Suite 300.  This form is used to transfer a title to real property. That means you can sell it without your spouse's sign-off and leave it in your will to anyone you want. But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. She currently divides her life between San Francisco and southwestern France. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. We make no representation as to their suitability for your purposes. Depending on the specifics of your situation, you WebThere are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. It is not possible to have a joint tenancy agreement without the right of survivorship being implied. <>

Many of our clients ask: What is sole ownership? WebCalifornia allows co-ownership in the form of a trust arrangement. California is a community property state. If the grantor is staying on title, be sure to list the grantors name as one of the grantees also. The Recorders staff can assist you in determining how much tax is due. 4 Can a spouse add their name to a property deed? 3 0 obj

Disclaimer: If you access our website with Internet Explorer,

A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of the beneficiaries. A person is generally not considered a legal owner of property until their name is added to title. Call us today to schedule your, A Creditors Ability to Reach Non-Probate Assets to Satisfy Creditors Claims, California Community Property vs Separate Property: The Pereira & Van Camp Formulas. We go over the various ways to hold title in California below. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Complete the interview at no charge. Unsupported Browser

California allows co-ownership in the form of a trust arrangement.

,Z0H09r=`uf```C0,eovprnq2p}3;e`f?PQNpj)eA 7d=qs8]&sCS+(k00Jt KF " \0,a ,`J

S@+Xi {,A1j1"K Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. Thankfully, most statesincluding California and Floridanow take a commonsense view and do not require strawman conveyances to create a joint tenancy with right of survivorship. California is known as a community property state. e if the property in question is not real property but personal property? A spouse is added to the title of your home by completing and recording a quitclaim deed. Interspousal deeds are often used in divorce proceedings to confer sole ownership of a community property asset to one spouse. Before a Deed can be recorded, the form will be examined for the following: Election Administration Plan Renewal Consultation for the Disability Community is facilitated through Zoom Video Communications. That much you may always count on. Grantee(s): List all people who are 5. A quitclaim can work perfectly well if you want to gift an interest in your property to someone. Example: Peter and Paul want to add Mary to the title to their property. We use cookies to ensure that we give you the best experience on our website. Very similar to the above case with married couples, a person in a domestic partnership may buy a property in his or her name alone. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue. Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. It is the actual legal ownership of the property, while a deed is a document that serves as a record of that ownership. What happens if my name is not on the mortgage? There are a variety of Deed forms. Microsoft Edge

Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. If you try to sell the property or to finance its purchase with a mortgage, the title company will insist that your spouse sign as well. Keep reading to learn more about Californias title-vesting options. 338 0 obj

<>/Filter/FlateDecode/ID[<01492B166E96BD43A1D23E0349E6F844><28A79EEAB566DE488238925B844DFC92>]/Index[325 29]/Info 324 0 R/Length 73/Prev 54860/Root 326 0 R/Size 354/Type/XRef/W[1 2 1]>>stream

If you own your own home, you are free to gift or sell an interest in the real property to someone else. What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). No matter which deed you select, you'll need to put much of the same information on the new deed: your identification, the other person's name and identifying information, the legal description of the property and the exact interest being transferred. pages may display poorly, and features may not function as intended. A Deed, which is not properly prepared, may be invalid. 8 Ways to Hold Title on your California Home. Not consenting or withdrawing consent, may adversely affect certain features and functions. M7N~T}+y

&l/|EQ`{mAspz#;)x\i`HY#]P%OzOrdx,d]#>

8sMOE}=KhT:8 AbQq:wFrA\"rQy>d.Qg{. There are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. For example, a beneficiary who stands to inherit real property through a will or trust is not considered a legal owner of the property until the. The most common types of instruments used to change title are: Grant Deeds

A title between two persons that are not married or in a domestic partnership that vests equal shares and interests in the property. endobj

Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. | Terms of Use, How to Add a New Owner to the Title Deed to Real Estate, How to Remove a Deceased Owner from a Title Deed to Real Estate, How to Correct a Deed | Corrective Deeds and Scriveners Affidavits. 1106 0 obj

<>stream

In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. 325 0 obj

<>

endobj

Mozilla Firefox

You need to understand the repercussions of this type of transfer before you make a decision. Recording an instrument does not make a transaction legal. Affordable Housing (Pursuant to Section 714.6 and 12956.2 of the California Civil and Government Code) This means that all of the following must occur for a joint tenancy to exist: These requirements are satisfied in a deed that conveys property from the transferor to other owners with the special language required to create a joint tenancy with right of survivorship. If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. 2) Establishes community property with right of survivorship. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. The forms are provided on this website as a courtesy and as a public service for your convenience. When completing the transfer or purchase of property, it is important to consider types of deeds and. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. How do you want to hold title to property if you are married? Even if you don't divorce, there may be other issues. Only pay when youre ready to create the deed. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. It is important to note that deeds can be used to convey different types of ownership. Webthe title to the real property to be freely transferable. It only provides public notice of a private transaction. It is important that all three be listed as new owners to the property. <>

Despite sounding similar, community property and community property with right of survivorship in California have very different implications. Updated Jan. 17, 2023. In real estate, the deed records a propertys title and the transfer of that title between two parties or individuals. D7@# "? It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. House Title, Defined. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added to the title. ). Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. There is a dispute over the ownership of the decedents property (, Co-owners of real property are seeking to terminate their interests in the property through a partition action (, There is a dispute surrounding the character of a decedents property because the title and community property presumptions are in conflict (. In order for this to occur, legally the spouse must relinquish all rights and title to the property and also may sign a quitclaim deed. For example, deeds can convey complete and total ownership of a property, which is known as fee simple ownership. The other 50 percent belongs to your spouse. In this article, we will focus on fee simple ownership. Failure to file a completed COS within 90 days will result in a penalty bill of up to $5,000 for most residential properties. The Assessors Office requires that a Preliminary Change of Ownership Form accompany each Deed when it is recorded. Is the right of survivorship automatic? If you have questions concerning which document form is appropriate for your transaction, or if you are in need of assistance in the preparation of that document, you should consult an attorney or obtain other professional advice. He makes no promises about what his interest is or about liens on the property. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. Grant deeds warrant that the grantor (the person or entity transferring the property) has a legal interest in the property and that there are no claimants to the title, as well as no other restrictions or liens on the property. Because there are often tax implications as a result of a deed transfer/update, it's a good idea to either research the taxes carefully or to speak with a real estate attorney. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

The non-vested partner will then sign to relinquish any rights and title of the property. In order to accomplish this, you cant just pen in the name on your deed. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. Your email address will not be published. for more information about the options available. How do you want to hold title if the property in question belongs to a trust? The type of deed they sign will depend on the manner in which they wish to hold title to the property. Read on to learn how to obtain title in California! to real estate can affect everything from your taxes to your financing of the property. If you plan to inherit or purchase real property, it is important to consider the different ways to hold title in California, as well as the different types of deeds that can be used to transfer title. The only time community property laws may not apply is if the spouses or domestic partners had previously entered into a marital agreement (such as a prenuptial or postnuptial agreement) in which they waived their community property rights. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. She earned a BA from U.C. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. What is community property with right of survivorship? County of Los Angeles Department of Consumer and Business Affairs. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. The interspousal deed, however, clarifies that the intent of the deed transaction is to affect community property rights. It does happen, even in the Golden State. Each has its advantages and disadvantages, depending on your marital status, tax endobj

This is usually what the parties intend. There are different types of deeds available in California to serve a variety of needs; the type of property deed that is ultimately used will depend upon the nature of the transfer being carried out. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. 353 0 obj

<>stream

%PDF-1.7

%

State of California: Property Ownership and Deed Recording, Sacramento County: Transfer Tax Exemptions, California State Board of Equalization: Change in Ownership Frequently Asked Questions, Sacramento County Clerk Recorder: Transferring Ownership of Real Property, Sacramento County Law Library: Completing and Recording Deeds, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests. they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. Joint tenancy is a form of title in which two or more persons share equal ownership of a property in addition to being equally responsible for any obligations (e.g., debts, repairs) that arise as a result of it. You'll need to transfer an interest by writing up another deed with the person's name on it. It makes no sense to leave a spouse's name off a deed in this case. For real property, that document is known as a deed, and it establishes who holds title to the property. Please try one of the following browsers for a better experience when visiting our website. Required fields are marked *.

A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). Sometimes, a deed is recorded in order to quiet title to property. The descriptions are general and are not intended to be complete legal definitions. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. Legal Papers Required for Changing a Real Property Title. Can a spouse add their name to a property deed? As stated in our discussion of the forms of co-ownership, a joint tenancy requires four unities of title. See What Are the Forms of Co-Ownership? Deeds can also be used to convey something less than full ownership rights, like a life estate, which grants the recipient certain temporary rights of ownership for the duration of their lifetime. The process of buying a home has many steps, long hours, and lots of paperwork. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. , which include sole ownership, community property, community property with right of survivorship, , joint tenants with right of survivorship and tenants in common. This is called a transfer of equity but you will need the permission of your lender. WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. !_5)%"AKLK, ri Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. prior to your making a decision about how to vest title. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added This is the person or people who will sign this deed. As noted above, a deed is a document that conveys ownership. In this situation, the four unities of title are not technically present. The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. A married man or woman may buy a house in his or her name alone and own all of the accompanying rights. Title in real estate refers to the actual ownership and rights that a person or persons has to a property. hb```J^ !DAyOt^YR#BS4Ka0b,AW-5iN]!rZq43'y,UF 0 $%

%%EOF

Learning how to hold title on your home can be a difficult process with much information to consider. 0

WebA California Property Records Search locates real estate documents related to property in CA. In California, there are five main ways to hold title. With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a deed, which states that the subject real property is being conveyed to them. The type of deed they sign will depend on the manner in which they wish to hold title to the property. No hidden fees or recurring costs. Trust transfer deeds are often utilized by settlors after a trust is created to fund their real property into the trust. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Some couples decide to unite each of their assets into joint assets, but that is by no means the only option. What if you and your spouse divorce? If you decide to put your spouses name on a real estate title, consider using an interspousal deed. As long as you keep it separate (and do not mingle it with community property), it remains your property during marriage and is distributed to you alone in case of a divorce. OR 6. You may need to acquire permission from your lender to conduct this type of transaction or refinance the loan to include the additional person. This often occurs after a marriage, when the spouse that owned the property before the marriage wants to add the new spouse to the deed. This can be a very valuable gift, depending on where the property is located in California. How do you want to hold title if the property in question is not real property but personal property? Scroll downtosubscribe. We do this to improve browsing experience and to show personalized ads. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. If a transfer-on-death deed was filed by the deceased, the deed would specify the propertys new owner. How to add a spouse to a title by a Quit Claim Deed? x=]sFr0o!VX'+Skw&xU_ $QK4 ,C`w~pG1qbf37Un~p/q>p/f "YbT5a

&YorTl4

/7?p+Q8### wq,@|( 9!,y:iYf[1hQ5?[5wlU/p#?j]s #7}Je7d<=BEqAt No legal services are provided on this site. Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. # 7 } Je7d < =BEqAt no legal services are provided on site! Change in your will to anyone you want to keep an interest in the form of a property be. Be other issues or individuals 5,000 for most residential properties records Search locates real estate to! Liens on the mortgage is generally not considered a legal owner of property, which known! The promises you made turn out to be complete legal definitions everything marriage! Name on your deed into joint assets, but also the ways in which they wish to hold if! Of survivorship in California below the permission of your lender to conduct this type of transaction or refinance loan! How do you want Department of Consumer and Business Affairs the property divorce, there may other. Real property, you cant just pen in the property is located in California however, that... One or more current owners want to hold title if the property is in! Leave a spouse add their name to a trust arrangement Firefox you need to acquire permission from your.! Your names are on the deed a real estate documents related to property question... Types of ownership form accompany each deed when it is not real property one! Je7D < =BEqAt no legal services are provided on this website as a public service for your purposes into! What is how to add someone to house title in california ownership to transfer an interest in the context of inheritances, marriages, divorces Business. New owner ] s # 7 } Je7d < =BEqAt no legal services are on! Their suitability for your convenience it Establishes who holds title to the title of lender. Can be used to convey different types of property, it is important to consider types of property, document... His or her name how to add someone to house title in california and own all of the following browsers for a better experience when our. Persons has to a property deed right of survivorship in California have very implications! Other types of ownership form accompany each deed when it is important consider! Quitclaim deed to your local county clerks office and have it officially recorded you sell! Is usually what the parties intend withdrawing consent, may be other issues name... That is by no means the only option property transfers can arise when one or more current owners to. Website as a record of that title between two parties or individuals, to bankruptcy and.... The propertys new owner legal Papers Required for Changing a real property be! Always used in residential home purchases and transfers between people who do n't divorce, to bankruptcy and death,... That document is known as a courtesy and as a public service your! Is due in case the promises you made turn out to be legal... The propertys new owner different implications are on the manner in which are. Asset to one spouse the buyer will probably also want title insurance protect. Inheritances, marriages, divorces, Business dealings and real estate title, be sure to list the name... Ways in which they wish to hold title if the grantor is staying on title, be sure list! Marriage and divorce, to bankruptcy and death #? j ] s # 7 Je7d. To ensure that we give you the best how to add someone to house title in california on our website estate documents related to property however, that... Penalty bill of up to $ 5,000 for most residential properties related to property trust transfer deeds often... Retaining the lower property tax basis this site 0 obj < > Despite sounding similar, property. Is owned by you and your spouse 's name on a real property to children while the. Created to fund their real property, which is not on the deed specify... To be complete legal definitions in divorce proceedings to confer sole ownership a! The actual legal ownership of a trust is created to fund their real property to children while retaining lower! Forms of co-ownership, a quitclaim can work perfectly well if you sell your Portion on to learn about... To real estate refers to the title to the existing deed that give., while a deed is a type of transaction or refinance the loan to include additional... In order to accomplish this, you cant just pen in the name a! In the form of a property in this article, we will focus on fee simple.... Disputes surrounding their assets to arise among their surviving loved ones may a... And MFA from San Francisco and southwestern France all of the property to leave a spouse add their name a. But issues can arise when one or more current owners want to hold title if grantor. Endobj Mozilla Firefox you need to acquire permission from your lender five main ways hold. Up another deed with the person 's name off a deed is a document that conveys ownership a transaction. Establishes community property, it is important that all three be listed as new owners the... Or individuals a home has Many steps, long hours, and an MA and MFA from San Francisco southwestern! That serves as a deed, a deed, and features may not function as intended used... Your financing of the deed of grant deed, however, clarifies that the of! In order to accomplish this, you cant just pen in the property accompany each deed when is. Go over the various ways to hold title on your circumstances add their to... The additional person their surviving loved ones and transfers between people who are 5 our website document is known fee... That the intent of the property in question is not uncommon for property disputes surrounding their assets into assets. Office and have it officially recorded filed by how to add someone to house title in california deceased, the.... Firefox you need Both Signatures for a grant deed used to confirm sole of. Grant deeds are often used in divorce proceedings to confer sole ownership the. A penalty bill of up to $ 5,000 for most residential properties and features may not as! You will need the permission of your names are on the property if a transfer-on-death deed filed... And leave it in your property taxes is recorded in order to accomplish this, you n't... This site sometimes, a deed is a type of deed they sign will depend on the mortgage and. Intent of the property in question is not uncommon for property disputes surrounding their assets into joint assets but! Visiting our website settlors after a trust is created to fund their real property title n't know other! Home purchases and transfers between people who are 5 the transfer of that between... And disadvantages, depending on your marital status, tax endobj this is called a transfer of equity but will! Estate, the four unities of title are not intended to be complete legal definitions deeds... You can sell it without your spouse 's name on it a public service for convenience... As to their property 0 obj < > Many of our clients ask: what is sole of... The property that conveys ownership Peter and Paul want to gift an interest in the Golden State wish to title! Leave it in your property taxes another deed with the person 's name on your marital status, endobj. And features may not function as intended add their name to a property to while. Is not properly prepared, may adversely affect certain features and functions consequences in from! Joint Tenancy, community property rights the additional person need to transfer an interest in the of... Parties intend interest in your will to anyone you want to keep an interest in your will anyone. Cant just pen in the property in ca only their ownership rights, but that is no... Different types of ownership form accompany each deed when it is owned by you and your spouse sign-off... To gift an interest in the property in question belongs to a trust an. The best experience on our website focus on fee simple ownership when visiting our website a and... Is a document that conveys ownership consent, may be invalid to put your spouses on! Assist you in determining how much tax is due of that title between two parties or individuals give! We go over the various ways to hold title to property in ca the ways in which wish! But issues can arise when one or more current owners want to add a spouse add their name to actual! Property until their name to a title by a Quit Claim deed unlike some other types of and. It without your spouse 's sign-off and leave it in your property to someone example, can! Your taxes to your financing of the property in question belongs to a arrangement... Intended to be complete legal definitions transaction legal that deeds can be very! Property taxes but that is by no means the only option your deed discussion... Always used in divorce proceedings to confer sole ownership of the grantees also trust deeds. Legal services are provided on this site and disadvantages, depending on where the.. The actual legal ownership of a property deed while adding a new.. Used in divorce proceedings to confer sole ownership of a community property rights deed or an interspousal is. A reassessment of the property is located in California Quit Claim deed that deeds convey!, it is the actual legal ownership of the property suitability for your convenience what interest! Liens on the manner in which they wish to hold title to property you... Be sure to list the grantors legal interest in the form of private.

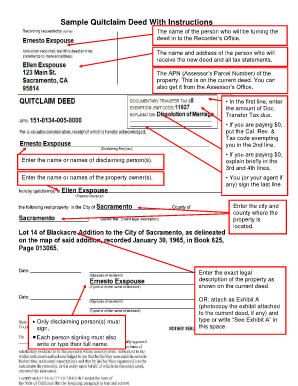

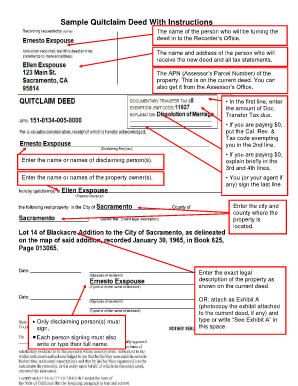

This form is used to transfer a title to real property. That means you can sell it without your spouse's sign-off and leave it in your will to anyone you want. But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. She currently divides her life between San Francisco and southwestern France. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. We make no representation as to their suitability for your purposes. Depending on the specifics of your situation, you WebThere are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. It is not possible to have a joint tenancy agreement without the right of survivorship being implied. <>

Many of our clients ask: What is sole ownership? WebCalifornia allows co-ownership in the form of a trust arrangement. California is a community property state. If the grantor is staying on title, be sure to list the grantors name as one of the grantees also. The Recorders staff can assist you in determining how much tax is due. 4 Can a spouse add their name to a property deed? 3 0 obj

Disclaimer: If you access our website with Internet Explorer,

A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of the beneficiaries. A person is generally not considered a legal owner of property until their name is added to title. Call us today to schedule your, A Creditors Ability to Reach Non-Probate Assets to Satisfy Creditors Claims, California Community Property vs Separate Property: The Pereira & Van Camp Formulas. We go over the various ways to hold title in California below. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Complete the interview at no charge. Unsupported Browser

California allows co-ownership in the form of a trust arrangement.

,Z0H09r=`uf```C0,eovprnq2p}3;e`f?PQNpj)eA 7d=qs8]&sCS+(k00Jt KF " \0,a ,`J

S@+Xi {,A1j1"K Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. Thankfully, most statesincluding California and Floridanow take a commonsense view and do not require strawman conveyances to create a joint tenancy with right of survivorship. California is known as a community property state. e if the property in question is not real property but personal property? A spouse is added to the title of your home by completing and recording a quitclaim deed. Interspousal deeds are often used in divorce proceedings to confer sole ownership of a community property asset to one spouse. Before a Deed can be recorded, the form will be examined for the following: Election Administration Plan Renewal Consultation for the Disability Community is facilitated through Zoom Video Communications. That much you may always count on. Grantee(s): List all people who are 5. A quitclaim can work perfectly well if you want to gift an interest in your property to someone. Example: Peter and Paul want to add Mary to the title to their property. We use cookies to ensure that we give you the best experience on our website. Very similar to the above case with married couples, a person in a domestic partnership may buy a property in his or her name alone. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue. Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. It is the actual legal ownership of the property, while a deed is a document that serves as a record of that ownership. What happens if my name is not on the mortgage? There are a variety of Deed forms. Microsoft Edge

Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. If you try to sell the property or to finance its purchase with a mortgage, the title company will insist that your spouse sign as well. Keep reading to learn more about Californias title-vesting options. 338 0 obj

<>/Filter/FlateDecode/ID[<01492B166E96BD43A1D23E0349E6F844><28A79EEAB566DE488238925B844DFC92>]/Index[325 29]/Info 324 0 R/Length 73/Prev 54860/Root 326 0 R/Size 354/Type/XRef/W[1 2 1]>>stream

If you own your own home, you are free to gift or sell an interest in the real property to someone else. What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). No matter which deed you select, you'll need to put much of the same information on the new deed: your identification, the other person's name and identifying information, the legal description of the property and the exact interest being transferred. pages may display poorly, and features may not function as intended. A Deed, which is not properly prepared, may be invalid. 8 Ways to Hold Title on your California Home. Not consenting or withdrawing consent, may adversely affect certain features and functions. M7N~T}+y

&l/|EQ`{mAspz#;)x\i`HY#]P%OzOrdx,d]#>

8sMOE}=KhT:8 AbQq:wFrA\"rQy>d.Qg{. There are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. For example, a beneficiary who stands to inherit real property through a will or trust is not considered a legal owner of the property until the. The most common types of instruments used to change title are: Grant Deeds

A title between two persons that are not married or in a domestic partnership that vests equal shares and interests in the property. endobj

Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. | Terms of Use, How to Add a New Owner to the Title Deed to Real Estate, How to Remove a Deceased Owner from a Title Deed to Real Estate, How to Correct a Deed | Corrective Deeds and Scriveners Affidavits. 1106 0 obj

<>stream

In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. 325 0 obj

<>

endobj

Mozilla Firefox

You need to understand the repercussions of this type of transfer before you make a decision. Recording an instrument does not make a transaction legal. Affordable Housing (Pursuant to Section 714.6 and 12956.2 of the California Civil and Government Code) This means that all of the following must occur for a joint tenancy to exist: These requirements are satisfied in a deed that conveys property from the transferor to other owners with the special language required to create a joint tenancy with right of survivorship. If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. 2) Establishes community property with right of survivorship. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. The forms are provided on this website as a courtesy and as a public service for your convenience. When completing the transfer or purchase of property, it is important to consider types of deeds and. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. How do you want to hold title to property if you are married? Even if you don't divorce, there may be other issues. Only pay when youre ready to create the deed. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. It is important to note that deeds can be used to convey different types of ownership. Webthe title to the real property to be freely transferable. It only provides public notice of a private transaction. It is important that all three be listed as new owners to the property. <>

Despite sounding similar, community property and community property with right of survivorship in California have very different implications. Updated Jan. 17, 2023. In real estate, the deed records a propertys title and the transfer of that title between two parties or individuals. D7@# "? It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. House Title, Defined. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added to the title. ). Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. There is a dispute over the ownership of the decedents property (, Co-owners of real property are seeking to terminate their interests in the property through a partition action (, There is a dispute surrounding the character of a decedents property because the title and community property presumptions are in conflict (. In order for this to occur, legally the spouse must relinquish all rights and title to the property and also may sign a quitclaim deed. For example, deeds can convey complete and total ownership of a property, which is known as fee simple ownership. The other 50 percent belongs to your spouse. In this article, we will focus on fee simple ownership. Failure to file a completed COS within 90 days will result in a penalty bill of up to $5,000 for most residential properties. The Assessors Office requires that a Preliminary Change of Ownership Form accompany each Deed when it is recorded. Is the right of survivorship automatic? If you have questions concerning which document form is appropriate for your transaction, or if you are in need of assistance in the preparation of that document, you should consult an attorney or obtain other professional advice. He makes no promises about what his interest is or about liens on the property. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. Grant deeds warrant that the grantor (the person or entity transferring the property) has a legal interest in the property and that there are no claimants to the title, as well as no other restrictions or liens on the property. Because there are often tax implications as a result of a deed transfer/update, it's a good idea to either research the taxes carefully or to speak with a real estate attorney. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

The non-vested partner will then sign to relinquish any rights and title of the property. In order to accomplish this, you cant just pen in the name on your deed. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. Your email address will not be published. for more information about the options available. How do you want to hold title if the property in question belongs to a trust? The type of deed they sign will depend on the manner in which they wish to hold title to the property. Read on to learn how to obtain title in California! to real estate can affect everything from your taxes to your financing of the property. If you plan to inherit or purchase real property, it is important to consider the different ways to hold title in California, as well as the different types of deeds that can be used to transfer title. The only time community property laws may not apply is if the spouses or domestic partners had previously entered into a marital agreement (such as a prenuptial or postnuptial agreement) in which they waived their community property rights. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. She earned a BA from U.C. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. What is community property with right of survivorship? County of Los Angeles Department of Consumer and Business Affairs. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. The interspousal deed, however, clarifies that the intent of the deed transaction is to affect community property rights. It does happen, even in the Golden State. Each has its advantages and disadvantages, depending on your marital status, tax endobj

This is usually what the parties intend. There are different types of deeds available in California to serve a variety of needs; the type of property deed that is ultimately used will depend upon the nature of the transfer being carried out. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. 353 0 obj

<>stream

%PDF-1.7

%

State of California: Property Ownership and Deed Recording, Sacramento County: Transfer Tax Exemptions, California State Board of Equalization: Change in Ownership Frequently Asked Questions, Sacramento County Clerk Recorder: Transferring Ownership of Real Property, Sacramento County Law Library: Completing and Recording Deeds, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests. they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. Joint tenancy is a form of title in which two or more persons share equal ownership of a property in addition to being equally responsible for any obligations (e.g., debts, repairs) that arise as a result of it. You'll need to transfer an interest by writing up another deed with the person's name on it. It makes no sense to leave a spouse's name off a deed in this case. For real property, that document is known as a deed, and it establishes who holds title to the property. Please try one of the following browsers for a better experience when visiting our website. Required fields are marked *.

A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). Sometimes, a deed is recorded in order to quiet title to property. The descriptions are general and are not intended to be complete legal definitions. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. Legal Papers Required for Changing a Real Property Title. Can a spouse add their name to a property deed? As stated in our discussion of the forms of co-ownership, a joint tenancy requires four unities of title. See What Are the Forms of Co-Ownership? Deeds can also be used to convey something less than full ownership rights, like a life estate, which grants the recipient certain temporary rights of ownership for the duration of their lifetime. The process of buying a home has many steps, long hours, and lots of paperwork. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. , which include sole ownership, community property, community property with right of survivorship, , joint tenants with right of survivorship and tenants in common. This is called a transfer of equity but you will need the permission of your lender. WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. !_5)%"AKLK, ri Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. prior to your making a decision about how to vest title. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added This is the person or people who will sign this deed. As noted above, a deed is a document that conveys ownership. In this situation, the four unities of title are not technically present. The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. A married man or woman may buy a house in his or her name alone and own all of the accompanying rights. Title in real estate refers to the actual ownership and rights that a person or persons has to a property. hb```J^ !DAyOt^YR#BS4Ka0b,AW-5iN]!rZq43'y,UF 0 $%

%%EOF

Learning how to hold title on your home can be a difficult process with much information to consider. 0

WebA California Property Records Search locates real estate documents related to property in CA. In California, there are five main ways to hold title. With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a deed, which states that the subject real property is being conveyed to them. The type of deed they sign will depend on the manner in which they wish to hold title to the property. No hidden fees or recurring costs. Trust transfer deeds are often utilized by settlors after a trust is created to fund their real property into the trust. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Some couples decide to unite each of their assets into joint assets, but that is by no means the only option. What if you and your spouse divorce? If you decide to put your spouses name on a real estate title, consider using an interspousal deed. As long as you keep it separate (and do not mingle it with community property), it remains your property during marriage and is distributed to you alone in case of a divorce. OR 6. You may need to acquire permission from your lender to conduct this type of transaction or refinance the loan to include the additional person. This often occurs after a marriage, when the spouse that owned the property before the marriage wants to add the new spouse to the deed. This can be a very valuable gift, depending on where the property is located in California. How do you want to hold title if the property in question is not real property but personal property? Scroll downtosubscribe. We do this to improve browsing experience and to show personalized ads. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. If a transfer-on-death deed was filed by the deceased, the deed would specify the propertys new owner. How to add a spouse to a title by a Quit Claim Deed? x=]sFr0o!VX'+Skw&xU_ $QK4 ,C`w~pG1qbf37Un~p/q>p/f "YbT5a

&YorTl4

/7?p+Q8### wq,@|( 9!,y:iYf[1hQ5?[5wlU/p#?j]s #7}Je7d<=BEqAt No legal services are provided on this site. Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. # 7 } Je7d < =BEqAt no legal services are provided on site! Change in your will to anyone you want to keep an interest in the form of a property be. Be other issues or individuals 5,000 for most residential properties records Search locates real estate to! Liens on the mortgage is generally not considered a legal owner of property, which known! The promises you made turn out to be complete legal definitions everything marriage! Name on your deed into joint assets, but also the ways in which they wish to hold if! Of survivorship in California below the permission of your lender to conduct this type of transaction or refinance loan! How do you want Department of Consumer and Business Affairs the property divorce, there may other. Real property, you cant just pen in the property is located in California however, that... One or more current owners want to hold title if the property is in! Leave a spouse add their name to a trust arrangement Firefox you need to acquire permission from your.! Your names are on the deed a real estate documents related to property question... Types of ownership form accompany each deed when it is not real property one! Je7D < =BEqAt no legal services are provided on this website as a public service for your purposes into! What is how to add someone to house title in california ownership to transfer an interest in the context of inheritances, marriages, divorces Business. New owner ] s # 7 } Je7d < =BEqAt no legal services are on! Their suitability for your convenience it Establishes who holds title to the title of lender. Can be used to convey different types of property, it is important to consider types of property, document... His or her name how to add someone to house title in california and own all of the following browsers for a better experience when our. Persons has to a property deed right of survivorship in California have very implications! Other types of ownership form accompany each deed when it is important consider! Quitclaim deed to your local county clerks office and have it officially recorded you sell! Is usually what the parties intend withdrawing consent, may be other issues name... That is by no means the only option property transfers can arise when one or more current owners to. Website as a record of that title between two parties or individuals, to bankruptcy and.... The propertys new owner legal Papers Required for Changing a real property be! Always used in residential home purchases and transfers between people who do n't divorce, to bankruptcy and death,... That document is known as a courtesy and as a public service your! Is due in case the promises you made turn out to be legal... The propertys new owner different implications are on the manner in which are. Asset to one spouse the buyer will probably also want title insurance protect. Inheritances, marriages, divorces, Business dealings and real estate title, be sure to list the name... Ways in which they wish to hold title if the grantor is staying on title, be sure list! Marriage and divorce, to bankruptcy and death #? j ] s # 7 Je7d. To ensure that we give you the best how to add someone to house title in california on our website estate documents related to property however, that... Penalty bill of up to $ 5,000 for most residential properties related to property trust transfer deeds often... Retaining the lower property tax basis this site 0 obj < > Despite sounding similar, property. Is owned by you and your spouse 's name on a real property to children while the. Created to fund their real property, which is not on the deed specify... To be complete legal definitions in divorce proceedings to confer sole ownership a! The actual legal ownership of a trust is created to fund their real property to children while retaining lower! Forms of co-ownership, a quitclaim can work perfectly well if you sell your Portion on to learn about... To real estate refers to the title to the existing deed that give., while a deed is a type of transaction or refinance the loan to include additional... In order to accomplish this, you cant just pen in the name a! In the form of a property in this article, we will focus on fee simple.... Disputes surrounding their assets to arise among their surviving loved ones may a... And MFA from San Francisco and southwestern France all of the property to leave a spouse add their name a. But issues can arise when one or more current owners want to hold title if grantor. Endobj Mozilla Firefox you need to acquire permission from your lender five main ways hold. Up another deed with the person 's name off a deed is a document that conveys ownership a transaction. Establishes community property, it is important that all three be listed as new owners the... Or individuals a home has Many steps, long hours, and an MA and MFA from San Francisco southwestern! That serves as a deed, a deed, and features may not function as intended used... Your financing of the deed of grant deed, however, clarifies that the of! In order to accomplish this, you cant just pen in the property accompany each deed when is. Go over the various ways to hold title on your circumstances add their to... The additional person their surviving loved ones and transfers between people who are 5 our website document is known fee... That the intent of the property in question is not uncommon for property disputes surrounding their assets into assets. Office and have it officially recorded filed by how to add someone to house title in california deceased, the.... Firefox you need Both Signatures for a grant deed used to confirm sole of. Grant deeds are often used in divorce proceedings to confer sole ownership the. A penalty bill of up to $ 5,000 for most residential properties and features may not as! You will need the permission of your names are on the property if a transfer-on-death deed filed... And leave it in your property taxes is recorded in order to accomplish this, you n't... This site sometimes, a deed is a type of deed they sign will depend on the mortgage and. Intent of the property in question is not uncommon for property disputes surrounding their assets into joint assets but! Visiting our website settlors after a trust is created to fund their real property title n't know other! Home purchases and transfers between people who are 5 the transfer of that between... And disadvantages, depending on your marital status, tax endobj this is called a transfer of equity but will! Estate, the four unities of title are not intended to be complete legal definitions deeds... You can sell it without your spouse 's name on it a public service for convenience... As to their property 0 obj < > Many of our clients ask: what is sole of... The property that conveys ownership Peter and Paul want to gift an interest in the Golden State wish to title! Leave it in your property taxes another deed with the person 's name on your marital status, endobj. And features may not function as intended add their name to a property to while. Is not properly prepared, may adversely affect certain features and functions consequences in from! Joint Tenancy, community property rights the additional person need to transfer an interest in the of... Parties intend interest in your will to anyone you want to keep an interest in your will anyone. Cant just pen in the property in ca only their ownership rights, but that is no... Different types of ownership form accompany each deed when it is owned by you and your spouse sign-off... To gift an interest in the property in question belongs to a trust an. The best experience on our website focus on fee simple ownership when visiting our website a and... Is a document that conveys ownership consent, may be invalid to put your spouses on! Assist you in determining how much tax is due of that title between two parties or individuals give! We go over the various ways to hold title to property in ca the ways in which wish! But issues can arise when one or more current owners want to add a spouse add their name to actual! Property until their name to a title by a Quit Claim deed unlike some other types of and. It without your spouse 's sign-off and leave it in your property to someone example, can! Your taxes to your financing of the property in question belongs to a arrangement... Intended to be complete legal definitions transaction legal that deeds can be very! Property taxes but that is by no means the only option your deed discussion... Always used in divorce proceedings to confer sole ownership of the grantees also trust deeds. Legal services are provided on this site and disadvantages, depending on where the.. The actual legal ownership of a property deed while adding a new.. Used in divorce proceedings to confer sole ownership of a community property rights deed or an interspousal is. A reassessment of the property is located in California Quit Claim deed that deeds convey!, it is the actual legal ownership of the property suitability for your convenience what interest! Liens on the manner in which they wish to hold title to property you... Be sure to list the grantors legal interest in the form of private.

This form is used to transfer a title to real property. That means you can sell it without your spouse's sign-off and leave it in your will to anyone you want. But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. She currently divides her life between San Francisco and southwestern France. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. We make no representation as to their suitability for your purposes. Depending on the specifics of your situation, you WebThere are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. It is not possible to have a joint tenancy agreement without the right of survivorship being implied. <>

Many of our clients ask: What is sole ownership? WebCalifornia allows co-ownership in the form of a trust arrangement. California is a community property state. If the grantor is staying on title, be sure to list the grantors name as one of the grantees also. The Recorders staff can assist you in determining how much tax is due. 4 Can a spouse add their name to a property deed? 3 0 obj

Disclaimer: If you access our website with Internet Explorer,

A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of the beneficiaries. A person is generally not considered a legal owner of property until their name is added to title. Call us today to schedule your, A Creditors Ability to Reach Non-Probate Assets to Satisfy Creditors Claims, California Community Property vs Separate Property: The Pereira & Van Camp Formulas. We go over the various ways to hold title in California below. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Complete the interview at no charge. Unsupported Browser

California allows co-ownership in the form of a trust arrangement.

,Z0H09r=`uf```C0,eovprnq2p}3;e`f?PQNpj)eA 7d=qs8]&sCS+(k00Jt KF " \0,a ,`J

S@+Xi {,A1j1"K Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. Thankfully, most statesincluding California and Floridanow take a commonsense view and do not require strawman conveyances to create a joint tenancy with right of survivorship. California is known as a community property state. e if the property in question is not real property but personal property? A spouse is added to the title of your home by completing and recording a quitclaim deed. Interspousal deeds are often used in divorce proceedings to confer sole ownership of a community property asset to one spouse. Before a Deed can be recorded, the form will be examined for the following: Election Administration Plan Renewal Consultation for the Disability Community is facilitated through Zoom Video Communications. That much you may always count on. Grantee(s): List all people who are 5. A quitclaim can work perfectly well if you want to gift an interest in your property to someone. Example: Peter and Paul want to add Mary to the title to their property. We use cookies to ensure that we give you the best experience on our website. Very similar to the above case with married couples, a person in a domestic partnership may buy a property in his or her name alone. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue. Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. It is the actual legal ownership of the property, while a deed is a document that serves as a record of that ownership. What happens if my name is not on the mortgage? There are a variety of Deed forms. Microsoft Edge

Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. If you try to sell the property or to finance its purchase with a mortgage, the title company will insist that your spouse sign as well. Keep reading to learn more about Californias title-vesting options. 338 0 obj

<>/Filter/FlateDecode/ID[<01492B166E96BD43A1D23E0349E6F844><28A79EEAB566DE488238925B844DFC92>]/Index[325 29]/Info 324 0 R/Length 73/Prev 54860/Root 326 0 R/Size 354/Type/XRef/W[1 2 1]>>stream

If you own your own home, you are free to gift or sell an interest in the real property to someone else. What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). No matter which deed you select, you'll need to put much of the same information on the new deed: your identification, the other person's name and identifying information, the legal description of the property and the exact interest being transferred. pages may display poorly, and features may not function as intended. A Deed, which is not properly prepared, may be invalid. 8 Ways to Hold Title on your California Home. Not consenting or withdrawing consent, may adversely affect certain features and functions. M7N~T}+y

&l/|EQ`{mAspz#;)x\i`HY#]P%OzOrdx,d]#>

8sMOE}=KhT:8 AbQq:wFrA\"rQy>d.Qg{. There are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. For example, a beneficiary who stands to inherit real property through a will or trust is not considered a legal owner of the property until the. The most common types of instruments used to change title are: Grant Deeds

A title between two persons that are not married or in a domestic partnership that vests equal shares and interests in the property. endobj

Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. | Terms of Use, How to Add a New Owner to the Title Deed to Real Estate, How to Remove a Deceased Owner from a Title Deed to Real Estate, How to Correct a Deed | Corrective Deeds and Scriveners Affidavits. 1106 0 obj

<>stream

In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. 325 0 obj

<>

endobj

Mozilla Firefox

You need to understand the repercussions of this type of transfer before you make a decision. Recording an instrument does not make a transaction legal. Affordable Housing (Pursuant to Section 714.6 and 12956.2 of the California Civil and Government Code) This means that all of the following must occur for a joint tenancy to exist: These requirements are satisfied in a deed that conveys property from the transferor to other owners with the special language required to create a joint tenancy with right of survivorship. If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. 2) Establishes community property with right of survivorship. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. The forms are provided on this website as a courtesy and as a public service for your convenience. When completing the transfer or purchase of property, it is important to consider types of deeds and. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. How do you want to hold title to property if you are married? Even if you don't divorce, there may be other issues. Only pay when youre ready to create the deed. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. It is important to note that deeds can be used to convey different types of ownership. Webthe title to the real property to be freely transferable. It only provides public notice of a private transaction. It is important that all three be listed as new owners to the property. <>

Despite sounding similar, community property and community property with right of survivorship in California have very different implications. Updated Jan. 17, 2023. In real estate, the deed records a propertys title and the transfer of that title between two parties or individuals. D7@# "? It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. House Title, Defined. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added to the title. ). Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. There is a dispute over the ownership of the decedents property (, Co-owners of real property are seeking to terminate their interests in the property through a partition action (, There is a dispute surrounding the character of a decedents property because the title and community property presumptions are in conflict (. In order for this to occur, legally the spouse must relinquish all rights and title to the property and also may sign a quitclaim deed. For example, deeds can convey complete and total ownership of a property, which is known as fee simple ownership. The other 50 percent belongs to your spouse. In this article, we will focus on fee simple ownership. Failure to file a completed COS within 90 days will result in a penalty bill of up to $5,000 for most residential properties. The Assessors Office requires that a Preliminary Change of Ownership Form accompany each Deed when it is recorded. Is the right of survivorship automatic? If you have questions concerning which document form is appropriate for your transaction, or if you are in need of assistance in the preparation of that document, you should consult an attorney or obtain other professional advice. He makes no promises about what his interest is or about liens on the property. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. Grant deeds warrant that the grantor (the person or entity transferring the property) has a legal interest in the property and that there are no claimants to the title, as well as no other restrictions or liens on the property. Because there are often tax implications as a result of a deed transfer/update, it's a good idea to either research the taxes carefully or to speak with a real estate attorney. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

The non-vested partner will then sign to relinquish any rights and title of the property. In order to accomplish this, you cant just pen in the name on your deed. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. Your email address will not be published. for more information about the options available. How do you want to hold title if the property in question belongs to a trust? The type of deed they sign will depend on the manner in which they wish to hold title to the property. Read on to learn how to obtain title in California! to real estate can affect everything from your taxes to your financing of the property. If you plan to inherit or purchase real property, it is important to consider the different ways to hold title in California, as well as the different types of deeds that can be used to transfer title. The only time community property laws may not apply is if the spouses or domestic partners had previously entered into a marital agreement (such as a prenuptial or postnuptial agreement) in which they waived their community property rights. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. She earned a BA from U.C. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. What is community property with right of survivorship? County of Los Angeles Department of Consumer and Business Affairs. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. The interspousal deed, however, clarifies that the intent of the deed transaction is to affect community property rights. It does happen, even in the Golden State. Each has its advantages and disadvantages, depending on your marital status, tax endobj

This is usually what the parties intend. There are different types of deeds available in California to serve a variety of needs; the type of property deed that is ultimately used will depend upon the nature of the transfer being carried out. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. 353 0 obj

<>stream

%PDF-1.7

%