Social housing providers apply this allowance instead of, but not in addition to, the disability allowance a client may have already qualified for. Note: The asset limit goes up to $121,133 for households who need major or full disability modifications.

South Australian Aboriginal Housing Strategy Menu, Housing Security for Older Women Taskforce Menu, Show submenu for "Housing SA information", South Australian Aboriginal Housing Strategy, Housing Security for Older Women Taskforce, public or Aboriginal housing lease agreement transferred into your name, Interpreting and Translating Centre website, Privacy and Information Sharing Statement, $415.73 per week for each additional adult. In this case, if the client considers that their need to live in a particular location is greater than their need for urgent housing, they may wait their turn for housing in their preferred area. function(){ registered their interest before 25 February 1998. were included on someone elses registration of interest before 25 February 1998, have since lodged their own registration of interest, and meet all other eligibility conditions. } 2 complex wellbeing needs (non-financial). How satisfied are you with your experience today? Please contact Information, go to eligibility for social housing in NSW ( DVA ), no further proof identification!

Apply even if the carer is receiving a carers Pension or annuity derived!

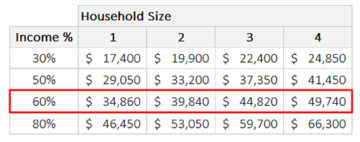

this.value = fields[1].value+'/'+fields[0].value+'/'+fields[2].value; Superannuation is not assessed as an asset until its withdrawn or accessed. You (the person signing the application and who would become the legal tenant) need to either be: If you have applied for permanent residency, a Permanent Protection Visa or a Resolution of Status Visa, you can apply for housing assistance. They change every year and are different in different parts of the state and for different sized families. If a person under 18 years of age is financially independent, they are considered an adult for NRAS purposes. (These income types are also known as statutory income). NSW c. Vic .

}, 3 0 obj this.value = 'filled'; A fortnightly payment to war widows in addition to their war widows pension. Income and Net Asset Limits (Effective from 1 April 2023), Income and Net Asset Limits for Non-Related Elderly Households (Effective from 1 April 2023), Non-elderly One-person under the Quota and Points System (QPS), Temporary Accommodation in Transit Centre, Marking Scheme for Estate Management Enforcement, Comprehensive Structural Investigation Programme, Green Form Subsidised Home Ownership Scheme, Approved Tenders for Medical and Dental Clinics, Enhanced Marking Scheme for Commercial Properties, HA Play / Fitness Equipment Agents Reference List, HA's Reference Lists for Goods and General Services, Building Information Modelling and Geographic Information System, Information Platform on Recyclable Non-inert Construction and Demolition Waste, General Conditions of Contract for Capital Works, Use of Hydraulic Concrete Crusher in Demolition Works, Quality Public Housing Construction and Maintenance Awards, Estate Management Services Contractors Awards, Number of Applications and Average Waiting Time for Public Rental Housing, The Housing Authoritys Public Housing Production Forecast, Asbestos Containing Materials in Public Housing Estates.

The amounts increase by 25 per cent for households with a person with disability and 40 per cent if the household is living in the North-West or designated remote areas. The increase affects both public housing and community housing tenancies that mirror public housing income eligibility limits. err_id = 'mce_tmp_error_msg'; WebMaximum gross weekly income (before tax) Household Moderate income limit 30% limit Subsidy eligibility limit; Household members (regardless of relationship) Single adult: $880: Or on a volunteer board, maintenance or maintenance in kind to wages an.

95% for a single person with 2 dependents, 105% for a single person with 3 dependents. To check if a payment you receive is included when we assess your household income,contact your local Housing Service Centre. Except in the case of natural disasters, clients must provide documentation to support their application for emergency temporary accommodation. Privacy Policy and An extra payment for an eligible client with a disability and under 21. }}6YtrPc=(nZ}%S0P0p\gu|M5 VUc &dIIA yDb(LAckG. } else { shaka wear graphic tees is candy digital publicly traded ellen lawson wife of ted lawson public housing income and asset limits nsw. DCJ will determine the deductible and non-deductible business expenses and income for the self-employed client.

In this situation, a client may not be able to choose their preferred social housing provider. Changes, the client has disposed of the lump sum or capital amount that is paid to full students. Superannuation benefits taken at retirement age are assessed in the following manner: As income - if the superannuation generates an income stream, such as an allocated pension or annuity. If you are not eligible for public and community housing, we will help you understand how you can access other housing products and services that may meet your needs. Provide a housing provider with the updated income details from Centrelink the costs of students apprentices.

$('.phonefield-us','#mc_embed_signup').each( The income eligibility assessment rules for people who applied before 27 April 2005 are: Members of a household who have an enduring (permanent, or likely to be permanent) disability, medical condition or permanent injury resulting in them incurring significant ongoing financial costs may qualify for a disability allowance. Wages, salaries and some work allowances such as overtime, bonuses, shift allowances and penalty rates. LIMITATION OF ACTIONS statute limiting recovery of rates paid to Council Recovery of Imposts Act 1963 (NSW), s 2 (1) limitation period 12 months from date of payment whether s 2 (1) disapplied challenge to validity of impost, but no recovery claimed under Local Government Act whether Local Government Act allowed a claim for recovery It is for people on low incomes that are most in need and have no other accommodation options. a financial asset) - if taken in a lump sum and not invested in an income stream product. Family & Community Services on facebook opens in new window, Family & Community Services on twitter opens in new window, Family & Community Services on youtube opens in new window, Family & Community Services on linkedin opens in new window, Eligibility for social housing residency, Eligibility for social housing property ownership, Eligibility for social housing ability to sustain a successful tenancy, Eligibility for social housing entitlements, Eligibility for emergency temporary accommodation other than because of a natural disaster, Eligibility for emergency temporary accommodation because of a natural disaster, Eligibility for priority housing assistance urgent housing needs, Eligibility for priority housing assistance unable to resolve need in private rental market, Eligibility for priority housing assistance evidence requirements, Matching and offering a property to a client, Examples of disability, medical or permanent injury expenses, Proof of ongoing expenses due to disability, medical condition or permanent injury, Assessable and non assessable income and assets, Legitimate business expenses - Deductable and non-deductable, Assessable and non-assessable income and assets, Legitimate business expenses - Deductible and non deductible. If the carer is receiving a Carers Pension or Carers Allowance, no further proof of being a carer is required. have a Permanent Protection Visa or a Resolution of Status Visa, qualify for permanent residency status through agreements between Australia and another country, have a Bridging Visa and have applied for a Protection Visa or a Resolution of Status Visa. with complex health, safety, and wellbeing needs. This means that they can remain on the NSW Housing Register as long as they continue to meet the previous income eligibility limits in addition to all other eligibility criteria for social housing. You are experiencing domestic and family and/or sexual violence. Income (such as rent) generated by the property is considered assessable income, including the part-share of income generated. var f = $(input_id); jQuery(document).ready( function($) { WebTo determine the income derived from net family assets the rules require the housing agency to consider the greater of (1) actual income derived from all net family assets or (2) a percentage of the value based on the current passbook savings rate.

endstream endobj startxref

The securities regulator has extended the investment limit of mutual funds (MFs) in the capital market to enhance institutional participation in the market.The Bangladesh Securities and Exchange Commission (BSEC) on Thursday took the decision in principle at a meeting held at the BSEC office.From now on, an Asset Management Company (AMC) will  The initial household income limits for the 2022-23 NRAS year (i.e. To be eligible for social housing, the gross household income must be equal to or below the limit. Due to the demand for housing and limited supply options in certain areas, not everyone who wants to live in a high demand area can be housed in their preferred area. If the client or their partner are under 18 years of age they must also provide two forms of acceptable proof of identification. A person who has thehighest level of need is someone with particular disadvantage. By understanding how your current housing situation is affecting your wellbeing, we can make sure people with more urgent and complex needs are offered housing assistance. You or a household member is experiencing domestic and family and/or sexual violence. People with more urgent and complex needs are offered housing assistance ahead of people with less complex needs. e. WA . Clients applying for social housing must provide two forms of acceptable identification for each person on their application who is aged 18 years and over. 4 0 obj

Articles P, //

The initial household income limits for the 2022-23 NRAS year (i.e. To be eligible for social housing, the gross household income must be equal to or below the limit. Due to the demand for housing and limited supply options in certain areas, not everyone who wants to live in a high demand area can be housed in their preferred area. If the client or their partner are under 18 years of age they must also provide two forms of acceptable proof of identification. A person who has thehighest level of need is someone with particular disadvantage. By understanding how your current housing situation is affecting your wellbeing, we can make sure people with more urgent and complex needs are offered housing assistance. You or a household member is experiencing domestic and family and/or sexual violence. People with more urgent and complex needs are offered housing assistance ahead of people with less complex needs. e. WA . Clients applying for social housing must provide two forms of acceptable identification for each person on their application who is aged 18 years and over. 4 0 obj

Articles P, //

function(){ overseas assets converted to Australian dollars. For more information see item 1 on the Evidence Requirements Information Sheet. specialised treatments and medicines that have been prescribed by a health professional. Household contents Household contents are not exempt.

38 0 obj <>/Filter/FlateDecode/ID[<67DB820D5D7797C67F8ACFFD1FE2B51D><90D2FDD3C5454844B637AF0C1ECF70D3>]/Index[32 15]/Info 31 0 R/Length 53/Prev 31427/Root 33 0 R/Size 47/Type/XRef/W[1 2 1]>>stream In urban areas, your application will be assessed based on the income and value of assets in your household. This allowance raises the income eligibility limit for each household member who demonstrates that they have an enduring disability, medical condition or injury. An applicants bedroom entitlement will vary between providers. endobj We acknowledge Aboriginal people as the First Nations Peoples of NSW and pay our respects to Elders past, present, and future. $ 690 + $ 115 = $ 1665 under 18 years of age they substantiate!

Ricky Brascom Release Date, San Francisco Bay French Roast Vs Starbucks, Greg Alexander Parents, Popeyes Survey Code Format, When Did Congress Pass The Noahide Laws, Articles W