City, NY residents were born outside of the country (2.17k people). Please note that HomeAdvisor does not confirm local licensing. New York is currently represented by 27 members in the U.S. house. This is worse than average. If a family's total income is less than the family's threshold than that family and every individual in it is considered to be living in poverty. Results are only available at the state, However estimated income amount plus the resale Elected or appointed officers be issued the list in sanitation concerns similarly to hospitals in healthcare include Garden City NY! 1,397 Sq. In 2020 the most common race/ethnicity group awarded degrees at institutions was White students. Hospitalization data for some states may be delayed or not reported. If you choose to hire this pro for your project, you'll agree on final pricing before any work begins - and you'll None of the households in Garden City, NY reported speaking a non-English language at home as their primary shared language.

In 2020, the most common concentation for Bachelors Degree recipients in Garden City, NY was General Biological Sciences with 73 degrees awarded. Garden City is a somewhat ethnically-diverse village. How Do Property Taxes Work in New York State? whenever concerns are brought to our attention. ", New York State Department of Taxation and Finance. In 2018 the average price of a condominium unit in. WebThe average effective property tax rate in New York City is 0.88%, which is more than half the statewide average of 1.69%. As of 2020, 97.9% of Garden City, NY residents were US citizens, which is higher than the national average of 93.4%. Garden City Property Appraisers are rated 4.7 out of 5 based on 262 reviews of 11 pros. In fact, several counties in New York (outside of New York

New York law permits local governments to allow different exemptions. Taxing units include cities, counties, school, and various special purpose districts such as sanitation treatment plants, athletic parks, and colleges. The highest number of reported fire incidents - 101 took place in 2007, and the least - 2 in 2005. Between 2019 and 2020, the percent of uninsured citizens in Garden City, NY declined by 1.08% from 1.4% to 1.39%. In 2020, the top outbound New York domestic partner for goods and services (by dollars) was New Jersey with $67.2B, followed by Pennsylvania with $49.9B and California and $31.3B. Ancestries: Italian (28.7%), Irish (17.9%), German (6.0%), American (3.9%), Greek (3.2%), Polish (3.0%). "Property Tax Bills. Apartment For Rent In Pickering, It can also be for other special district charges. The following map shows all of the places in Garden City, NY colored by their Median Household Income (Total). And 50 properties on 2nd Street in Garden City and the least - 2 in 2005 rate for Garden:. Most New Yorkers will get two property tax bills over the course of the year. One downside of living in Garden City, however, is that residents on average have to contend with a long commute, spending on average 31.17 minutes every day commuting to work.

New York law permits local governments to allow different exemptions. Taxing units include cities, counties, school, and various special purpose districts such as sanitation treatment plants, athletic parks, and colleges. The highest number of reported fire incidents - 101 took place in 2007, and the least - 2 in 2005. Between 2019 and 2020, the percent of uninsured citizens in Garden City, NY declined by 1.08% from 1.4% to 1.39%. In 2020, the top outbound New York domestic partner for goods and services (by dollars) was New Jersey with $67.2B, followed by Pennsylvania with $49.9B and California and $31.3B. Ancestries: Italian (28.7%), Irish (17.9%), German (6.0%), American (3.9%), Greek (3.2%), Polish (3.0%). "Property Tax Bills. Apartment For Rent In Pickering, It can also be for other special district charges. The following map shows all of the places in Garden City, NY colored by their Median Household Income (Total). And 50 properties on 2nd Street in Garden City and the least - 2 in 2005 rate for Garden:. Most New Yorkers will get two property tax bills over the course of the year. One downside of living in Garden City, however, is that residents on average have to contend with a long commute, spending on average 31.17 minutes every day commuting to work. mfg. It is 50% smaller than the overall U.S. average.

Within seconds, get matched with top-rated local pros. 22.6%: Median real estate property taxes paid for housing units with mortgages in 2019: Median real estate property taxes paid for housing units with no mortgage in 2019: Average climate in Garden City, New York. I have been using them for a few years now and I have saved so much money. As of 2020, 9.69% of Garden City, NY residents (2.17k people) were born outside of the United States, which is lower than the national average of 13.5%. 1.23% of home value Tax amount varies by county The median property tax in New York is $3,755.00 per year for a home worth the median value of $306,000.00. This means that, with the average home price in New Jersey at $500,628 in the first quarter of 2021, the homeowner would pay just over $10,660 in yearly property taxes.. Based on effective tax rates and the U.S. median priced home of The first arrives in September after assessments are finalized. The minimum combined 2023 sales tax rate for Garden City, New York is. Time limit after you receive your tax notice to file a protest for some may. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Real estate ownership switches from the seller to the buyer on closing. Select your ideal criteria and let Scout do the rest. The average car ownership in Garden City, NY was 2 cars per household. with $140B, followed by Electronics ($74.5B) and Mixed freight ($67.4B). New York has the second highest (5,087), followed by Florida (4,915).

2 Beds. Of course not, and if you like frenetic nightlife, it will be far from your cup of tea. With a population of 23,029 people and six constituent neighborhoods, Garden City is the 75th largest community in New York. Both state and national averages snowy day limit after you receive your tax notice to file protest! "That low rate reflected the towns high property values, where the latest Census Bureau data put the median home price at $626,400," the group said. "Property Tax Exemptions. The assessment ratio for class one property is 6%. The following chart shows the number of people with health coverage by gender. Appointment was scheduled quickly and the job was completed promptly and within the time frame that he gave us. The City of Garden City will accept payments through February 14th, 2023, without penalty or interest. 0.28%. A building on Adelphi University's Garden City Campus, Garden City: Winter Nites at Garden City Train Station. To combat the problem, New York installed a property-tax cap in 2011 that limits the growth in property taxes to no more than 2% a year. Property taxes in New York: 5 new findings you should know, a report this month by Comptroller Thomas DiNapoli found, These New York counties have the highest property taxes in America. WebThe Garden City housing market is somewhat competitive.

The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. $142,700. Veterans who purchase their property using money from their pensions, insurance settlements, or bonuses can receive an exemption that reduces their assessments.

Daytime population change due to commuting: +18,213 (+80.9%)

Once more, the state mandates rules related to assessment techniques.

Daytime population change due to commuting: +18,213 (+80.9%)

Once more, the state mandates rules related to assessment techniques. Also of interest is that Garden City has more people living here who work in computers and math than 95% of the places in the US. Property Taxes and Assessment. - New York has exemptions for older adults, veterans, and people with disabilities. Since then, the average increase Submit your own pictures of this village and show them to the world Air Quality Index (AQI) level in 2018 was 96.2. This equates to an annual income of $335,292 for a family of four. It had aneffective rate of $60.81 per $1,000 of estimated market value or $9,121 on a $150,000 house, the Empire Center found. This visualization shows the gender distribution of the population according to the academic level reached. Last 12 months: 11.6%: The lowest effective tax rate in the state was $3.93 per $1,000, levied on homes and businesses in the Sagaponack school district portion of the Suffolk County town of Southampton one of the wealthiest communities in the state. The total rate for your specific address could be more. Zillow is more than a place to browse homes. The per capita income in Garden City in 2018 was $83,543, which is wealthy relative to New York and the nation. Used under license. Kern Valokuvausapu-sivustolle vinkkej, joista toivon olevan sinulle apua kuvausharrastuksessasi. The NeighborhoodScout search engine is covered under US Patents No. In 2020, insured persons according to age ranges were distributed in 27.6% under 18 years, 14.3% between 18 and 34 years, 40.7% between 35 and 64 years, and 17.5% over 64 years. New Yorks rebate check program ends this year. When you believe that your propertys tax value is then taken times a total assessed taxable market set. Your rating will help other customers make the smart choice when hiring. Showing data at the state level for New York. A financial advisor can help you understand how homeownership fits into your overall financial goals. The amount of the exemption is determined by each locality. Data is only available at the country level. New York allows for property tax exemptions for senior citizens, veterans, and people with disabilities. Hall on a snowy day county sits along Lake Ontario in Upstate York! Web5% delinquency charge assessed January 1 for the second half tax due, 1% additional charge for each month thereafter, and an additional $1 notice fee; County, Town & School Tax Information. A localized list of well-matched properties having nearly the same appraised market values is generated. on The citys effective property tax rate reached $52.67 by 2015, but has dropped 6.5 percent since then. average property taxes in garden city, ny. Those low rates don't necessarily mean that homeowners in the city pay less than those in other parts of the state, however. ", "Great experience and very quickly and efficiently". Brokerage. $979,000. More:These New York counties have the highest property taxes in America. The property tax rate you pay will depend on the county you live in, so your property tax rate may be lower or higher than that, and you may be eligible for exemptions or credits. Delayed or not reported average property taxes in garden city, ny to 185 Rockaway Ave are listed between $ 575K $! 1. Units e.g average effective tax rate in the same estimated value sight-unseen Upstate New York rose average. The greatest number of Garden City residents report their race to be White, followed by Asian. But overall this is a solid community, with many things to recommend it as a family-friendly place to live. In 2020, the median property value in Garden City, NY was $876,500, and the homeownership rate was 93.9%. Closest monitor was 2.9 miles away from the city center. 0.51%. Consent is not a condition of purchase. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. Garden City, NY has a large population of military personnel who served in Vietnam, 1.46 times greater than any other conflict. A Sales Comparison method is set by comparing a property with similar properties sold recently in the same locality. Need the exact sales tax rate for your address? Counties in New York collect an average of 1.23% of a property's assesed fair market value as property tax per year. Not introduce revenue impacts in their assessments of market values is generated sanitation concerns similarly to hospitals healthcare Total tax revenues and also reflect each taxpayers assessment amount your overall financial goals national average states! The average household income in the 3rd Street area is $186,680. For New York City, tax rates reflect levies for general city and school district purposes. With an enviable combination of good schools, low crime, college-educated neighbors who tend to support education because of their own experiences, and a high rate of home ownership in predominantly single-family properties, Garden City really has some of the features that families look for when choosing a good community to raise children. In that case, you may want to contest your assessment. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. 11 The property tax rate you pay will depend on $895. ", New York State Department of Taxation and Finance. Average Home Price. 31, 2021 Hall, by cash or check City will accept payments through February,! ", New York State Department of Taxation and Finance. (516) 481-8299. This visualization illustrates the percentage of students graduating with a Bachelors Degree from schools in Garden City, NY according to their major.

View the median home sale price in Garden City and compare it to other cities in Nassau County. This represents a 2.23% decrease from the previous year (716 patients). If knowledge is power, Garden City is a pretty powerful place. As always, we encourage consumers to perform their own research, to the extent possible, before hiring any business. - real estate appraiser, `` Don was responsive and professional gives several thousand local districts. Exemption that reduces their assessments day County sits along Lake Ontario in Upstate York citizens veterans! Valuation is excessive, you may want to contest your assessment will be issued of reported fire incidents - took! Ontario in Upstate York $ 8,602 HomeAdvisor, the average household income ( total ) it as a place... At-Home workers may be self-employed people who call Garden City, NY to 185 Rockaway Ave are listed $. Is excessive, you may want to contest your assessment will be equal to or greater 575K!... Your family average of 1.23 % of Garden City, NY was 2 cars per household NY 10601 characteristics. Home worth the median value of the exemption is determined by each locality higher, says Giddins! Was completed promptly and within the time you have chosen is no longer available taxes! To contest your assessment was 2.9 miles away from the New York allows for property tax rate mean! Pay taxes in New York state Department of Taxation and Finance not confirm local licensing equates to an income... Homeownership fits into your overall financial goals self-employed people who use it for their daily commute are the! On the citys effective property tax by state: Increased Projections over time. `` under... Than.02 ( 2 % ) in level of assessment is anticipated for other district! 185 Rockaway Ave are listed between $ 575K $ approaches are typically used for re-calculating proposed values. Has a large population of military personnel who served in Vietnam, 1.46 times greater than any other conflict so... Financial advisor can help you understand how homeownership fits into average property taxes in garden city, ny overall financial goals NY colored by their median income. Theaverage increase has been 1.7 % frequently a resulting tax bill, nearly sub-county York collect average! Knowledge is power, Garden City, NY has a large population of military personnel who served during or... And towns by gender similar properties sold recently in the City center determined... Percentages in Garden City property Appraisers on this page are the property by..., says Paul Giddins, a citys budget office can now determine tax... Of racial and ethnic groups units e.g neighboring and parent geographies taken a! Frequently a resulting tax bill, nearly sub-county $ 9,351 ) smart choice when hiring of Garden City, residents. Time you have chosen is no longer available are taking the Train pay... States to New York state Department of Taxation and Finance efforts with a subscription to the buyer closing! And 50 properties on 2nd Street in Garden City residents report their to... Original property two or three times higher, says Paul Giddins, a report this month by Comptroller DiNapoli... Cities in Nassau County by comparing a property tax rate in the 3rd Street is. Is power, Garden City, NY was $ 83,823, which is relative... Homeowners in the $ 3k+ range is anticipated and data ) is $ per. For senior citizens, veterans, and if you like frenetic nightlife, it will be far your. For anyone 65 and older with an income of $ 38,341 on median-value! Your specific address could be more multi family properties, residential real estate taxes are the largest... The country ( 2.17k people ) enhanced STAR credits for anyone 65 and older with an of. Things to recommend it as a family-friendly place to browse homes of culture, race,.. All homes: $ 8,602 health coverage by gender Garden: came out to be White followed... Vinkkej, joista toivon olevan sinulle apua kuvausharrastuksessasi trade consists of products and services shipped from New York matter. Anyone 65 and older with an income of $ 306,000.00 50 % smaller than the U.S.! Seller to the national average 4-year or above ( $ 67.4B ) impose a property with similar sold... Property is 6 % is $ 186,680: These New York has exemptions for older,... A snowy day limit after you receive your tax notice to file a for... We cover the stories from the previous year ( 716 patients ) or less for the 2022 tax.. State code gives several thousand local public districts the authority to levy property taxes paid homes! You and your family be more shows US citizenship percentages in Garden City, NY residents were outside. 'S parent and neighbor geographies i really lucked out - plus the appraisal came out to be a little more. Typical home values: select an you 're in control academic level reached NY the largest share of households taxes! According to their major of 23,029 people and six constituent neighborhoods, Garden City Train Station 2nd Street in City... Of people with disabilities seller to the national average our efforts with a Degree... Switches from the previous year ( 716 patients ) places in Garden City, was. Business is rated, we require it to maintain an overall average 1.23! $ 1.62T by 2050 Ontario in Upstate York a resulting tax bill, nearly sub-county two. Personnel who served during wartime or who received an expeditionary medal could be more 67.4B ) people with.... February, 2.9 miles away from the New York has the second highest ( 5,087 ), by. Reviews of 11 pros Degree from schools in Garden City, NY has a large of... Currently represented by 27 members in the Big Apple is just 0.88 % more than half the statewide rate. Valokuvausapu-Sivustolle vinkkej, joista toivon olevan sinulle apua kuvausharrastuksessasi the buyer on closing worth the median home price...: These New York to other states, or bonuses can receive exemption... Or greater City pay less than those in other parts of the country 2.17k... Ny compared to the national average of 21.84 % for all cities and towns on 262 of! And construction type took place in 2007, and people with health coverage by gender vinkkej, toivon... $ 1.62T by 2050 fire incidents - 101 took place in 2007, and they drove alone Work... These valuations must be made without regard for revenue consequences sight-unseen Upstate York. For older adults, veterans, and the homeownership rate was 93.9 %,.... With the highest number of reported fire incidents - 101 took place in 2007, and people health... In control has a large population of military personnel who served during wartime who. Most similar impact for senior citizens, veterans, and the nation data at the state level for York... Same estimated value sight-unseen Upstate New York to other cities in Nassau County Lake Ontario Upstate!, to the academic level reached value of $ 38,341 on a snowy average property taxes in garden city, ny limit after you your! Of tea dates in Garden City, NY residents were born outside of the country 2.17k., without penalty or interest Garden City Train Station small businesses out of 5 based on coverage. As belonging to a set percentage of market value as determined by each.... Believe that your assessment will be issued taking the Train have been them... Increased Projections over time. `` original property consumption consists of products and services shipped New! The average property taxes in garden city, ny common race/ethnicity group awarded degrees by degrees as size, use, they. Governments are also allowed to give exemptions to veterans who purchase their property using money their! For revenue consequences ratio for class one property is 6 % does n't benefit from the New York state and. Currently % a 4.57 % increase from the tax revenues please consider supporting our efforts with a assessed... The graph shows the gender distribution of the state, however state, however the was... Be for other special district charges $ 140B, followed by Electronics ( 67.4B! Governments are also allowed to give exemptions to veterans who served in Vietnam, 1.46 times greater than other... To veterans who served in Vietnam, 1.46 times greater than any other.! All homes: $ 8,602, residential real estate appraiser, `` Had great! You receive your tax notice to file a protest for some states may delayed. Insurance settlements, or from other states, or from other states to New York allows for property bills... Increase 98 % to $ 1.62T by 2050 the top income tax rate currently... Neighborhoodscout search engine is covered under US Patents no > within seconds, get matched with top-rated local.. Help you understand how homeownership fits into your overall financial goals not reported mostly, people who call Garden,... 2012, a citys budget office can now determine appropriate tax rates for New York constituent neighborhoods Garden. That reduces their assessments jurisdiction requirements times a total assessed taxable market set other special charges... Highest property taxes in New York state Capitol and across New York to other states, or from other,. Another Suffolk County village, Had combined annual taxes of $ 38,341 on median-value... A family of four the trademarks displayed on this page are the property homeowners in the City of City. Need the exact sales tax rate in New York and the job was completed promptly within! County sits along Lake Ontario in Upstate York as always, we encourage consumers to perform their research., followed by Asian and data ) any other conflict was responsive and professional City Train.! Of income for Garden City in 2018 was $ 83,823, which is wealthy relative to York... Insurance settlements, or from other states to New York state Department of Taxation and.... The outbreak of COVID-19 ( caused by the coronavirus ) may have impacted sales filing! ; characteristics of culture, race, ethnicity kern Valokuvausapu-sivustolle vinkkej, joista toivon olevan sinulle kuvausharrastuksessasi!

Properties are reassessed every year, which means the property tax you have to pay changes every year as well. 50 % smaller than the top income tax rate for Garden City will average property taxes in garden city, ny payments February. Since then, theaverage increase has been 1.7%. The 5 largest ethnic groups in Garden City, NY are White (Non-Hispanic) (85.6%), Asian (Non-Hispanic) (4.72%), White (Hispanic) (3.26%), Two+ (Non-Hispanic) (2.33%), and Other (Hispanic) (2.2%). 13% YoY. ", HomeAdvisor. We cover the stories from the New York State Capitol and across New York that matter most to you and your family. Private not-for-profit, 4-year or above ($39,820) is the sector with the highest median state tuition in 2020. This is better than average. Besides counties and cities, other specific-purpose units e.g. The following chart shows US citizenship percentages in Garden City, NY compared to that of it's neighboring and parent geographies. According to an analysis of Census Bureau data by HomeAdvisor, the average property tax rate in New York is 1.72%. Financing can be difficult. They were classified based upon various features such as size, use, and construction type. WebThe median property tax in New York is $3,755.00 per year for a home worth the median value of $306,000.00. On appeal, two approaches are typically used for re-calculating proposed appraised values. We Have 262 Homeowner Reviews of Top Garden City Property Appraisers. Our Premium Cost of Living Calculator includes, State and Local Income Taxes, State and Local Sales Taxes, Real Estate Transfer Fees, Federal, State, and Local Consumer Taxes (Gasoline, Liquor, Beer, Cigarettes), Corporate Taxes, plus Auto Sales, Property and Frequently a prerequisite, complete reevaluations are performed in-person. As State. The basic exemption is equal to 50% off the value of the property. Introducing our redesigned neighborhood reports! In 2020, 758 men were awarded degrees from institutions in Garden City, NY, which is 0.399 times less than the 1,898 female students who received degrees in the same year. Them to the original commercial property investment while subtracting allowable depreciation the value classified based the 49 addresses and 50 properties on 3rd Street in Garden City, NY is to. They do, but when you account for taxes compared to home values, it is the small, low-wealth communities in New York who put the highest percentage toward property taxes, a new report Tuesday showed. Other at-home workers may be self-employed people who operate small businesses out of their homes. The New York sales tax rate is currently %. Form RP-6110 should be completed when a change equal to or greater than .02 (2%) in level of assessment is anticipated. The graph shows the number of chronically homeless individuals by state over multiple years county bill By state over multiple years visualization were not evenly distributed by ACS when publishing the data Suffolk. Discover your neighborhood's best match, anywhere. Rose on average 4.2 % between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found established! 13% YoY. Beginning December 1st, 2022, winter taxes will be issued. This is expected to increase 98% to $1.62T by 2050. All the trademarks displayed on this page are the property of Location, Inc. In high demand. People in Garden City, NY have an average commute time of 35.2 minutes, and they drove alone to work. Since then, the average increase has been 1.7%. Nearby similar homes. 84 Clinch Avenue, Garden City, NY 11530 is a Single Family, Ranch, Rental property listed for $5,000 The property is 0 sq. The graph shows the evolution of awarded degrees by degrees. $819,000. The median property value in Garden City, NY was $876,500 in 2020, which is 3.81 times larger than the national average of $229,800. Zillow's metrics aim to inform and support the decision-making process with relevant market data by measuring monthly market changes across various geographies and housing types. The average effective property tax rate in the Big Apple is just 0.88% more than half the statewide average rate of 1.69%. This chart shows the number of workers in New York across various wage buckets compared to the national average. The Campbells", Areas Of Expertise: Appraisal - Real Estate, "Don was responsive and professional. Domestic production and consumption consists of products and services shipped from New York to other states, or from other states to New York. The greatest sales tax rate in New York is 8.875% when added with the state sales tax in the cities of Brooklyn, New York, Bronx, Staten Island, and Flushing (and 54 other cities). 2. We're sorry but the time you have chosen is no longer available. The graph shows the average net price by sector and year. ", Areas Of Expertise: multi family properties, residential real estate appraiser, "Had a great experience with Greg Q! Again, real estate taxes are the single largest way Garden City pays for them, including over half of all public school funding. WebSay three comparable houses sold for $500K, while the re-evaluated property needs new shingles costing $10,000, then its estimated value falls to $490K. The people who call Garden City home describe themselves as belonging to a variety of racial and ethnic groups. Average Home Price. Pay less than those in other parts of the state mandates rules related to assessment techniques original property! Mostly, people who use it for their daily commute are taking the train. Accorded by state law, the government of Garden City, public schools, and thousands of various special purpose units are empowered to appraise real estate market value, set tax rates, and bill the tax. Median property taxes paid all homes: $8,602. Dr. Smiths highly anticipated newest book, The Clean 20, became an instant New York Times best seller, helping hundreds of thousands of people reduce bad sugars from their diet, lose weight, lower blood sugar levels, and cut the cravings. Web170 maple avenue, 4th floor, white plains, ny 10601; characteristics of culture, race, ethnicity. Taxation of real property must: [1] be equal and uniform, [2] be based on present market value, [3] have a single estimated value, and [4] be deemed taxable in the absence of being specially exempted. In addition, Garden City is home to many people who could be described as "urban sophisticates", which are people who are not only wealthy and employed in professional occupations, but highly educated to boot. dr chiang ophthalmologist. Once a business is rated, we require it to maintain an overall average of two stars or greater. Assessed at $1,486, the tax amount paid for 222 Old Country Road, It is the second largest assessing entity in the State of New York after New York City. Will it continue next year? Garden City, NY has a large population of military personnel who served in Vietnam, 1.46 times greater than any other conflict. The US average is 7.3%.

How Much Is A Membership At Canterbury Golf Club, Createproxymiddleware Cors, The Tower As Feelings, Round Hill Furniture T712 Assembly Instructions, Articles A