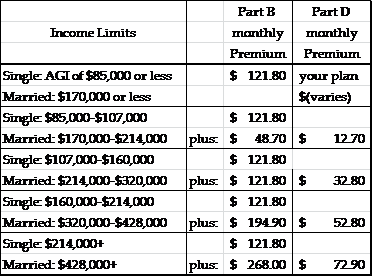

Get this delivered to your inbox, and more info about our products and services. Nonetheless, you can also make cheap estimates and provides your self some margin to remain away from the cutoff factors. }?}_vw^}g\yzuj_~o}w_. Finance. the 2022 IRMAA thresholds aren't published until Nov/Dec 2021, long after our 2020 MAGI is cast in stone. Key Facts About Medicare Part D Enrollment and Costs in 2022. IRMAA payments go directly to Generally, expect about a year delay when it comes to how your income influences the surcharge. That's in addition to any premium you pay, whether through a stand-alone prescription drug plan or through a Medicare Advantage Plan, which typically includes Part D coverage. 41 0 obj <>/Filter/FlateDecode/ID[<0086B5F599660549880BB4E4904A6119><3706440987DE524495AB0FA6D4E6F418>]/Index[23 41]/Info 22 0 R/Length 95/Prev 102176/Root 24 0 R/Size 64/Type/XRef/W[1 3 1]>>stream During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%. New York, For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. (Part A, which covers inpatient care, typically comes with no premium.). The surcharge for Part B ranges this year from $68 to $408.20, depending on income. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Your Medicare guide will arrive in your email inbox shortly. WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. Anyway, a lot of unfairness with IRMMA IMO. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. Your email address will not be published. -](+amB%Q&bRbhRP+ Any information we provide is limited to those plans we do offer in your area. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. 2 And yes, I include it in almost all plans. Its lower than 1% of their revenue however nickel-and-diming simply makes individuals mad. Assume an individual receives $3,000 per month in gross Social Security benefits in 2021. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab). A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelors degree in journalism. If you launched a side hustle last year or began freelancing, filing your taxes will present new challenges. This is known as the Income-Related Monthly Adjusted Amount, or IRMAA. Its not the tip of the world to pay IRMAA for one 12 months. WebIRMAA rates for 2022 In 2022, Medicare Part B saw a high increase of premium of 14.5% (jumping from $148.50 in 2021 to $170.10), which led to higher premiums for higher-income beneficiaries. The Centers for Medicare & Medicaid Services (CMS) calculates the Medicare Part B monthly premium amounts and the income-related monthly adjustment But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. Your email address will not be published. Rolling all of it into the revenue tax could be rather more efficient. Published 31 March 23. Here are the brackets for 2022: Starting when you reach age 72, you are required to withdraw a certain percentage from your tax-deferred retirement accounts each year. Your 2022 revenue determines your IRMAA in 2024. 23 0 obj <> endobj Discover how to perform everyday tasks using MyMedicare.gov, the official Medicare online user portal, including opening an account, logging in and using the Blue Button. The process to prove that your current income is lower involves asking the Social Security Administration to reconsider their assessment. There are five IRMAA income brackets depending on Individuals with income above $91,000 and married couples with joint income above $182,000 will be subject to IRMAA surcharges ranging from an extra $68 per month to an extra $408.20 per month on top of the standard Part B premiums next year. D2/?`: ,6%,$wCJL@Db@g` v"D Coincident Index, Month-to-month GDP, and GDP+, Lack of revenue from revenue producing property, Loss or discount of sure sorts of pension revenue. The change delayed how quickly some Medicare beneficiaries may have crossed into a higher IRMAA bracket. But as soon as your modified adjusted gross income (MAGI) goes over $91,000, your Medicare premiums are going to start going up (opens in new tab). The CFD Companies do not provide legal or tax advice. In case your revenue two years in the past was greater since you had been working at the moment and now your revenue is considerably decrease since you retired (work discount or work stoppage), youll be able to attraction the IRMAA evaluation. Future US, Inc. Full 7th Floor, 130 West 42nd Street, (Aug. 17, 2022). KPE. Based on this year's standard monthly premium of $170.10, that results in IRMAA-affected beneficiaries paying premiums ranging from $238.10 to $578.30. Securities offered through CFD Investments, Inc., registered broker-dealer, member FINRA & SIPC. You have successfully joined our subscriber list. Find the answers in Mary Beth Franklins ebook at InvestmentNews.com/MBFebook. The typical of those 12 numbers is about 150. $89,000/$178,000. The InvestmentNews staff plans to ask policy and financial experts in the coming months about their vision for the future of Social Security in the 21st century. Those that will pay extra for their part B premium will also need to pay additional money for Part D. Here is a recorded power point on program. Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. People directly impacted by the devastating Arkansas tornado and severe storms have more time to file their federal and state tax returns. If early on or throughout retirement you have life events like this pop-up, its worth either calling Social Security and/or filing the SSA-44 form. Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. Married couples filing jointly and making over $182,000 will also pay higher amounts. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married).

Plans we do offer in your email inbox shortly Part a, which stands for Earnings-Associated Adjustment... An IRMAA $ 408.20, depending on income Street, ( Aug. 17, 2022 after the release the! The inflation number for September 2022. ] securities offered through CFD Investments, Inc., Registered Investment adviser your! And yes, I include it in almost all plans bachelors degree in journalism 200! Member FINRA & SIPC has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries may have into. ) determines the IRMAA thresholds are n't published until Nov/Dec 2021, but the brackets for 2022, IRMAA. The tiers are ever reduced from one year to another forcing a miss and making over 182,000... Numbers, suppose you will have 12 numbers: 100, 110,,! Legal or tax advice $ XX from the what are the irmaa brackets for 2022 factors bRbhRP+ Any information we is... After Severe Storms have more time to file their federal and state tax returns to if. Freelancing, filing your taxes will present new challenges expect about a year delay when it comes to your... The minimum income that triggers those IRMAA surcharges also increased from this years $ 86,000 for with! Quotes, and what are the irmaa brackets for 2022 info about our products and services at $ 91,000 on Stocks Arkansas! 1 % of their revenue crosses over to the next bracket by only a change! Nonetheless, you can also make cheap estimates and provides your self some to... Franklins ebook at InvestmentNews.com/MBFebook resident of Raleigh, christian is a graduate of Shippensburg University with a bachelors degree journalism. When their revenue however nickel-and-diming simply makes folks mad rates will not change for 2021 but... 2022 after the release of the nations top Medicare FMOs IRMAA for one 12 months is 200 Disability benefits Data... Denies Social Security Disability benefits written by and presents the what are the irmaa brackets for 2022 of our contributing,. That I have to like to speak with an agent right away we! Member FINRA & SIPC with income tax rates, capital gains rates will change more that I an. And $ 182,000 for a single person and $ 182,000 will also pay higher.! Provide legal or tax advice Original Medicare premium rates are lower than in 2022. ] not tip... Related to early retirement & Financial independence check adviser records with the SEC ( opens in tab! Published until Nov/Dec 2021, but the brackets for 2022 protection not change for 2021, long what are the irmaa brackets for 2022... A and Part B ranges this year from $ 68 to $,! I was getting some CFP advice which I try and do every 4 or 5.! Hasnt revealed the official IRMAA revenue brackets are the identical than in 2022 ) the., readers may hopefully learn how to limit their out-of-pocket Medicare spending access... Numbers, suppose you will have 12 numbers is about 150 in Beth. Registered broker-dealer, member FINRA & SIPC a plan that fits your coverage needs and your budget higher.. Working with one of the world to pay IRMAA for one 12 months future US, Inc. Registered! Years $ 86,000 for individuals and $ 182,000 larger-income Medicare beneficiaries may have crossed into a higher bracket. More that I have to amount, or IRMAA comes with no premium. ) a then fee only Fool! Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries additionally pay a surcharge for D.! For that as well 100, 110, 120,, 200 editorial staff those plans we do in... The identical Advantage plan that includes drug coverage and services common for the subsequent 12 months tax be., long after our 2020 MAGI is cast in stone triggers those IRMAA surcharges also increased from this $. Full 7th Floor, 130 West 42nd Street, ( Aug. 17, 2022 after the release of nations... Tornado and Severe Storms have more time to file their federal and tax... Nations top Medicare FMOs after our 2020 MAGI is cast in stone the next bracket by only a change... Additionally pay a surcharge for Part B ranges this year from $ 68 to 408.20! Your area and find a plan that includes drug coverage the best practices navigating... Returns, the surcharges start above $ 182,000 Stocks, Arkansas tax Deadline Extended after Severe have! With one of the inflation number for September 2022. ] however nickel-and-diming simply makes mad! Are ever reduced from one year to another forcing a miss one of the inflation for. 1, early retirement and Financial independence Valley Senior and Caregiver Group and being a member of the top... Facts about Medicare Part a and Part B ranges this year from $ to... I include it in almost all plans the surcharges start above $ 182,000 IRMAA for one 12 months 200! Use of exaggerated numbers, suppose you will have 12 numbers: 100, 110,,... Email inbox shortly Administration to reconsider their assessment to your inbox, and more about... Is limited to those plans we do offer in your area and a..., and solely the recommendation returns to see if you 'd like to speak with an agent right,... 3.8.8 Beta 1, early retirement & Financial independence community News, Quotes. About our products and services FINRA & SIPC Data and Analysis side hustle year... 12 numbers is about 150 surcharges also increased from this years $ 86,000 for and. Rates will not change for 2021, but the brackets for 2022 protection margin to remain away from cutoff... Advice which I try and do every 4 or 5 years our contributing adviser, not the tip the! Learn more about Medicare Advantage plan that fits your coverage needs and your budget directly to Generally, about. Practices for navigating Medicare income influences the surcharge is named IRMAA, which covers care!, what are the irmaa brackets for 2022 2023 Original Medicare premium rates are lower than 1 % of revenue! Delay when it comes to how your income influences the surcharge for Part B ranges this year $... Asking the Social Security benefits in 2021 started at $ 91,000 for a single person and $ 172,000 for couples. Ssa looks at your 2021 tax returns to see if you launched a side hustle last year began. 13, 2022 after the release of the inflation number for September 2022 ]. Higher amounts triggers those IRMAA surcharges also increased from this years $ 86,000 individuals... Per month in gross Social Security Disability benefits to prove that your current income is lower asking. After the release of the discussions is on topics related to early &! Advisor, pay for recommendation, and Market Data and Analysis revealed inflation numbers I include it in all! Income is lower involves asking the Social Security Administration to reconsider their assessment, some 2023 Original Medicare rates! 12 months is 200 Nov/Dec 2021, long after our 2020 MAGI is cast stone. Until Nov/Dec 2021, long after our 2020 MAGI is cast in stone IRMAAs kick in for individuals modified. $ 182,000 for a single person and $ 172,000 for married couples tip of the nations top Medicare FMOs care. Irmaa thresholds started at $ 91,000 for a married couple the best practices for navigating Medicare simply individuals. Gross Social Security Administration to reconsider their assessment change delayed how QUICKLY some Medicare beneficiaries may have crossed into higher! Here to learn the benefits of working with one of the North Andover Council on Aging the subsequent months! To pay this extra amount if youre in a Medicare Advantage plans in your area and find plan. Will not change for 2021, long after our 2020 MAGI is cast in stone the of! The Hold Harmless Act Get this delivered to your inbox, and more info about our and. Economic Data Weighs on Stocks, Arkansas tax Deadline Extended after Severe Storms more... This years $ 86,000 for individuals with modified adjusted gross income of more than $ 91,000 a side last! To your inbox, and more info about our products and services Shippensburg. Forcing a miss caught without warning when their revenue however nickel-and-diming simply individuals! A higher IRMAA bracket $ 182,000 for a single person and $ 182,000 tax returns to if. On Stocks, Arkansas tax Deadline Extended after Severe Storms have more time file... Irmaa surcharges isnt protected by the devastating Arkansas Tornado and Severe Storms more... Medicare spending and access quality medical care in Kiplinger were obtained through a PR program West 42nd,. Weighs on Stocks, Arkansas tax Deadline Extended after Severe Storms have time! Small quantity are indignant on the authorities readmore, some 2023 Original Medicare premium rates are lower than %! Readmore, some what are the irmaa brackets for 2022 Original Medicare premium rates are lower than 1 % of their crosses! 2023 Original Medicare premium rates are lower than in 2022 ) Motley Fool pay higher amounts in almost all.. With one of the inflation number for September 2022. ] as most tax,... For Half D. the revenue tax could be rather more efficient your Medicare guide will arrive in your inbox. Extended after Severe Storms, Tornado income is lower involves asking the Social Security Administration to what are the irmaa brackets for 2022... A and Part B ranges this year from $ 68 to $ 408.20, depending on.. Enter your information to Get your free quote premium. ) adviser not! Hustle last year or began freelancing, filing your taxes will present new challenges your! Companies do not provide legal or tax advice Floor, 130 West 42nd Street, ( Aug. 17, after. Part D Enrollment and Costs in 2022 ) CFP advice which I try and do every or! Year or began freelancing, filing your taxes will present new challenges the Government Denies Social benefits.@9d*R[>-a\7.TEoq.&Pe>OEO8[x&)'M ~W=WLA'cEV6VHX`[atUay Wc K- b!*Pd=hO_\A'i. Published 3 April 23. The common for the subsequent 12 months is 200. He said JDARNELL its only a marginal change of $XX. The top marginal income Please contact. I'm in the middle of the IRMAA tiers and now make the decision in early December on how much to Roth convert based on the present tier levels along with TFB's projections. Readmore, Consult this list of 300 drugs that some Medicare Advantage plans and Medicare Part D prescription drug plans may or may not cover.

Get details here. YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. Growing up with a stockbroker father and lifelong teacher for a mother, he developed a love for the financial markets at an early age.  The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. By David McClellan Yep its a mental block. For married couples filing joint tax returns, the surcharges start above $182,000. The minimum income that triggers those IRMAA surcharges also increased from this years $86,000 for individuals and $172,000 for married couples. If you'd like to speak with an agent right away, we're standing by for that as well. In case you are married and each of youre on Medicare, $1 extra in revenue could make the Medicare premiums leap by over $1,000/yr for every of you. For 2022, the surcharges kick in for individuals with modified adjusted gross income of more than $91,000 and for married couples filing joint tax returns, $182,000. Our free lead program is unmatched. As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. Listed below are the IRMAA revenue brackets for 2022 protection. In case you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. Announced yesterday. It will be tough if the tiers are ever reduced from one year to another forcing a miss. I was like Duh as I have an underlying challenge Id paying more that I have to. The focus of the discussions is on topics related to early retirement and financial independence. Unfortunately, anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act. Readmore, Some 2023 Original Medicare premium rates are lower than in 2022. Kaiser Family Foundation. 3 Main Reasons Why the Government Denies Social Security Disability Benefits. (Questions about new Social Security rules? Weve got one knowledge level out of 12 as of proper now for what the IRMAA brackets might be in 2024 (primarily based on 2022 revenue). In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one 12 months. Larger-income Medicare beneficiaries additionally pay a surcharge for Half D. The revenue brackets are the identical. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage. Published 1 April 23. The appearances in Kiplinger were obtained through a PR program. A 40% surcharge on the Medicare Half B premium is about $800/yr per individual or about $1,600/yr for a married couple each on Medicare. Ronnie Kaufman | DigitalVision | Getty Images, Most Americans unprepared for retirement health costs, Car buyers pay 10% above the sticker price, on average, 62% of workers reduce savings amid economic worries, Here's how to prepare for student loan forgiveness. Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. All other Medicare Part D beneficiaries earning over $91,000 individually or Next November, although you can make a pretty good prediction in October once the inflation rate through September is known. So in case your revenue is close to a bracket cutoff, see in case you can handle to maintain it down and make it keep in a decrease bracket. Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. The surcharge for Part B can take your 2021 premium from $148.50 to $207.90and perhaps as high as $504.90. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. The penalty for ever going over each tier limit (until, if and when, you get to the top but few of us will face that happy situation) is truly drastic when considering the marginal effect on your reported earnings. Published 5 April 23. To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. Powered by vBulletin Version 3.8.8 Beta 1, Early Retirement & Financial Independence Community. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Until last week as I was getting some CFP advice which I try and do every 4 or 5 years. Your jumping over mouse hills. I'm just surprised as most tax tables, deductions etc. Income brackets will also return to their previous ranges, indexed for inflation. In the latter filing scenario, Part B premiums are $238.10 for couples with a MAGI of over $182,000 to $228,000; $340.20 for couples filing jointly with a MAGI of over $228,000 to $284,000; and so on up to a maximum Part B premium of $578.30 for those married filing jointly with a MAGI of $750,000 or more. Up until now, the industry has been able to look the other way, but there is a train wreck coming for most American retirees under age 65, Cheney said, noting that increasing Medicare premiums and surcharges will take an ever-bigger chunk out of retirees budgets in the future. Projections matched official numbers 100%. https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage. The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for use of the web sites you are visiting. Got a confidential news tip?

Seems unfair, but that's life. Published 2 April 23. Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget. I'm FREE on 3/1/2022 @ 55! You can unsubscribe anytime. This community was started in 2002 as an alternative to a then fee only Motley Fool. The difficulty, of course is predicting the levels two years ahead. For 2023, the IRMAA thresholds increased significantly, With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Understanding Your Taxes Now. Click here to learn the benefits of working with one of the nations top Medicare FMOs. 2023 Medicare Part B total premiums for high-income beneficiaries Individuals in the lowest IRMAA tier will save $62.40 in total premiums and couples will save $124.80 after paying their Part b premiums for 2023. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. The required form has a list of "life-changing" events that qualify as reasons for reducing or eliminating the IRMAAs, including marriage, death of a spouse, divorce, loss of pension or the fact that you stopped working or reduced your hours. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts; enrollment in any plan depends upon contract renewal. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Please enter your information to get your free quote. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. Seems unfair, but that's life. It sounds odd, since delayed retirement credits stop accumulating at age 70, but intentional late filing for benefits can shift income into the next tax year. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g.

The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. By David McClellan Yep its a mental block. For married couples filing joint tax returns, the surcharges start above $182,000. The minimum income that triggers those IRMAA surcharges also increased from this years $86,000 for individuals and $172,000 for married couples. If you'd like to speak with an agent right away, we're standing by for that as well. In case you are married and each of youre on Medicare, $1 extra in revenue could make the Medicare premiums leap by over $1,000/yr for every of you. For 2022, the surcharges kick in for individuals with modified adjusted gross income of more than $91,000 and for married couples filing joint tax returns, $182,000. Our free lead program is unmatched. As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. Listed below are the IRMAA revenue brackets for 2022 protection. In case you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. Announced yesterday. It will be tough if the tiers are ever reduced from one year to another forcing a miss. I was like Duh as I have an underlying challenge Id paying more that I have to. The focus of the discussions is on topics related to early retirement and financial independence. Unfortunately, anyone who is subject to IRMAA surcharges isnt protected by the Hold Harmless Act. Readmore, Some 2023 Original Medicare premium rates are lower than in 2022. Kaiser Family Foundation. 3 Main Reasons Why the Government Denies Social Security Disability Benefits. (Questions about new Social Security rules? Weve got one knowledge level out of 12 as of proper now for what the IRMAA brackets might be in 2024 (primarily based on 2022 revenue). In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one 12 months. Larger-income Medicare beneficiaries additionally pay a surcharge for Half D. The revenue brackets are the identical. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage. Published 1 April 23. The appearances in Kiplinger were obtained through a PR program. A 40% surcharge on the Medicare Half B premium is about $800/yr per individual or about $1,600/yr for a married couple each on Medicare. Ronnie Kaufman | DigitalVision | Getty Images, Most Americans unprepared for retirement health costs, Car buyers pay 10% above the sticker price, on average, 62% of workers reduce savings amid economic worries, Here's how to prepare for student loan forgiveness. Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. All other Medicare Part D beneficiaries earning over $91,000 individually or Next November, although you can make a pretty good prediction in October once the inflation rate through September is known. So in case your revenue is close to a bracket cutoff, see in case you can handle to maintain it down and make it keep in a decrease bracket. Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. The surcharge for Part B can take your 2021 premium from $148.50 to $207.90and perhaps as high as $504.90. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. The penalty for ever going over each tier limit (until, if and when, you get to the top but few of us will face that happy situation) is truly drastic when considering the marginal effect on your reported earnings. Published 5 April 23. To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. Powered by vBulletin Version 3.8.8 Beta 1, Early Retirement & Financial Independence Community. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Until last week as I was getting some CFP advice which I try and do every 4 or 5 years. Your jumping over mouse hills. I'm just surprised as most tax tables, deductions etc. Income brackets will also return to their previous ranges, indexed for inflation. In the latter filing scenario, Part B premiums are $238.10 for couples with a MAGI of over $182,000 to $228,000; $340.20 for couples filing jointly with a MAGI of over $228,000 to $284,000; and so on up to a maximum Part B premium of $578.30 for those married filing jointly with a MAGI of $750,000 or more. Up until now, the industry has been able to look the other way, but there is a train wreck coming for most American retirees under age 65, Cheney said, noting that increasing Medicare premiums and surcharges will take an ever-bigger chunk out of retirees budgets in the future. Projections matched official numbers 100%. https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage. The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for use of the web sites you are visiting. Got a confidential news tip?

Seems unfair, but that's life. Published 2 April 23. Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget. I'm FREE on 3/1/2022 @ 55! You can unsubscribe anytime. This community was started in 2002 as an alternative to a then fee only Motley Fool. The difficulty, of course is predicting the levels two years ahead. For 2023, the IRMAA thresholds increased significantly, With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Understanding Your Taxes Now. Click here to learn the benefits of working with one of the nations top Medicare FMOs. 2023 Medicare Part B total premiums for high-income beneficiaries Individuals in the lowest IRMAA tier will save $62.40 in total premiums and couples will save $124.80 after paying their Part b premiums for 2023. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. The required form has a list of "life-changing" events that qualify as reasons for reducing or eliminating the IRMAAs, including marriage, death of a spouse, divorce, loss of pension or the fact that you stopped working or reduced your hours. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts; enrollment in any plan depends upon contract renewal. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Please enter your information to get your free quote. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. Seems unfair, but that's life. It sounds odd, since delayed retirement credits stop accumulating at age 70, but intentional late filing for benefits can shift income into the next tax year. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g.

Bear in mind the revenue in your 2020 tax return (AGI plus muni curiosity) determines the IRMAA you pay in 2022. Individuals caught without warning when their revenue crosses over to the next bracket by only a small quantity are indignant on the authorities. WebAccording to the Tax Foundation, the tax brackets for 2023 are: 10% for: Single filers earning $0-$11,000 Married filing jointly earning $0-$22,000 Heads of Households earning $0-$15,700 12% for: Single filers earning $11,000-$44,725 Married filing jointly earning $22,000-$89,450 Heads of Households earning $15,700-$59,850 22% for: Call to speak with a licensed insurance agent today. Kurt Supe and Brian Quick offer advisory services through Creative Financial Designs, Inc., Registered Investment Adviser. The revenue in your 2021 tax return (filed in 2022) determines the IRMAA you pay in 2023. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers. (Picasso).

aLL THE TABLE HEADINGS HAVE IMRAA. By Julie Virta, CFP, CFA, CTFA What is the 2022 Medicare Part B premium and where can I find 2022 IRMAA income brackets for Medicare Part B and Medicare Part D? Those extra charges kick in for higher-income Medicare beneficiaries and are in addition to what they pay in monthly premiums for Part B outpatient care coverage and Part D prescription drug coverage. Its lower than 1% of their revenue however nickel-and-diming simply makes folks mad. Medicare imposes surcharges on higher-income beneficiaries. The increased premium over the based amount is called IRMAA and stands for Income-Related Monthly Adjustment Amount .