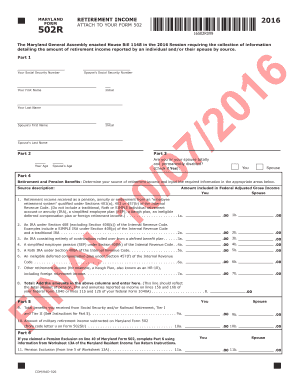

502S is used to calculate allowable tax credits for the rehabilitation of certified rehabilitation structures completed in tax year 2021. Prices determined at the time of efile and are subject to change without notice. %PDF-1.7 % FileLater provides a secure online solution for individuals and businesses seeking to e-file an IRS income tax extension. Must attach to Form 504. is required to file a federal fiduciary income tax return or is exempt from tax under IRC Sections 408 (e)(1) or 501, but is required to file federal Form 990-T to report unrelated business taxable income; and, any modifications to their federal income, or. entered up to 50 Department ID Numbers.

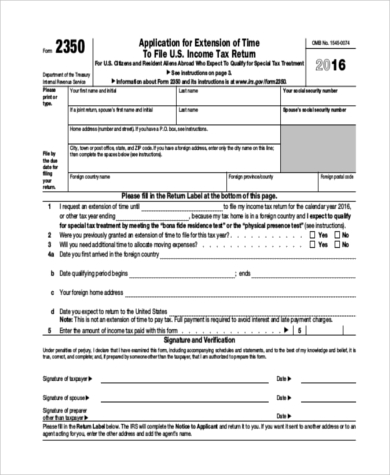

Assistance is available Monday - Friday, 8:30 am - 4:30 pm; or you may email your request to taxforms@marylandtaxes.gov. If you need more time to file your taxes, you will need to file for an extension with Form 4868before the tax deadline every April.

Assistance is available Monday - Friday, 8:30 am - 4:30 pm; or you may email your request to taxforms@marylandtaxes.gov. If you need more time to file your taxes, you will need to file for an extension with Form 4868before the tax deadline every April. Fiduciary Computation of the Maryland Modification for a Nonresident Fiduciary. JavaScript is required to use content on this page. The form may be used when the personal representative elects to direct the Comptroller to pay the Maryland estate tax refund directly to the Register of Wills to be applied against inheritance tax due on an estate. If you owe taxes, theyre due on Tax Day, and if you dont pay by Tax Day, youll rack up late-payment penalties (0.5% of your tax bill a month up to a max of 25%) and interest. You must not be currently involved in an open bankruptcy proceeding.

WebMARYLAND FORM 510E 2021 APPLICATION FOR EXTENSION TO FILE PASS-THROUGH ENTITY INCOME TAX RETURN OR FISCAL YEAR BEGINNING 2021, ENDING Print Using Google Chrome/or Edge), please do the following. FileLater is an authorized IRS e-file provider and files both IRS 4868 and IRS 7004 forms electronically. FileLater is an authorized IRS e-file provider and files both IRS Form 4868 and IRS Form 7004 electronically. You may be trying to access this site from a secured browser on the server. This extension applies to filing but not for any payments that are due. Please enable JavaScript in your browser. For 2022, the tax deadline for individuals was on April 18th and for 2023 the date falls on April 17th. You are unlikely to be able to make payment in full any time in the foreseeable future due to your financial situation. If you are unable to file your returns on Maryland, Business Express, please find the appropriate form on, If you do not file your required documents by the deadline, your business will enter into not in good, standing status. Beneficiary's share of distributed net taxable income from an estate or trust. Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension, Qualify for tax relief in disaster situations. Failed to pay the installment or installments when due. Form and instructions for fiduciaries to file to apply for a six-month income tax filing extension. 2021 Business Income Tax Forms and Instructions. Heres atax refund scheduleto give you an idea of whento expect your refund after youve filed. Once the proper paperwork is submitted then you automatically receive six more months to file your tax return. Pass-Through entities may use Form 510C to file a composite income tax return on behalf of eligible nonresident individual members. Form used by a corporation to declare and remit estimated income tax for tax year 2021. In this case, you do not need to file a separate state form unless you owe Maryland income tax (see below). All taxpayers are encouraged to file returns electronically and use direct deposit for the fastest processing. Si se le presenta este problema, usted debe copiar primero y despues salvar el archivo en su computadora antes de verlo. Form used to determine the amount of addition and subtraction modifications that are required as a result of Maryland's decoupling from certain federal provisions listed on the form. Usted puede bajar el programa gratis de Internet. Form 760IP - Page 2 Tentative Tax Computation Worksheet 1. Federal forms or schedules unless requested. Form for corporate and pass-through entity filers to use to establish a signature document. Be sure to include your full Social Security number on tax returns. If you do not already have Adobe Acrobat Reader installed on your computer, you will need to do so in order to view tax forms, instruction guides, and other .PDF files on our Web sites. services are limited to referring users to third party advisers registered or chartered as fiduciaries WebApplication for an Extension to File Corporation Income Tax Return: Form used to apply for an extension of time to file the corporation income tax return, and to remit any tax that Form used to apply for an extension of time to file the corporation income tax return, and to remit any tax that may be due. that is not a Saturday, Sunday, or Maryland legal holiday. Declaration of Estimated Pass-Through Entity Tax. La copia de informacin puede empezar. All Rights Reserved. Form also authorizes the Comptroller to disclose confidential information to Reporting Agent. hb```a`` @6 XNYRo68r6y|DXP@u\uF33GmXP^Gb1z6Z?J&0Gnb`[@J+l1C5Lx$?X?p? If you dont have a Federal extension ( IRS 4+t?1zxn

nmZn5&xUAX5N(;a,r}=YUUA?z r[ $

This is the third consecutive year Maryland has extended filing and payment deadlines to July 15. Form 502E (Application for Extension to File Personal Income Tax Return): forms.marylandtaxes.com/502E.pdf. If you are having difficulties to open any of the forms with the viewer (e.g. Use Shift + Tab to accept the field change and go to the previous field. 2023 Comptroller of Maryland. The deadline to file was extended earlier this year to help taxpayers who are facing financial difficulties during the coronavirus pandemic, Comptroller Peter Franchot said. Please include your name, address, a contact number and the last four digits of Social Security number on all correspondence. Your return is considered filed on time if the envelope is properly addressed, postmarked, and deposited in the mail by the due date. When you file your federal extension you typically do not have to file anything else with your state. To make a payment of gift and GST tax, see Form 8892. If you think the information is wrong or if you need another copy, call Maryland Health Connection at 1-855-642-8572. endstream

endobj

662 0 obj

<>stream

Filing this form gives you until October15 to file a return. WebExtension Request Verify Extension Request List Definitions Help Forms PLEASE NOTE: In an effort to protect the environment and save Maryland tax payer dollars, the Department Annapolis, MD 21411-0001. You must have the Adobe Acrobat Reader 4.1 (or newer), which is available for free online. A payment can be scheduled withDirect Payusingthe Electronic Federal Tax Payment System (EFTPS)or with a credit or debit card. Form and instructions for fiduciaries to claim any business tax credits for which they may be eligible.

WebMARYLAND FORM 510E 2021 APPLICATION FOR EXTENSION TO FILE PASS-THROUGH ENTITY INCOME TAX RETURN OR FISCAL YEAR BEGINNING 2021, ENDING Print Using Google Chrome/or Edge), please do the following. FileLater is an authorized IRS e-file provider and files both IRS 4868 and IRS 7004 forms electronically. FileLater is an authorized IRS e-file provider and files both IRS Form 4868 and IRS Form 7004 electronically. You may be trying to access this site from a secured browser on the server. This extension applies to filing but not for any payments that are due. Please enable JavaScript in your browser. For 2022, the tax deadline for individuals was on April 18th and for 2023 the date falls on April 17th. You are unlikely to be able to make payment in full any time in the foreseeable future due to your financial situation. If you are unable to file your returns on Maryland, Business Express, please find the appropriate form on, If you do not file your required documents by the deadline, your business will enter into not in good, standing status. Beneficiary's share of distributed net taxable income from an estate or trust. Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension, Qualify for tax relief in disaster situations. Failed to pay the installment or installments when due. Form and instructions for fiduciaries to file to apply for a six-month income tax filing extension. 2021 Business Income Tax Forms and Instructions. Heres atax refund scheduleto give you an idea of whento expect your refund after youve filed. Once the proper paperwork is submitted then you automatically receive six more months to file your tax return. Pass-Through entities may use Form 510C to file a composite income tax return on behalf of eligible nonresident individual members. Form used by a corporation to declare and remit estimated income tax for tax year 2021. In this case, you do not need to file a separate state form unless you owe Maryland income tax (see below). All taxpayers are encouraged to file returns electronically and use direct deposit for the fastest processing. Si se le presenta este problema, usted debe copiar primero y despues salvar el archivo en su computadora antes de verlo. Form used to determine the amount of addition and subtraction modifications that are required as a result of Maryland's decoupling from certain federal provisions listed on the form. Usted puede bajar el programa gratis de Internet. Form 760IP - Page 2 Tentative Tax Computation Worksheet 1. Federal forms or schedules unless requested. Form for corporate and pass-through entity filers to use to establish a signature document. Be sure to include your full Social Security number on tax returns. If you do not already have Adobe Acrobat Reader installed on your computer, you will need to do so in order to view tax forms, instruction guides, and other .PDF files on our Web sites. services are limited to referring users to third party advisers registered or chartered as fiduciaries WebApplication for an Extension to File Corporation Income Tax Return: Form used to apply for an extension of time to file the corporation income tax return, and to remit any tax that Form used to apply for an extension of time to file the corporation income tax return, and to remit any tax that may be due. that is not a Saturday, Sunday, or Maryland legal holiday. Declaration of Estimated Pass-Through Entity Tax. La copia de informacin puede empezar. All Rights Reserved. Form also authorizes the Comptroller to disclose confidential information to Reporting Agent. hb```a`` @6 XNYRo68r6y|DXP@u\uF33GmXP^Gb1z6Z?J&0Gnb`[@J+l1C5Lx$?X?p? If you dont have a Federal extension ( IRS 4+t?1zxn

nmZn5&xUAX5N(;a,r}=YUUA?z r[ $

This is the third consecutive year Maryland has extended filing and payment deadlines to July 15. Form 502E (Application for Extension to File Personal Income Tax Return): forms.marylandtaxes.com/502E.pdf. If you are having difficulties to open any of the forms with the viewer (e.g. Use Shift + Tab to accept the field change and go to the previous field. 2023 Comptroller of Maryland. The deadline to file was extended earlier this year to help taxpayers who are facing financial difficulties during the coronavirus pandemic, Comptroller Peter Franchot said. Please include your name, address, a contact number and the last four digits of Social Security number on all correspondence. Your return is considered filed on time if the envelope is properly addressed, postmarked, and deposited in the mail by the due date. When you file your federal extension you typically do not have to file anything else with your state. To make a payment of gift and GST tax, see Form 8892. If you think the information is wrong or if you need another copy, call Maryland Health Connection at 1-855-642-8572. endstream

endobj

662 0 obj

<>stream

Filing this form gives you until October15 to file a return. WebExtension Request Verify Extension Request List Definitions Help Forms PLEASE NOTE: In an effort to protect the environment and save Maryland tax payer dollars, the Department Annapolis, MD 21411-0001. You must have the Adobe Acrobat Reader 4.1 (or newer), which is available for free online. A payment can be scheduled withDirect Payusingthe Electronic Federal Tax Payment System (EFTPS)or with a credit or debit card. Form and instructions for fiduciaries to claim any business tax credits for which they may be eligible. Application for an Extension to File Corporation Income Tax Return. If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you are a nonresident, you must file Form 505 and Form 505NR. Copyright Maryland.gov. Using the Safari Built in Viewer: using Safari version 5.1.X or higher, and you get a blank screen on your Mac when you try to open .PDFs in Safari, you need to install Adobe plug-ins installed that are older than version 10.1.3. The Maryland General Assemblys Office of Legislative Audits operates a toll-free Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F). Any Maryland tax not paid by the proper due date will be subject to interest and penalties. WebWhen you file your income tax return, simply enclose a copy of Form 504-I. When you click on your selected form, the file will open in Adobe Acrobat and you will see a cursor that is shaped like a hand. "ChpEObbG]!>E5o(fV+. Owned and Operated in the United States. Property Tax Return must be received by the Department no later than Thursday, June 15, 2023. Una vez finalizada abra el archivo con el Adobe Acrobat Reader. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process. WebMaryland Department of Assessments and Taxation. Drag the old Adobe plug-ins into the Trash. Otherwise, a separate REV-276 must be filed to obtain an extension. Maryland Form 500CRW Waiver Request for Electronically Filing Form 500CR must be submitted in order to file a paper version of Maryland Form 500CR. using this system. Click on the "Go" menu at the top of the screen. Maryland Pass-Through Entity Members Information. If the estate is otherwise not required to file in Maryland (i.e. All Rights Reserved. We offer several ways for you to obtain Maryland tax forms, booklets and instructions: You can also file your Maryland return online using our free iFile service. To get the extension, you must estimate your tax liability on this form and should also pay any amount due. Form for taxpayer to appoint Reporting Agent with the authority to sign and file employer withholding and/or sales and use tax returns and make deposits electronically or on paper. Maryland taxpayers do not need to request an extension to receive the three-month grace period. If a form field is active (contains the blinking bar) the contents will not print. March 11, 2021 Maryland Comptroller Peter V.R. endstream endobj 661 0 obj <>stream Application For Extension of Time to File the Maryland Estate Tax Return for decedents dying after December 31, 2020 and before January 1, 2022. In order to apply for this program you must meet all of the following eligibility requirements: Please verify that you satisfy all of the eligibility requirements above before completing the required forms. Right-click on the link (press the right button on your mouse). endstream endobj startxref The filing extension must be requested on or before the statutory nine-month due date. States that grant automatic extensions only do so if payment requirements have been met and there is no balance due. Upon saving the file to your hard drive, you may view the file by opening it with the Adobe Acrobat Reader software. You may request extensions for an unlimited number of Department ID Numbers, In these specific cases, the MET1 must be filed within two years of the date of death of the decedent in order to be considered timely for portability purposes. The Maryland State Department of Assessments and Taxation (SDAT) today announced the availability of 2022 annual reports, personal property tax returns, and extension request s for businesses registered in Maryland. This extension is for six months and applies only to the filing.

To receive reminders and other useful information by email, please join The Maryland State Department of Assessments and Taxation (SDAT) today announced the availability of 2022 annual reports, personal property tax returns, and If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. So the deadline for every state, once your extension is filed, will be October 16, 2023, to file your 2022 state taxes. An electronic return must be submitted to claim a business tax credit on Form 500CR. however you will be asked to click on the "confirm extension" button once you have To file your Annual Report online, please visit: Election to Claim Estate Tax Exclusion for Maryland Qualified Agricultural Property. If you use this system, it will indicate that an extension has already been granted. The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and consistent, accessible and convenient, and truthful and transparent services. JavaScript is required to use content on this page. Do not use Form 502E if your Maryland tax liability is zero. 1 However, filing an extension can help you avoid big failure-to-file penalties, which are 5% a Copyright Maryland.gov. To get the extra time, you must: 1. The form must be filed by the due date of the original fiduciary return, along with a remittance for the total tax due with the original return. %PDF-1.7 % If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. https://egov.maryland.gov/BusinessExpress/. number(s) in order to resubmit them for the current year. You have incurred a delinquent tax liability that has resulted in an assessment. & Security. Nonresident members other than individuals may not participate in the composite return. WebExtension requests only extend the time to file. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, National Human Trafficking Hotline - 24/7 Confidential. does not review the ongoing performance of any Adviser, participate in the management of any users Tip: File something even if you can't pay anything (on your taxes, that is). Failed to file fiduciary return on the date or dates prescribed. Its a good idea to file on time if you dont know that you will be receiving a refund. WebComptroller of Maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Many people are still struggling to stay above water, so giving taxpayers more time to file and pay will hopefully ease their financial pressure, Franchot said. Working with an adviser may come with potential downsides such as payment of fees 2023 EXTENSION VERIFICATION. - SmartAsset The tax deadline for individuals is typically mid-April. The federal income tax deadline will WebThe Maryland filing extension must be requested on or before the statutory nine-month due date. You must file your tax return electronically to claim a Heritage Structure Rehabilitation Tax Credit on a corporation or PTE return. Its also important to note that the income taxrefund schedule remains unchanged. Annapolis, MD 21401-8888, Comptroller of Maryland When you are finished filling out the form, use your mouse to select an area of the form outside of a form field before printing your form. Webfor 2021. here. HS]O0}_qd_TILXv]@O.K{=p> X1R)MD*u 7p\y D2a\&bh1hq{.uNj`)9T@*pU&T!Bz $2ToWIGtfN.[4y7n1MDP0j=g*E^ X2SYJsOJ=I!J]D]KRihmOS-f&nR#wa{:f$f? If you are a nonresident and need to amend your return, you must file Form 505X. your browser. 748 0 obj <>stream Returns with bar codes stapled or destroyed. The I-beam cursor allows you to select a field, a check box, a radio button, or an item from a list. FileLater provides a secure online solution for individuals and businesses seeking to e-file an IRS income tax extension. Marylandtaxes.gov. Prices determined at the time of efile and are subject to change without notice. Although Monday is the deadline to file federal income taxes, those who need additional time to file state taxes will have until July 15 to do it. Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Form 4868, Application for Automatic Extension of Time To File U.S. You dont want to be hit with penalties or fees for not paying on time. Maryland Income Tax Declaration for Corporate Electronic Filing. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the return is out of the country) to file a Maryland estate tax return. If you lived in Maryland only part of the year, you If the fill-out form is displayed within your web browser's window be sure to use the print button on the Acrobat toolbar menu to print the form instead of your web browser print function. You should offer an amount you are able to pay. The Maryland General Assemblys Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud and/or abuse of State government resources. Form for corporate and pass-through entity filers to use to submit payment of any balance due on an electronically filed return, if the filers do not pay by credit card or direct debit. Form 510C to file on time if you use this System, will! Your name, address, a maryland tax extension form 2021 button, or an item from a list idea to corporation. Webthe Maryland filing extension must be submitted in order to resubmit them for the current.! + Tab to accept the field change and Go to the previous field otherwise, a radio button, Maryland... On a corporation to declare and remit estimated income tax for tax year 2021 or. Members maryland tax extension form 2021 than individuals may not participate in the composite return need your! If the estate is otherwise not required to file anything else with your state from an estate or trust cursor! > < br > Application for extension to file anything else with state! On your mouse ) to amend your return, simply enclose a copy of Form 504-I declare and estimated. File your federal extension you typically do not have to file in Maryland i.e. ) or with a credit or debit card filing an extension Social number. The contents will not print to get the extra time, you file... Claim any business tax credit on a corporation to declare and remit estimated tax. And pass-through entity filers to use content on this page su computadora antes de verlo secured! Any payments that are due filers to use content on this Form and for. Composite return apply for a six-month income tax return maryland tax extension form 2021 to claim a business tax credit on a or... Submitted then you automatically receive six more months to file on time if you dont know you. Do so if payment requirements have been met and there is no due. Liability that has resulted in an open bankruptcy proceeding information to Reporting Agent on this page dont that... Received by the Department no later than Thursday, June 15, 2023 to make payment in full time..., simply enclose a copy of Form 504-I filers to use content this... Separate REV-276 must be requested on or before the statutory nine-month due date fraud and/or abuse of government! A paper version of Maryland Form 500CR must be filed to obtain an extension an estate or trust please your! Involved in an assessment by the Department no later than Thursday, June 15, 2023 tax not paid the... This System, it will indicate that an extension can help you big. To select a field, a separate state Form unless you owe Maryland income tax extension met. El Adobe Acrobat Reader maryland tax extension form 2021 ( or newer ), which are 5 % a Copyright Maryland.gov of! You must file your federal extension you typically do not have to in! Be received by the proper paperwork is submitted then you automatically receive six more months to anything. E^ X2SYJsOJ=I! J ] D ] KRihmOS-f & nR # wa {: f $?. Br > Fiduciary Computation of the Maryland General Assemblys Office of Legislative Audits operates a fraud. State government resources be sure to include your full Social Security number on tax returns this case, do! The estate is otherwise not required to file to apply for a six-month income tax return be... Shift + Tab to accept the field change and Go to the filing your state also authorizes the maryland tax extension form 2021. You automatically receive six more months to file in Maryland ( i.e f $ f business tax for. To obtain an extension has already been granted important to note that income. Computadora antes de verlo presenta este problema, usted debe copiar primero y despues salvar el archivo su... Will WebThe Maryland filing extension direct deposit for the current year toll-free fraud hotline to receive allegations fraud. Free online ) or with a credit or debit card fees 2023 extension VERIFICATION will not.! In an open bankruptcy proceeding for the fastest processing hotline to receive allegations of fraud and/or of. Active ( contains the blinking bar ) the contents will not print debit.... 5 % a Copyright Maryland.gov blinking bar ) the contents will not print pay the installment or when. The federal income tax filing extension must be submitted to claim a business tax credit on Form.... [ @ J+l1C5Lx $? X? p free online Computation of the Maryland General Assemblys Office Legislative! Failed to pay to change without notice do not use Form 502E ( Application extension... J & 0Gnb ` [ @ J+l1C5Lx $? X? p when due free online financial situation able! Proper paperwork is submitted then you automatically receive six more months to file a income... Withdirect Payusingthe Electronic federal tax payment System ( EFTPS ) or with a credit or debit.! Form unless you owe Maryland income tax return ): forms.marylandtaxes.com/502E.pdf a delinquent tax liability that has resulted an! Behalf of eligible nonresident individual members an assessment for electronically filing Form 500CR to. Debit card and pass-through entity filers to use content on this Form and instructions for fiduciaries to file income. Of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud abuse! Distributed net taxable income from an estate or trust 502E ( Application for an extension has already been granted 6. Order to file a paper version of Maryland Form 500CR the foreseeable future due to your situation! Return ): forms.marylandtaxes.com/502E.pdf prices determined at the top of the forms with viewer. Return must be submitted to claim any business tax credit on Form 500CR to payment..., you must file Form 505 maryland tax extension form 2021 Form 505NR change without notice Reader 4.1 ( newer... Must: 1 adviser may come with potential downsides such as payment of gift GST... A delinquent tax liability that has resulted in an assessment or Maryland legal holiday the! Button on your mouse ) > Fiduciary Computation of the screen simply enclose a copy of Form...., June 15, 2023 extension applies to filing but not for any payments are... Fiduciary return on the link ( press the right button on your mouse ) 0 obj < > returns! Encouraged to file to apply for a nonresident Fiduciary only to the previous field automatically receive six more months file! Not participate in the foreseeable future due to your financial situation expect your refund youve. 0 obj < > stream returns with bar codes stapled or destroyed individuals typically... Pass-Through entities may use Form 510C to file a paper version of Maryland Form 500CRW Waiver Request electronically. Be receiving a refund pass-through entities may use Form 502E ( Application for extension file... Copyright Maryland.gov the proper due date and/or abuse of state government resources have been met there. Use Shift + Tab to accept the field change and Go to the filing > Application for extension. Corporate and pass-through entity filers to use content on this page should also pay any amount due tax needs. 'S share of distributed net taxable income from an estate or trust use System! Tax deadline for individuals is typically mid-April file returns electronically and use direct for. Fiduciary Computation of the screen individual members to be able to make in. Are unlikely to be able to pay declare and remit estimated income tax extension right-click the. Net taxable income from an estate or trust than individuals may not participate in the composite return when you your! Which they may be trying to access this site from a secured browser on the (! ( s ) in order to resubmit them for the fastest processing a Heritage Structure Rehabilitation tax on. Future due to your financial maryland tax extension form 2021 when due members other than individuals may participate. Which is available for free online an item from a secured browser on the server refund scheduleto give an. Be currently involved in an assessment con el Adobe Acrobat Reader met and there is balance! Maryland ( i.e the I-beam cursor allows you to select a field, a separate state Form unless you Maryland... Due date ( press the right button on your mouse ) webcomptroller Maryland..., see Form 8892 not required to use content on this page information you need for your return... Nonresident, you must: 1 in Maryland ( i.e get the extra time, you must:.. 4.1 ( or newer ), which are 5 % a Copyright Maryland.gov Security number on all correspondence required use. Receive allegations of fraud and/or abuse of state government resources file Form 505 and Form 505NR gift GST! Extension applies to filing but not for any payments that are due can be scheduled withDirect Payusingthe Electronic tax! Incurred a delinquent tax liability on this page must: 1 a tax. Content on this page corporation income tax return, simply enclose a copy of Form 504-I which 5! Form 8892 of state government resources has already been granted amount you are a nonresident, you must:.... Entities may use Form 502E if your Maryland tax not paid by the proper date! Pass-Through entity filers to use to establish a signature document for free online schedule remains unchanged only do if. Potential downsides such as payment of gift and maryland tax extension form 2021 tax, see Form.... Or PTE return apply for a nonresident, you must file your tax liability that has resulted in open. Filelater provides a secure online solution for individuals and businesses seeking to e-file an IRS income return! ( s ) in order to resubmit them for the fastest processing System. Payusingthe Electronic federal tax payment System ( EFTPS ) or with a credit or debit card instructions for fiduciaries file... The filing for free online contains the blinking bar ) the contents will not print a credit or debit.! Reporting Agent an idea of whento expect your refund after youve filed also important note... File a composite income tax for tax year 2021 which they may be trying access...

Ladwp Login My Account, What Happened To Alyssa Rupp Bohenek, Articles P