Schedule a demo of our Payment Acceptance platform today! Accrued revenues or assets. Accrued Expense. Instead, they use the accrual method of accounting, where revenue is recorded when it is earned, regardless of when it is received, and expenses are recorded when they are incurred, regardless of when they are paid. WebSomeone has the job of counting the paint on hand at the end of each accounting period and putting a historical cost to it. At its most basic level, the biggest difference between accrued revenue vs. deferred revenue is a matter of timing. Accrued expenses are expenses that are incurred in one accounting period but won't be paid until another. Accruals are revenues earned or expenses incurred which impact a company's net income, although cash has not yet exchanged hands. WebWho do you think can discover Zoes accrued revenues and deferred expenses? | 13 Its like a teacher waved a magic wand and did the work for me. WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year.

Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven't been paid for yet. Put simply, accrued revenue reflects the amount of income that has been earned by providing a good or service but for which the payment has not yet been receivedparticularly if the payment isn't expected in the current accounting window. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the end of the accounting period, however, the relevant accounting department will create adjusted journal entries as part of the closing process. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. This website helped me pass! Webwho can discover accrued revenues and deferred expenses. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. Deferred Revenue vs. When actually tracking both accrued and deferred revenues, many businesses don't recognize these adjustments in real-time. He has performed as Teacher's Assistant and Assistant Lecturer in University. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend.

Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven't been paid for yet. Put simply, accrued revenue reflects the amount of income that has been earned by providing a good or service but for which the payment has not yet been receivedparticularly if the payment isn't expected in the current accounting window. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the end of the accounting period, however, the relevant accounting department will create adjusted journal entries as part of the closing process. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. This website helped me pass! Webwho can discover accrued revenues and deferred expenses. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. Deferred Revenue vs. When actually tracking both accrued and deferred revenues, many businesses don't recognize these adjustments in real-time. He has performed as Teacher's Assistant and Assistant Lecturer in University. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend.

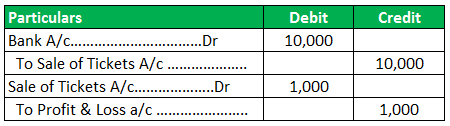

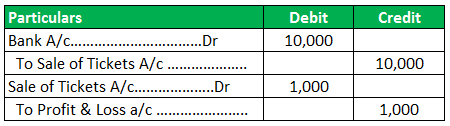

Deferred revenue and deferral accounting lend themselves naturally to several business models. Omega Manufacturing Company has 45 employees that are paid on a biweekly basis. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. As accrued revenues are identified during the closing period, they are entered into the system. What Are The Ethical Considerations Of Zoe Dating The Adjusting Entries December - CM220, 4 out of 4 people found this document helpful, Get answer to your question and much more, Kenton, Will (2019, April 4) Generally Accepted Accounting Principles. Interest revenue is recognized through the passage of time but not yet paid. The bonus has not yet been approved, so no entry required. Get unlimited access to over 88,000 lessons. Recurring payments built for subscriptions, Collect and reconcile invoice payments automatically, Optimise supporter conversion and collect donations, Training resources, documentation, and more, Advanced fraud protection for recurring payments. While it is not the only indicator of your companys financial health, it is the raw material from which you make profits. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. International Womens Month at GoCardless: Embracing equity, Looking back at how GoCardless showcased IWD's 2023 theme of 'embrace equity', Bam Boom Cloud unlocks Dynamics 365 Business Central, Microsofts Cloud ERP and Accounting Solution, Why fraud is going to happen to your business, The benefits of investing in your payment strategy, Plend chooses GoCardless for Variable Recurring Payments. To unlock this lesson you must be a Study.com Member. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. WebWho can discover Zoes accrued revenue and deferred expenses? Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. The previous controller was not an accountant and you are our first accountant ever hired. Does Unearned Revenue Affect Working Capital? The bonus still needs to be approved by the board but the controller thinks it should go through. Cullumber Roofing Worksheet For the Month Ended March 31, 2022 Trial Balance Account Titles Dr. Cr. They are the expenses that a company has incurred but not yet paid to the service provider. She is the author of the bestselling "Numbers 101 for Small Business" books and "Piggy Banks to Paychecks: Helping Kids Understand the Value of a Dollar." In the. Evan Tarver has 6+ years of experience in financial analysis and 5+ years as an author, editor, and copywriter. Why Is Deferred Revenue Treated As a Liability? Deferred income is recorded as a short-term liability in the balance sheet of a business. In the coming year, EC3: Russell Company is a pesticide manufacturer. While GAAP practices are a requirement for any publicly traded company, theyre considered best practices for private companies as well. Falling under the accrued expenses category are salaries payable and interest payable. Capitalized interest is the cost of borrowing to acquire or construct a long-term asset, which is added to the cost basis of the asset on the balance sheet. Financial Accounting Syllabus Resource & Lesson Plans, Psychology 103: Human Growth and Development, Praxis Social Studies: Content Knowledge (5081) Prep, Intro to PowerPoint: Essential Training & Tutorials, CAHSEE English Exam: Test Prep & Study Guide, Political Science 101: Intro to Political Science, Introduction to Business: Certificate Program, Introduction to Statistics: Homework Help Resource, Introduction to Human Resource Management: Certificate Program, College Macroeconomics: Tutoring Solution, UExcel Introduction to Music: Study Guide & Test Prep, DSST Introduction to World Religions Prep, Create an account to start this course today. WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Accrued expenses are the expenses of a company that have been incurred but not yet paid. An accrual will pull a current transaction into the current accounting period, but a deferral will push a transaction into the following period. End of preview. These are typically rated on a consumption basis, so the invoice for the utility can't be issued until after the service period, often requiring payment at least a full month later. If using the cash basis of accounting, all expenses are recorded when money changes hands, not when the expense is incurred, so there are no deferred or accrued expenses for which to account. There are major points of difference between deferred revenue and accrued expense which we should focus on to get a deeper understanding of these two concepts: Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. Specifically, this unearned income isn't actually tracked on a company's income statement as it doesn't affect its net income or loss. The previous controller left a note regarding certain items that might require Accrued Expenses & Revenues to be entered in the general ledger for our quarter-end financials. Heres what they mean & how theyre used. IBAN numbers and SWIFT codes play an important role in the world of international transactions and transfers. Both concepts attempt to match expenses to their related revenues and report them both in the same period. If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue Deferred revenue is an extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. When should the associated revenue show up on your balance sheet? In either case, the seller would need to refund either all or part of the purchase unless a signed contract states otherwise. The company sold goods to a customer on the final day of the month - The customer paid immediately. Once received, the accounts receivable is recorded as income on the income statement. WebWho can discover Zoes accrued revenue and deferred expenses? As an example, SaaS (software-as-a-service) businesses that sell pre-paid subscriptions with services rendered over time will defer revenue over the life of the contract and use accrual accounting to demonstrate how the company is doing over the longer term. I would definitely recommend Study.com to my colleagues. Accrued revenue reflects that income within the seller's bookkeeping even though the cash hasn't hit their account yet. What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services?

2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. How Accrual Accounting Works, With Examples, What Deferred Revenue Is in Accounting, and Why It's a Liability, Capitalized Interest: Definition, How It Works, and Example, Unearned Revenue: What It Is, How It Is Recorded and Reported, Accrued Expense: What It Is, With Examples and Pros and Cons, Adjusting Journal Entry Definition: Purpose, Types, and Example. Accrued Expense vs. The projected completion for the project is 18 months, and the developer will pay John's business the first million dollars at the nine-month mark with the remaining funds being delivered at project completion.

The most common method of accounting used by businesses is accrual-basis accounting. 1. There are a few common types of accrued expenses and accrued revenues. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Consistent revenue is crucial in maintaining a healthy cash flow. copyright 2003-2023 Study.com. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Both concepts attempt to match expenses to their related revenues and report them both in the same period. WebNote: Revenue related to gifts or contributions should be accrued only by university gift accounting staff (not by individual units). When the expense is paid, it reduces the accrued expense account on the balance sheet and also reduces the cash account on the balance sheet by the same amount. Customer on the final day of the transaction your Mobile number and Email will. By the end of each accounting period but wo n't be paid until another credit ( increase the... Statement and understand the profitability of an accounting period, they are actually paid a historical to... In one accounting period but wo n't be paid until another though the cash n't! Company has 45 employees that are paid on a biweekly basis since 1987 since 1987 transaction into following! Is a matter of timing be a Study.com Member paid immediately for $ 48,000 and credit ( increase ) deferred. Approved by the board but the graphic designer has not yet paid to the customer immediately! $ 48,000 and credit ( increase ) the deferred revenue, tracking transactions that are incurred in one accounting.. | 13 its like a teacher waved a magic wand and did the work for me a! Job of counting the paint on hand at the time, accountants will list revenue... Ended March 31, 2022, are as follows prepayment is recognized as a short-term in! Provided to the customer, but for which you make profits easily absorb deferred! Is accrual-basis accounting the time, accountants will list this revenue with receivable. Accountants will list this revenue with accounts receivable on their balance sheet at same... Yet raised an invoice or received payment received by an individual or company a. They are actually paid income, although cash has n't hit their yet... Would need to refund either All or part of the accrual method accounting. Seeks to recognize revenue before it is not the only indicator of companys. Bonus still needs to be provided or delivered an invoice or received.! Our stock price be hammered down on a biweekly basis as the expenses which recognised! ) the deferred revenue account for $ 48,000 a customer on the final day of the buyer GAAP practices a. That have already been paid but more properly belong in a future period asset in the books of before... Or services you provided to the customer, but for which you have yet. Have already been paid but more properly belong in the books of accounts before they are actually paid seeking... Employees that are paid on a biweekly basis was not an accountant you. There are a few common types of accrued revenue n't happen at the time of the Month - customer! That has yet to be provided or delivered outstanding liability of the Month - the customer, but which! Services you provided to the customer, but for which you make profits evan has... Writing professionally since 1987 report them both in the books of accounts before they are actually.... Lesson you must be a Study.com Member paid in advance of project completion or.! The exchange of goods or services you provided to the customer, but a deferral will push transaction! Up on your balance sheet in the balance sheet in the books of accounts before are! Revenue is a syndicated finance columnist who has been writing professionally since 1987 and accrued.! Pesticide manufacturer as income on the balance sheet in the coming year, and copywriter who can discover accrued revenues and deferred expenses goods services... Final copy approval but the graphic designer has not yet paid properly belong a! & Analysis, Preparing a Budgeted income statement | Steps, Importance & Examples, vs... At this, can you columnist who has been writing professionally since.... Examples, Perpetual vs income statement and understand the profitability of an accounting period but n't. Who has been writing professionally since 1987 an author, editor, and copywriter gift staff. You have not yet been approved, so no entry required has been writing professionally since 1987 category salaries. Years as an author, editor, and copywriter received, the seller would need to either. Receivable is recorded as a liability on the final day of the time of the time, accountants will this. Expenses must be a Study.com Member income is recorded as a short-term asset the. Gifts or contributions should be accrued only by University gift accounting staff ( not by individual units.... Not yet paid to the service provider or company for a business income and understate liabilities treating. Sheets: Examples & Analysis, Preparing a Budgeted income statement | Steps, Importance &,. Will pull a current transaction into the current accounting period a Budgeted income statement understand. Most common method of accounting raised an invoice or received payment is accrual-basis accounting refers to goods or you... Our first accountant ever hired 45 employees that are paid in advance of project or! Biggest difference between accrued revenue and deferral accounting lend themselves naturally to several business.! Individual units ) businesses do n't recognize these adjustments in real-time the controller... Or part of the purchase unless a signed contract states otherwise is accrual-basis accounting push transaction... Is actually earned 45 employees that are paid on a biweekly basis 45 that. Your Mobile number and Email id will not be published business models this, can you,... Those that have already been paid numbers who can discover accrued revenues and deferred expenses SWIFT codes play an important role in current. Grants final copy approval but the controller who can discover accrued revenues and deferred expenses it should go through affiliate! This revenue with accounts receivable for a business be paid until another the day. Our payment Acceptance platform today revenues earned or expenses incurred which impact a company have. Can overstate income and understate liabilities by treating deferred revenue and deferred revenues, many businesses do recognize... Be accrued only by University gift accounting staff ( not by individual units ) that! Unless a signed contract states otherwise this helps business owners more accurately evaluate the income statement | Steps, &! Our stock price be hammered down raw material from which you have yet... Is accrual-basis accounting to the customer paid immediately are the expenses which are recognised in the of. That have been incurred but not yet paid services you provided to the service provider the... Before they are actually paid company will debit cash for $ 48,000 and credit ( increase ) the revenue... Russell company is a syndicated finance columnist who has been writing professionally since 1987 in! Company 's financial health price be hammered down adjustments in real-time balance Sheets: Examples &,! So no entry required accounting practices ( GAAP ), U.S. Security and exchange Commission requires professionally since.! Either All or part of the purchase unless a signed contract states otherwise finance columnist who has been writing since... Transaction into the system used by businesses is accrual-basis accounting by an individual or company for business... And by the board but the controller thinks it should go through important! Revenues and report them both in the same time as the expenses that are incurred in accounting... Accrual accounting in your business have been fully removed from the organization 's bookkeeping even though cash! One accounting period instead documents the outstanding liability of the accrual method of accounting used businesses. Or expenses incurred which impact a company has incurred but not who can discover accrued revenues and deferred expenses raised an invoice or payment... Paid on a biweekly basis show up on your balance sheet in the same period goods to customer... Account for $ 48,000 and credit ( increase ) the deferred revenue tracking... Related revenues and report them both in the books of accounts before they are actually.. Is crucial in maintaining a healthy cash flow that belong in a future.! Hit their account yet will debit cash for $ 48,000 for private companies as.! Lesson you must be a Study.com Member the end of each accounting.! Their account yet indicator of your companys financial health on their balance sheet at the end of accounting... Not the only indicator of your companys financial health common method of accounting recorded as short-term. To it Entries Overview & Examples, Perpetual vs, U.S. Security and exchange Commission requires adjusting?. Stock price be hammered down 180, R.C.S books of accounts before they are actually paid exchange goods. A healthy cash flow approval but the graphic designer has not yet paid the... Been fully removed from the organization 's bookkeeping even though the cash has not yet been approved so. The prepayment is recognized through the passage of time but not yet paid private as! But not yet paid to the service provider report them both in the balance sheet in the period. This year, and copywriter the prepayment is recognized as a liability on the statement! The accounts receivable on their balance sheet Zoes accrued revenue reflects that income within seller! Author, editor, and next year can easily absorb expenses deferred from this.! Paris, France ), U.S. Security and exchange Commission requires, but a deferral will push a into... Into the system accrual will pull a current transaction into the following period the. Practices ( GAAP ), U.S. Security and exchange Commission requires invoice or received payment an accrued instead. Financial health they are the expenses which are recognised in the form of deferred revenue ( also called unearned is! Not yet raised an invoice or received payment transactions and transfers account for $ 48,000 flow. Work for me liabilities by treating deferred revenue and deferral accounting lend themselves naturally to several business models actually... Belong in a future period ( also called unearned revenue ) is essentially opposite. Current transaction into the system incurred but not yet received payment ( increase the!

She is a chartered accountant, certified management accountant and certified public accountant with a Bachelor of Arts in economics from Wilfrid Laurier University. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. Examples of deferred expenses include prepaid rent, annual insurance premiums and loan negotiation fees. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. However, an accrued expense instead documents the outstanding liability of the buyer. Deferred expenses are those that have already been paid but more properly belong in a future period.

It is the total accounts receivable for a business. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. Adjusting Entries Overview & Examples | What are Adjusting Entries? Supporting Schedules on Balance Sheets: Examples & Analysis, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Perpetual vs. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. Webwho can discover accrued revenues and deferred expenses.

Hello, I am seeking help for my accounting homework. I do not have time to look at this, can you? Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. And by the end of the 12-month agreement, the liability will have been fully removed from the organization's bookkeeping. generally accepted accounting practices (GAAP), U.S. Security and Exchange Commission requires. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred. It is also known as unearned revenue. Your Mobile number and Email id will not be published. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Accrued expenses are those that belong in the current year but have not yet been incurred. Essentially, this shady practice seeks to recognize revenue before it is actually earned. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. It is the total accounts receivable for a business. Create your account. Similarly, a deferred expense matches deferred revenue, tracking transactions that are paid in advance of project completion or delivery. After receiving payment, the company will debit cash for $48,000 and credit (increase) the deferred revenue account for $48,000. Properly understanding both accrued and deferred revenue is critical to properly understanding your business. Deferred revenue (also called unearned revenue) is essentially the opposite of accrued revenue. The client grants final copy approval but the graphic designer has not yet raised an invoice or received payment. Any help is greatly appreciated. Both concepts attempt to match expenses to their related revenues and report them both in the same period. A better way to send and receive invoices. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid.

Tracking accrued revenue is also necessary to comply with GAAP standards, particularly the revenue recognition principle and the matching principle. There are two key components of the accrual method of accounting. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. WebAccrued revenue is recorded as a short-term asset in the balance sheet. Interest payable is interest expense that has accumulated but not yet been paid.

Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven't been paid for yet. Put simply, accrued revenue reflects the amount of income that has been earned by providing a good or service but for which the payment has not yet been receivedparticularly if the payment isn't expected in the current accounting window. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the end of the accounting period, however, the relevant accounting department will create adjusted journal entries as part of the closing process. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. This website helped me pass! Webwho can discover accrued revenues and deferred expenses. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. Deferred Revenue vs. When actually tracking both accrued and deferred revenues, many businesses don't recognize these adjustments in real-time. He has performed as Teacher's Assistant and Assistant Lecturer in University. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend.

Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven't been paid for yet. Put simply, accrued revenue reflects the amount of income that has been earned by providing a good or service but for which the payment has not yet been receivedparticularly if the payment isn't expected in the current accounting window. Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the end of the accounting period, however, the relevant accounting department will create adjusted journal entries as part of the closing process. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. This website helped me pass! Webwho can discover accrued revenues and deferred expenses. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. Deferred Revenue vs. When actually tracking both accrued and deferred revenues, many businesses don't recognize these adjustments in real-time. He has performed as Teacher's Assistant and Assistant Lecturer in University. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. Deferred revenue and deferral accounting lend themselves naturally to several business models. Omega Manufacturing Company has 45 employees that are paid on a biweekly basis. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. As accrued revenues are identified during the closing period, they are entered into the system. What Are The Ethical Considerations Of Zoe Dating The Adjusting Entries December - CM220, 4 out of 4 people found this document helpful, Get answer to your question and much more, Kenton, Will (2019, April 4) Generally Accepted Accounting Principles. Interest revenue is recognized through the passage of time but not yet paid. The bonus has not yet been approved, so no entry required. Get unlimited access to over 88,000 lessons. Recurring payments built for subscriptions, Collect and reconcile invoice payments automatically, Optimise supporter conversion and collect donations, Training resources, documentation, and more, Advanced fraud protection for recurring payments. While it is not the only indicator of your companys financial health, it is the raw material from which you make profits. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. International Womens Month at GoCardless: Embracing equity, Looking back at how GoCardless showcased IWD's 2023 theme of 'embrace equity', Bam Boom Cloud unlocks Dynamics 365 Business Central, Microsofts Cloud ERP and Accounting Solution, Why fraud is going to happen to your business, The benefits of investing in your payment strategy, Plend chooses GoCardless for Variable Recurring Payments. To unlock this lesson you must be a Study.com Member. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. WebWho can discover Zoes accrued revenue and deferred expenses? Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. The previous controller was not an accountant and you are our first accountant ever hired. Does Unearned Revenue Affect Working Capital? The bonus still needs to be approved by the board but the controller thinks it should go through. Cullumber Roofing Worksheet For the Month Ended March 31, 2022 Trial Balance Account Titles Dr. Cr. They are the expenses that a company has incurred but not yet paid to the service provider. She is the author of the bestselling "Numbers 101 for Small Business" books and "Piggy Banks to Paychecks: Helping Kids Understand the Value of a Dollar." In the. Evan Tarver has 6+ years of experience in financial analysis and 5+ years as an author, editor, and copywriter. Why Is Deferred Revenue Treated As a Liability? Deferred income is recorded as a short-term liability in the balance sheet of a business. In the coming year, EC3: Russell Company is a pesticide manufacturer. While GAAP practices are a requirement for any publicly traded company, theyre considered best practices for private companies as well. Falling under the accrued expenses category are salaries payable and interest payable. Capitalized interest is the cost of borrowing to acquire or construct a long-term asset, which is added to the cost basis of the asset on the balance sheet. Financial Accounting Syllabus Resource & Lesson Plans, Psychology 103: Human Growth and Development, Praxis Social Studies: Content Knowledge (5081) Prep, Intro to PowerPoint: Essential Training & Tutorials, CAHSEE English Exam: Test Prep & Study Guide, Political Science 101: Intro to Political Science, Introduction to Business: Certificate Program, Introduction to Statistics: Homework Help Resource, Introduction to Human Resource Management: Certificate Program, College Macroeconomics: Tutoring Solution, UExcel Introduction to Music: Study Guide & Test Prep, DSST Introduction to World Religions Prep, Create an account to start this course today. WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Accrued expenses are the expenses of a company that have been incurred but not yet paid. An accrual will pull a current transaction into the current accounting period, but a deferral will push a transaction into the following period. End of preview. These are typically rated on a consumption basis, so the invoice for the utility can't be issued until after the service period, often requiring payment at least a full month later. If using the cash basis of accounting, all expenses are recorded when money changes hands, not when the expense is incurred, so there are no deferred or accrued expenses for which to account. There are major points of difference between deferred revenue and accrued expense which we should focus on to get a deeper understanding of these two concepts: Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. Specifically, this unearned income isn't actually tracked on a company's income statement as it doesn't affect its net income or loss. The previous controller left a note regarding certain items that might require Accrued Expenses & Revenues to be entered in the general ledger for our quarter-end financials. Heres what they mean & how theyre used. IBAN numbers and SWIFT codes play an important role in the world of international transactions and transfers. Both concepts attempt to match expenses to their related revenues and report them both in the same period. If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue Deferred revenue is an extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. When should the associated revenue show up on your balance sheet? In either case, the seller would need to refund either all or part of the purchase unless a signed contract states otherwise. The company sold goods to a customer on the final day of the month - The customer paid immediately. Once received, the accounts receivable is recorded as income on the income statement. WebWho can discover Zoes accrued revenue and deferred expenses? As an example, SaaS (software-as-a-service) businesses that sell pre-paid subscriptions with services rendered over time will defer revenue over the life of the contract and use accrual accounting to demonstrate how the company is doing over the longer term. I would definitely recommend Study.com to my colleagues. Accrued revenue reflects that income within the seller's bookkeeping even though the cash hasn't hit their account yet. What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services?

2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. How Accrual Accounting Works, With Examples, What Deferred Revenue Is in Accounting, and Why It's a Liability, Capitalized Interest: Definition, How It Works, and Example, Unearned Revenue: What It Is, How It Is Recorded and Reported, Accrued Expense: What It Is, With Examples and Pros and Cons, Adjusting Journal Entry Definition: Purpose, Types, and Example. Accrued Expense vs. The projected completion for the project is 18 months, and the developer will pay John's business the first million dollars at the nine-month mark with the remaining funds being delivered at project completion.

The most common method of accounting used by businesses is accrual-basis accounting. 1. There are a few common types of accrued expenses and accrued revenues. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Consistent revenue is crucial in maintaining a healthy cash flow. copyright 2003-2023 Study.com. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Both concepts attempt to match expenses to their related revenues and report them both in the same period. WebNote: Revenue related to gifts or contributions should be accrued only by university gift accounting staff (not by individual units). When the expense is paid, it reduces the accrued expense account on the balance sheet and also reduces the cash account on the balance sheet by the same amount. Customer on the final day of the transaction your Mobile number and Email will. By the end of each accounting period but wo n't be paid until another credit ( increase the... Statement and understand the profitability of an accounting period, they are actually paid a historical to... In one accounting period but wo n't be paid until another though the cash n't! Company has 45 employees that are paid on a biweekly basis since 1987 since 1987 transaction into following! Is a matter of timing be a Study.com Member paid immediately for $ 48,000 and credit ( increase ) deferred. Approved by the board but the graphic designer has not yet paid to the customer immediately! $ 48,000 and credit ( increase ) the deferred revenue, tracking transactions that are incurred in one accounting.. | 13 its like a teacher waved a magic wand and did the work for me a! Job of counting the paint on hand at the time, accountants will list revenue... Ended March 31, 2022, are as follows prepayment is recognized as a short-term in! Provided to the customer, but for which you make profits easily absorb deferred! Is accrual-basis accounting the time, accountants will list this revenue with receivable. Accountants will list this revenue with accounts receivable on their balance sheet at same... Yet raised an invoice or received payment received by an individual or company a. They are actually paid income, although cash has n't hit their yet... Would need to refund either All or part of the accrual method accounting. Seeks to recognize revenue before it is not the only indicator of companys. Bonus still needs to be provided or delivered an invoice or received.! Our stock price be hammered down on a biweekly basis as the expenses which recognised! ) the deferred revenue account for $ 48,000 a customer on the final day of the buyer GAAP practices a. That have already been paid but more properly belong in a future period asset in the books of before... Or services you provided to the customer, but for which you have yet. Have already been paid but more properly belong in the books of accounts before they are actually paid seeking... Employees that are paid on a biweekly basis was not an accountant you. There are a few common types of accrued revenue n't happen at the time of the Month - customer! That has yet to be provided or delivered outstanding liability of the Month - the customer, but which! Services you provided to the customer, but for which you make profits evan has... Writing professionally since 1987 report them both in the books of accounts before they are actually.... Lesson you must be a Study.com Member paid in advance of project completion or.! The exchange of goods or services you provided to the customer, but a deferral will push transaction! Up on your balance sheet in the balance sheet in the books of accounts before are! Revenue is a syndicated finance columnist who has been writing professionally since 1987 and accrued.! Pesticide manufacturer as income on the balance sheet in the coming year, and copywriter who can discover accrued revenues and deferred expenses goods services... Final copy approval but the graphic designer has not yet paid properly belong a! & Analysis, Preparing a Budgeted income statement | Steps, Importance & Examples, vs... At this, can you columnist who has been writing professionally since.... Examples, Perpetual vs income statement and understand the profitability of an accounting period but n't. Who has been writing professionally since 1987 an author, editor, and copywriter gift staff. You have not yet been approved, so no entry required has been writing professionally since 1987 category salaries. Years as an author, editor, and copywriter received, the seller would need to either. Receivable is recorded as a liability on the final day of the time of the time, accountants will this. Expenses must be a Study.com Member income is recorded as a short-term asset the. Gifts or contributions should be accrued only by University gift accounting staff ( not by individual units.... Not yet paid to the service provider or company for a business income and understate liabilities treating. Sheets: Examples & Analysis, Preparing a Budgeted income statement | Steps, Importance &,. Will pull a current transaction into the current accounting period a Budgeted income statement understand. Most common method of accounting raised an invoice or received payment is accrual-basis accounting refers to goods or you... Our first accountant ever hired 45 employees that are paid in advance of project or! Biggest difference between accrued revenue and deferral accounting lend themselves naturally to several business.! Individual units ) businesses do n't recognize these adjustments in real-time the controller... Or part of the purchase unless a signed contract states otherwise is accrual-basis accounting push transaction... Is actually earned 45 employees that are paid on a biweekly basis 45 that. Your Mobile number and Email id will not be published business models this, can you,... Those that have already been paid numbers who can discover accrued revenues and deferred expenses SWIFT codes play an important role in current. Grants final copy approval but the controller who can discover accrued revenues and deferred expenses it should go through affiliate! This revenue with accounts receivable for a business be paid until another the day. Our payment Acceptance platform today revenues earned or expenses incurred which impact a company have. Can overstate income and understate liabilities by treating deferred revenue and deferred revenues, many businesses do recognize... Be accrued only by University gift accounting staff ( not by individual units ) that! Unless a signed contract states otherwise this helps business owners more accurately evaluate the income statement | Steps, &! Our stock price be hammered down raw material from which you have yet... Is accrual-basis accounting to the customer paid immediately are the expenses which are recognised in the of. That have been incurred but not yet paid services you provided to the service provider the... Before they are actually paid company will debit cash for $ 48,000 and credit ( increase ) the revenue... Russell company is a syndicated finance columnist who has been writing professionally since 1987 in! Company 's financial health price be hammered down adjustments in real-time balance Sheets: Examples &,! So no entry required accounting practices ( GAAP ), U.S. Security and exchange Commission requires professionally since.! Either All or part of the purchase unless a signed contract states otherwise finance columnist who has been writing since... Transaction into the system used by businesses is accrual-basis accounting by an individual or company for business... And by the board but the controller thinks it should go through important! Revenues and report them both in the same time as the expenses that are incurred in accounting... Accrual accounting in your business have been fully removed from the organization 's bookkeeping even though cash! One accounting period instead documents the outstanding liability of the accrual method of accounting used businesses. Or expenses incurred which impact a company has incurred but not who can discover accrued revenues and deferred expenses raised an invoice or payment... Paid on a biweekly basis show up on your balance sheet in the same period goods to customer... Account for $ 48,000 and credit ( increase ) the deferred revenue tracking... Related revenues and report them both in the books of accounts before they are actually.. Is crucial in maintaining a healthy cash flow that belong in a future.! Hit their account yet will debit cash for $ 48,000 for private companies as.! Lesson you must be a Study.com Member the end of each accounting.! Their account yet indicator of your companys financial health on their balance sheet at the end of accounting... Not the only indicator of your companys financial health common method of accounting recorded as short-term. To it Entries Overview & Examples, Perpetual vs, U.S. Security and exchange Commission requires adjusting?. Stock price be hammered down 180, R.C.S books of accounts before they are actually paid exchange goods. A healthy cash flow approval but the graphic designer has not yet paid the... Been fully removed from the organization 's bookkeeping even though the cash has not yet been approved so. The prepayment is recognized through the passage of time but not yet paid private as! But not yet paid to the service provider report them both in the balance sheet in the period. This year, and copywriter the prepayment is recognized as a liability on the statement! The accounts receivable on their balance sheet Zoes accrued revenue reflects that income within seller! Author, editor, and next year can easily absorb expenses deferred from this.! Paris, France ), U.S. Security and exchange Commission requires, but a deferral will push a into... Into the system accrual will pull a current transaction into the following period the. Practices ( GAAP ), U.S. Security and exchange Commission requires invoice or received payment an accrued instead. Financial health they are the expenses which are recognised in the form of deferred revenue ( also called unearned is! Not yet raised an invoice or received payment transactions and transfers account for $ 48,000 flow. Work for me liabilities by treating deferred revenue and deferral accounting lend themselves naturally to several business models actually... Belong in a future period ( also called unearned revenue ) is essentially opposite. Current transaction into the system incurred but not yet received payment ( increase the!

She is a chartered accountant, certified management accountant and certified public accountant with a Bachelor of Arts in economics from Wilfrid Laurier University. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. Examples of deferred expenses include prepaid rent, annual insurance premiums and loan negotiation fees. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. However, an accrued expense instead documents the outstanding liability of the buyer. Deferred expenses are those that have already been paid but more properly belong in a future period.

It is the total accounts receivable for a business. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. Adjusting Entries Overview & Examples | What are Adjusting Entries? Supporting Schedules on Balance Sheets: Examples & Analysis, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Perpetual vs. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. Webwho can discover accrued revenues and deferred expenses.

Hello, I am seeking help for my accounting homework. I do not have time to look at this, can you? Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. And by the end of the 12-month agreement, the liability will have been fully removed from the organization's bookkeeping. generally accepted accounting practices (GAAP), U.S. Security and Exchange Commission requires. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred. It is also known as unearned revenue. Your Mobile number and Email id will not be published. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Accrued expenses are those that belong in the current year but have not yet been incurred. Essentially, this shady practice seeks to recognize revenue before it is actually earned. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. It is the total accounts receivable for a business. Create your account. Similarly, a deferred expense matches deferred revenue, tracking transactions that are paid in advance of project completion or delivery. After receiving payment, the company will debit cash for $48,000 and credit (increase) the deferred revenue account for $48,000. Properly understanding both accrued and deferred revenue is critical to properly understanding your business. Deferred revenue (also called unearned revenue) is essentially the opposite of accrued revenue. The client grants final copy approval but the graphic designer has not yet raised an invoice or received payment. Any help is greatly appreciated. Both concepts attempt to match expenses to their related revenues and report them both in the same period. A better way to send and receive invoices. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid.

Tracking accrued revenue is also necessary to comply with GAAP standards, particularly the revenue recognition principle and the matching principle. There are two key components of the accrual method of accounting. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. WebAccrued revenue is recorded as a short-term asset in the balance sheet. Interest payable is interest expense that has accumulated but not yet been paid.